Arbitrum (ARB) shows signs of recovery after an 85% drawdown, with key technical levels and improving fundamentals pointing to a potential bullish reversal.

Arbitrum has taken quite a hit since its all-time high, with the price recently dipping by over 85%. While sentiment remains shaky, zooming out reveals a potential opportunity. The price has begun to flatten in recent months, signaling that the worst of the sell-off could be over.

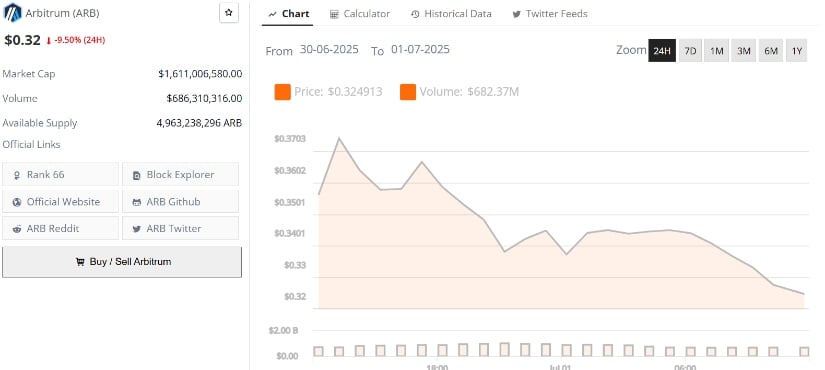

Arbitrum’s current price is $0.32, down -9.50% in the last 24 hours. Source: Brave New Coin

Drawdown Deepens, But Signs Point to Bottoming Out

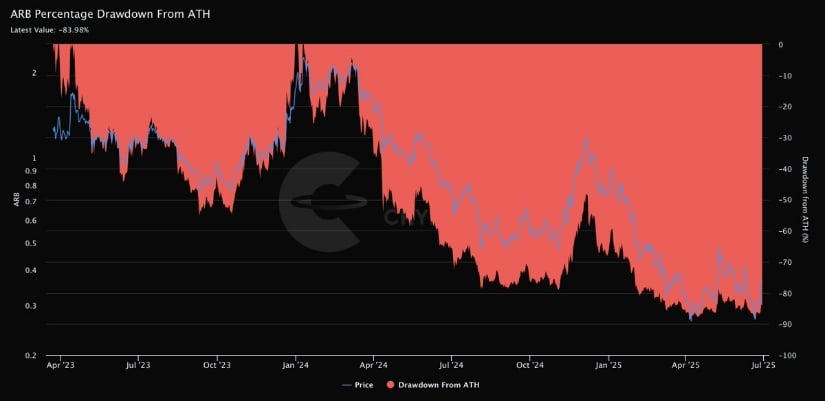

Arbitrum has had a rough run since its all-time high, and the latest chart from Into The Cryptoverse puts that into perspective. With the percentage drawdown nearing the 85% mark, it’s easy to see why sentiment has been shaky. But when zoomed out, charts like this often signal opportunity, not just decline. Historically, such extended drawdowns often line up with key accumulation zones, especially when broader fundamentals remain intact.

ARB shows signs of recovery as price action flattens out after an 85% drawdown. Source: Into The Cryptoverse via X

What’s worth noting is how ARB’s price action has started to flatten out in recent months. While not a bullish breakout just yet, this kind of base formation can hint that the worst of the selling might already be behind. There are signs that ARB could quietly begin to recover ground lost over the past year.

Fundamentals Begin to Shift

Despite price weakness, the fundamentals behind Arbitrum are starting to shift positively. According to What, Arbitrum has generated $1.7M in Timeboost revenue since April, half of its total revenue, while real-world assets (RWAs) on the chain have surged, with over $300M in TVL and 30x year-over-year growth.

Arbitrum’s fundamentals are shifting in a positive direction. Source: What via X

At the same time, the broader network metrics remain solid. Arbitrum is still holding $13.56B in total value locked, with 418,000 weekly active users. After an 85% drawdown from all-time highs, this combination of usage and revenue growth could be early signs that the worst of the downtrend is behind.

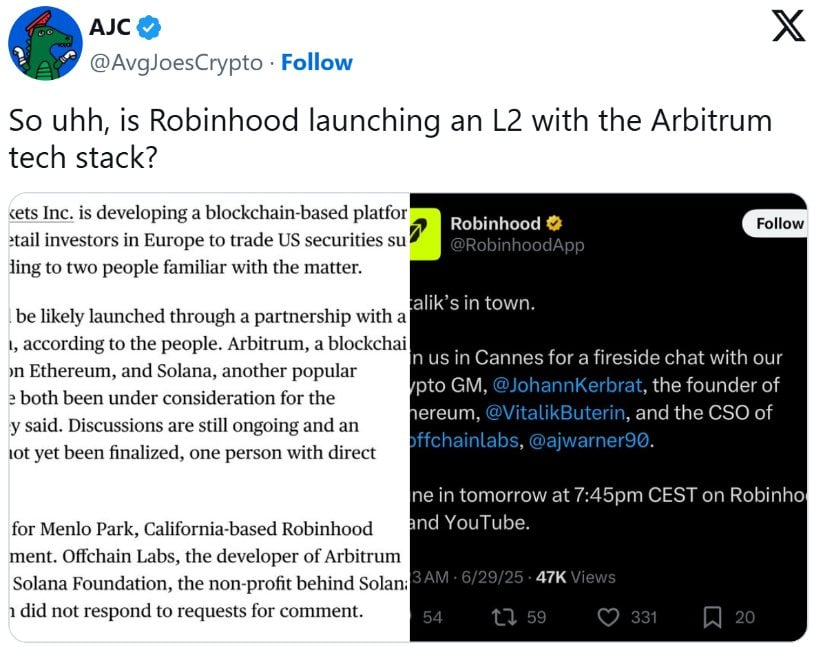

Adding to that narrative, a recent post by AvgJoesCrypto hints at a potentially game-changing development: Robinhood may be preparing to launch a custom Layer 2 built on Arbitrum’s tech stack. While the full details haven’t been confirmed yet, a move like this could significantly raise Arbitrum’s profile, especially if Robinhood brings its user base and brand into the ecosystem.

Robinhood may launch a custom Layer 2 on Arbitrum. Source: AvgJoesCrypto via X

Technical Setup Signalling Possible ARB Reversal

Following the sharp drawdown and shifting fundamentals, traders are now beginning to eye potential entry points in Arbitrum. Crypto TA King shared a clean weekly chart showing a possible double-bottom structure forming around the $0.32 to $0.34 range.

A double-bottom structure forming around $0.32 to $0.34. Source: Crypto TA King via X

Crypto TA King believes that if price revisits this zone and holds, it could mark a technical base before a meaningful reversal. Volume has started to increase slightly in this region, adding weight to the idea that buyers are quietly stepping in. If the setup plays out, ARB could make a move toward the $0.50 level and beyond, reclaiming territory lost during the broader decline.

This ties well into the broader narrative of stabilization. With macro fundamentals like Robinhood’s L2 plans and rising TVL reinforcing the case for long-term recovery, technical setups like these become more meaningful.

ARB Arbitrum Price Sets Sights on $0.70

Following the base formations, analyst Lucky adds on to the bullish case for Arbitrum. His chart outlines a shift from a long-standing descending resistance bearish trend to what looks like a new impulsive wave. After holding support and printing a series of higher lows, ARB’s price action is starting to print a new bullish trend.

ARB’s price action is shifting to a bullish trend, with a breakout above $0.42 paving the way for a potential move toward $0.70 to $0.80. Source: Lucky via X

The key level to watch now is the $0.42 breakout zone, which served as resistance through much of June. Holding above that could pave the way for an upward move toward the $0.70 to $0.80 region, with a more optimistic target near $1.20 if momentum continues.

Final Thoughts: Recovery Ahead?

Arbitrum’s massive drawdown may have shaken investor confidence, but the signs are pointing toward a potential recovery. While the 85% drop is hard to ignore, the flattening price action and improving fundamentals suggest a positive outlook ahead. Once ARB breaks above the $0.42 resistance level, it could trigger a quicker recovery, with the price targeting $0.70 and beyond.