Did you ever face a situation where you make a move to buy a token on the Uniswap/ ETH network, and out of nowhere, some bots outrun you! This Sandwiched.wtf review will help you find out such transactions by token name, date, when the transaction has been made, and most importantly, how much you have lost because of such transaction.

This drills down by a single transaction, and hence you will be able to assess by transactions and by dates.

What is Sandwiched.wtf?

Sandwiched.wtf is a program that shows you how much money MEV traders and bots have made by sandwiching your trades.

Who are MEV Traders?

Miner extractable value (MEV) is a metric used to investigate consensus security by simulating the profit a miner (or validator, sequencer, or another privileged protocol actor) might gain by unilaterally including, excluding, or reordering transactions in the blocks they generate.

MEV covers both ‘traditional’ profits from transaction fees and block rewards, as well as ‘untraditional’ gains from transaction reordering, insertion, and censorship within a miner’s block.

What do Bots Mean?

Traders use crypto trading bots to take advantage of the global cryptocurrency markets, which are open 24 hours a day, seven days a week; they can react swiftly. But, most investors lack time to devote to consistently obtaining the finest trade, which bots can.

An arbitrage bot is a popular form of bot that seeks to profit from price differences between exchanges.

Also, read Pionex Arbitrage Bot | Earn through Spot – Futures Crypto Arbitrage

Sandwiched.wtf Review: Sandwich

On a DEX like Uniswap, a sandwich is a pair of bot-inserted deals that wrap around your usual trade. As a result of this, the bot/ attacker will profit at your expense.

How Sandwiched.wtf computes the total losses?

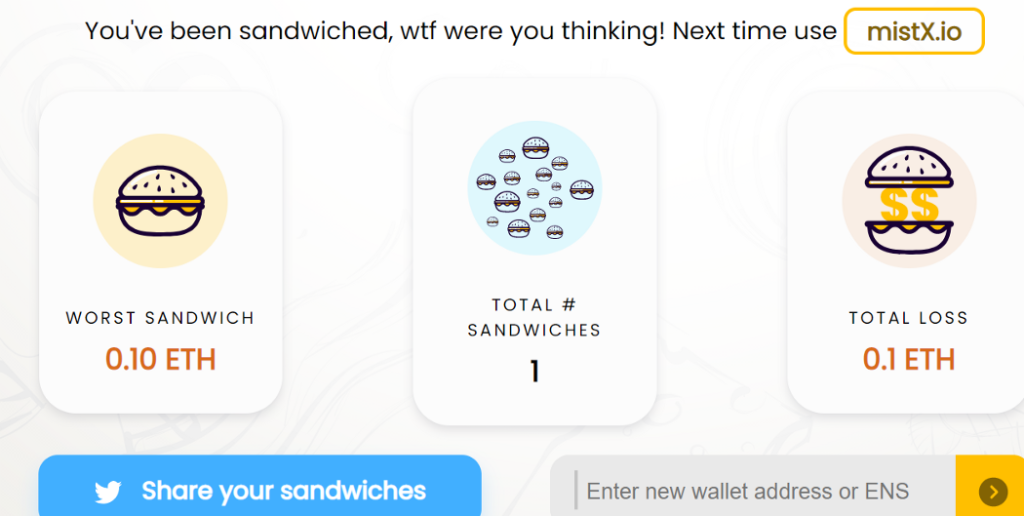

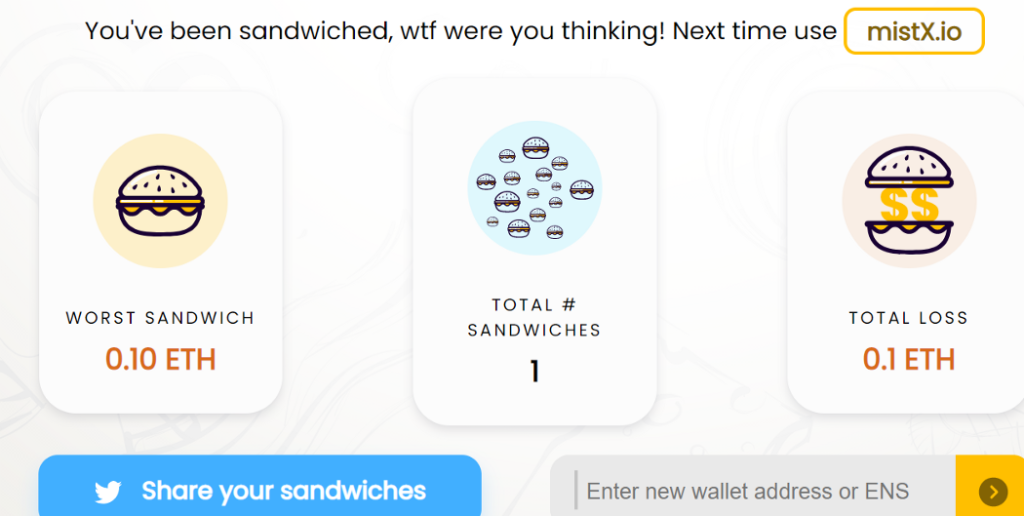

The overall loss figure (right-hand card) represents the entire profit of all sandwich bots. Profits in ETH are added as-is, and other tokens are converted to ETH at current rates using the Coingecko APIs. This means that the total loss for the same set of sandwiches can change over time.

How to use Sandwiched.wtf?

- Firstly, access the website.

- Thereafter, connect your wallet or enter the wallet address in the bottom right corner of the webpage

You should see something like this:

Sandwiched.wtf Review: MistX.io

Sandwiched.wtf only provides you the information about a problem and not the solution. MistX.io is a swapping platform and a solution to getting sandwiches. Additionally, the platform provides you Flashbots and does not publish your transactions to a public mempool.

Sandwiched.wtf Review: Conclusion

Front running, Flashbots, and MEV’s are the challenges are being faced by DeFi. Sandwiched.wtf will help you determine all of your losses over time. Furthermore, you can use Mistx.io to resolve this so that you directly tip the miner, and your transaction will be sent over for execution. You won’t be front-run using Mistx.io.

Frequently Asked Questions

Author: Eth!c@l Aka Kumar

Also, read