Bitcoin price today is hovering around $108,000 as traders digest a whirlwind of whale activity, ETF inflows, and macroeconomic uncertainty.

Despite a short-term dip from recent highs, bullish sentiment remains strong, with the crypto community eyeing a potential breakout toward the $120K milestone.

Bitcoin Technical Analysis: Consolidation Before the Next Leg Up?

Bitcoin (BTC) has recently tested the $107,000–$108,000 support zone after facing rejection near $110,500. The market showed signs of fatigue following a 10% rally from local lows near $98,000. Yet, Bitcoin’s chart structure still leans bullish, with higher lows and bullish indicators like a MACD crossover on the daily timeframe supporting further upside.

Bitcoin momentum remains bullish as the price defends the $107K support despite the recent pullback. Source: ebenezerrobot on TradingView

On the 1-hour and 4-hour charts, BTC is consolidating under the $109,000 resistance. A clean break above this level—especially if backed by volume—could pave the way to retest the all-time high of $112,000. On the downside, strong support lies around $106,000–$107,000. If these levels hold, bulls may stage another breakout attempt over the weekend.

Whale Moves, Dormant Wallets, and ETF Inflows Shape Sentiment

Bitcoin’s recent dip to $107K came despite $1 billion in net inflows into spot BTC ETFs over just two days. Surprisingly, the downturn appears linked not to weak fundamentals but to a historic on-chain event: the movement of 80,000 BTC—worth over $8.6 billion—from a dormant wallet believed to belong to a 2011-era miner.

A long-dormant whale moved 80,000 BTC—now worth $8.6 billion—after 14 years, with no signs of selling. Source: @CryptoRank_io via X

Such a large transfer understandably spooked some traders. However, on-chain analysts note that these moves are often symbolic rather than immediately bearish. Such a large and public movement of dormant Bitcoin is generally seen as unlikely to precede an immediate sale, as it would draw attention and risk impacting the market price. Instead, the transfer triggered short-term FUD (fear, uncertainty, and doubt)—a familiar occurrence in Bitcoin’s history.

ETF inflows, particularly into products like BlackRock’s iShares Ethereum Trust ETF (ETHA) and Grayscale’s ETHE, underscore growing institutional interest. Though this week’s ETF spotlight was partially shared with Ethereum, Bitcoin remains the leading crypto for institutional flows and long-term positioning.

Bullish Signals Persist Despite Pullback

Multiple technical and macro indicators are aligning in Bitcoin’s favor. The recent confirmation of a bullish MACD crossover, combined with BTC’s highest monthly close ever, adds confidence that the pullback may simply be a healthy correction.

Bitcoin is in Stage 2 with support near $108,535 and $104,410; a break above $115,882 may trigger Stage 3 and higher volatility. Source: Skill-Knowledge-Conduct on TradingView

Even with modest profit-taking and macro headwinds—like U.S. trade tensions and fiscal policy concerns—Bitcoin remains resilient. Funding rates on BTC futures remain positive, suggesting that long positions still dominate and the broader market maintains a bullish stance.

Despite short-term uncertainty, market sentiment remains firmly bullish. While the path to $120,000 may not be linear, Bitcoin’s strong technical setup, rising ETF inflows, and resilient investor demand suggest a breakout could be on the horizon—pending confirmation above key resistance levels.

BTC Outlook: Is $120,000 in Reach?

From a structural perspective, Bitcoin is entering a critical phase. The $112K level remains the immediate resistance to beat. If BTC can break and close above this psychological and technical ceiling, price discovery could quickly accelerate.

BTC closed June near $107,582, with projections suggesting a rise to $115,000–$120,000 in 2025. Source: BeingInvested via X

On the flip side, failure to hold the $106K support may trigger a retest of the $103K–$104K range. However, with liquidation heatmaps showing dense liquidity clusters near $110K, and positive ETF flows continuing, the bias remains to the upside.

Final Thoughts

Despite the ongoing spell of short-term volatility, Bitcoin’s larger trend points upward. ETF demand, favorable technical setups, and macro tailwinds are aligning in BTC’s favor—even as dormant whales stir the pot. The next few sessions will be pivotal as BTC tests resistance near $109,000 and aims to reclaim $112,000. Should bullish momentum hold, Bitcoin’s next big stop could very well be $120K.

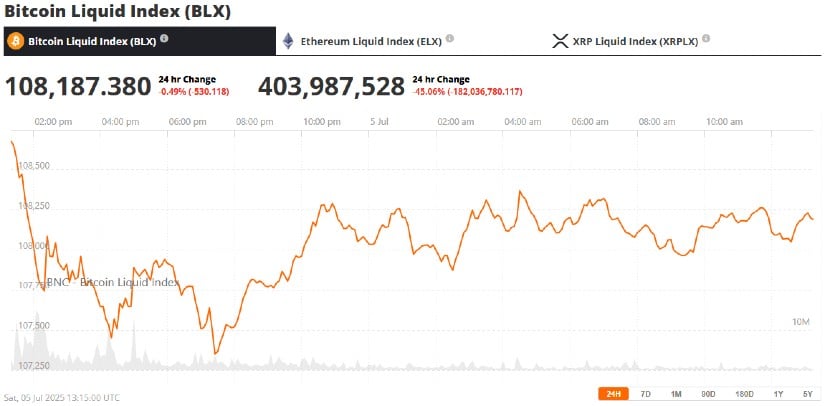

Bitcoin (BTC) was trading at around $108,187, down 0.49% in the last 24 hours at press time. Source:Bitcoin Liquid Index (BLX) viaBrave New Coin

As always, volatility remains a defining feature of crypto markets. But if current trends persist, Bitcoin may soon rewrite its all-time high—once again proving that the bulls are far from done.