Avalanche price is setting up for a breakout, with strong technicals pointing a rally towards $85 and beyond.

Despite slower price action in recent months, the foundations for a sustainable rally are well in place, with strong technicals and potential ETF catalysts gaining increasing significance.

AVAX Ecosystem on the Rise

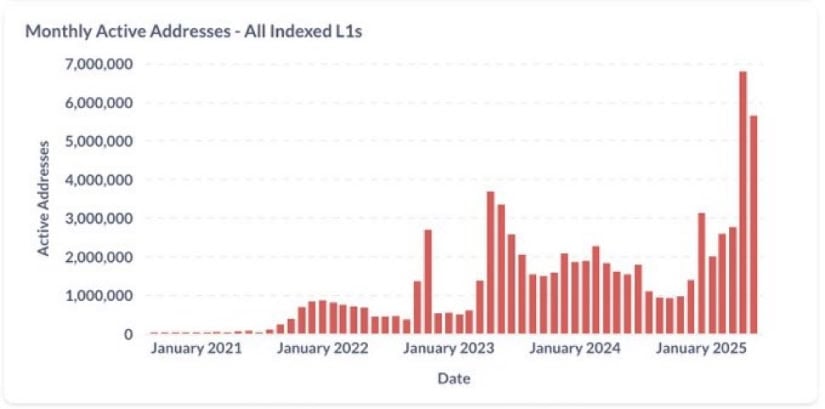

Avalanche’s L1 ecosystem is seeing a wave of growth that’s hard to ignore. A recent chart shared by Mash shows that monthly active addresses across subnets and Layer 1 chains inside the AVAX ecosystem have surged over the last five years, hitting peaks above 6 million. That kind of sustained user activity signals real adoption.

Avalanche’s L1 ecosystem sees explosive growth, with monthly active addresses surpassing 6 million. Source: Mash via X

While AVAX price action has stayed relatively slower than expected, the on-chain developments have been on a bullish run. Historically, when usage climbs this consistently, price tends to catch up. If this pace keeps up, the market could start pricing in Avalanche’s fair value.

Avalanche Eyes Recovery Toward $27

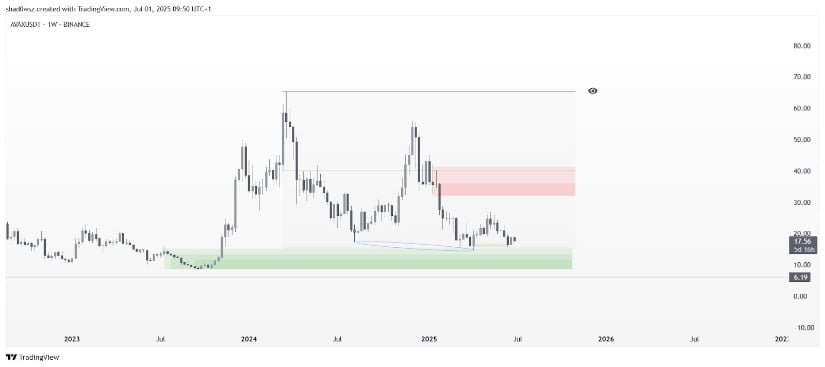

With on-chain activity heating up, AVAX may be preparing for a price catch-up. According to Tradenalytics, AVAX has a clean recovery setup on the chart, targeting the $27 zone. The current structure needs to hold above a key support trendline. If that line gets breached, the bullish thesis weakens, but if buyers defend it, AVAX Avalanche price could see a strong push upward.

AVAX sets sights on a $27 recovery, fueled by growing on-chain activity and a solid technical setup. Source: Tradenalytics via X

This potential recovery fits neatly into the broader narrative around Avalanche’s growing user base and expanding ecosystem. Price hasn’t fully reflected that strength yet, but if the technical structure stays intact, the momentum from the fundamental side could finally start making its way into the AVAX chart.

Technical Prediction: AVAX Wave Structure Sets Up a Long-Term Roadmap

Building on the momentum from AVAX’s ecosystem growth and recent recovery signals, EWcycles is now zooming out to a much bigger picture. According to him, AVAX could be entering a new Wave 3 in Elliott Wave terms, aiming first for a move toward $85. That’s the initial projection if the current breakout attempt holds and triggers follow-through. The structure maps out a textbook 5-wave impulse, supported by Fibonacci levels, with $85 aligning with the 1.618 extension from the previous correction.

AVAX sets the stage for a multi-leg rally, with Wave 3 targeting $85, followed by potential gains toward $211–$250. Source: EWcycles via X

After a likely pullback near $85, the chart outlines a broader Wave (3) that could end in the $211 to $250 zone. That would reflect not just bullish price action, but a full market cycle playing out. With growing on-chain use and a strong technical structure developing, AVAX is laying the groundwork for what could be a multi-leg rally if current levels hold.

ETF Moment Could Be the Catalyst

With the SEC officially approving Grayscale’s GDLC fund to convert into a spot ETF, attention is quickly shifting to Bitwise. Their Bitwise 10 Crypto Index Fund (BITW) is next in line for review and holds a mix of top assets, including AVAX. If Bitwise gets the green light, it could quietly act as a trigger for AVAX, giving it a boost from fresh institutional exposure.

Right now, AVAX is trading in a tight range between $18 and $20, and that area is starting to look like a base. A positive ETF decision could give it the push it needs to break out. With strong on-chain growth and recent technical strength, the outlook for Avalanche’s price is becoming increasingly promising.

Wyckoff Accumulation Further Strengthens The Basing Narrative

After months of slow price action, AVAX may be quietly setting up for something bigger. A recent weekly chart from marketmakerXBT shows a textbook Wyckoff accumulation pattern developing, with the price holding firm at the lower end of a multi-month range that’s lasted over 460 days. Support has repeatedly come in near the $13 to $16 zone, forming a solid demand base.

AVAX shows a textbook Wyckoff accumulation pattern, with strong support between $13 to $16. Source: marketmakerXBT via X

Technically, the next challenge lies near the $31 to $37 region, marked by a visible red supply zone on the weekly chart. That zone will be a real test for the Bulls. Once AVAX breaks through $37 with strength, it would flip the structure in favor of bulls.

Final Thoughts

Avalanche is on the verge of a major breakout, and all the signs are aligning for a rally ahead. With its ecosystem booming and on-chain activity hitting new heights, AVAX’s price is positioned to catch up. The technical setup is looking stronger than ever, with key levels holding firm, and the upcoming ETF approval could serve as a crucial catalyst. Whether it’s the Wyckoff accumulation signaling smart buying or the potential for a wave 3 in Elliott Wave theory targeting $85, the foundation for a multi-leg rally is in place.