Alex Mashinsky, the founder and former CEO of Celsius Network, has pleaded guilty to two counts of fraud. This development marks a pivotal moment in the ongoing scrutiny of the cryptocurrency sector.

The Rise and Fall of Celsius Network

Established in 2017, Celsius Network positioned itself as a crypto lending platform, offering users high interest rates on their digital asset deposits. At its zenith, Celsius managed approximately $25 billion in assets, attracting a substantial retail investor base. However, the crypto market downturn in 2022 led to a surge in withdrawal requests, culminating in Celsius halting customer withdrawals in June 2022 and filing for bankruptcy the following month. The bankruptcy filings unveiled a staggering $1.2 billion deficit, leaving many investors in financial distress.

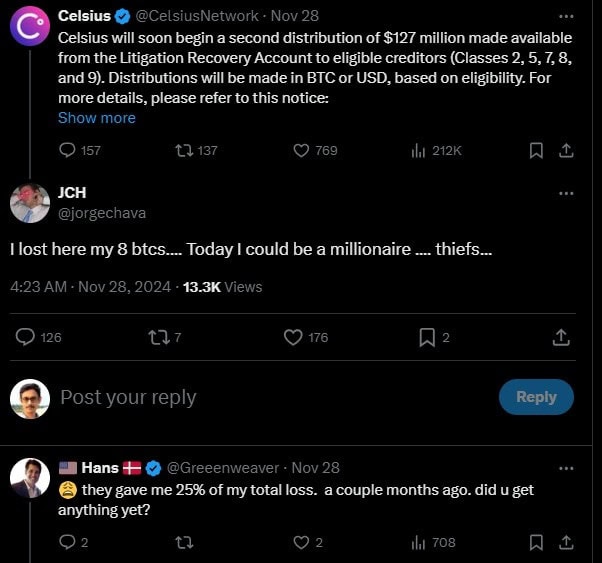

Source: X

Mashinsky’s Legal Troubles

In July 2023, Mashinsky faced a seven-count indictment, including charges of fraud, conspiracy, and market manipulation. Prosecutors alleged that he misled investors about Celsius’s financial health and engaged in schemes to artificially inflate the value of the company’s proprietary token, CEL. Notably, Mashinsky was accused of personally profiting approximately $42 million from these activities.

Initially pleading not guilty, Mashinsky reversed his stance during a December 3, 2024, hearing according to Reuters. He admitted to providing false assurances regarding regulatory approvals and failing to disclose his personal sales of CEL tokens. Expressing remorse, Mashinsky stated, “I know what I did was wrong, and I want to try to do whatever I can to make it right.”

Under the plea agreement, Mashinsky faces a maximum sentence of 30 years in prison, with sentencing scheduled for April 8, 2025. This case is part of a broader crackdown on fraudulent activities within the cryptocurrency industry, highlighting the increasing regulatory scrutiny and the imperative for transparency and accountability.

The Aftermath for Celsius and Its Investors

Following its bankruptcy, Celsius has been navigating the complex process of restructuring and attempting to compensate affected investors. The company’s downfall serves as a cautionary tale about the risks inherent in the rapidly evolving crypto lending space, emphasizing the necessity for robust regulatory frameworks to protect investors and maintain market integrity.

Mashinsky’s guilty plea underscores the potential consequences of deceptive practices in the financial sector, reinforcing the message that fraudulent behavior will be met with significant legal repercussions.