Bitcoin is showing impressive resilience following a $50 billion whale sell-off, with institutional investors stepping in to stabilize the market.

As BTC price hovers above key support zones, market watchers are asking: can this renewed institutional dominance drive Bitcoin to $150,000?

Bitcoin Market Overview: Technicals Suggest Steady Support

Despite the recent turbulence caused by long-time holders offloading over 500,000 BTC, equivalent to more than $50 billion, the Bitcoin price today is holding steady above the $108,500 level. This resilience is largely attributed to institutional demand absorbing the excess supply.

On the 2-hour chart, Bitcoin is consolidating between 50% and 61.8% Fibonacci levels, with a “fib squeeze” forming between $107,840 and $108,624. The 50-SMA and 100-SMA are converging, signaling a likely breakout.

Bitcoin’s uptrend is likely to continue toward key resistance levels, but a reversal could follow unless the price consolidates above this immediate supply zone. Source: STPFOREX on TradingView

If BTC manages to close above the $110,000 resistance, technical analysts suggest the next major targets could be $112,000, $113,200, and even $115,000. On the downside, major support zones lie at $108,350, $107,250, and $105,000.

Hourly indicators also remain optimistic:

- MACD is gaining bullish momentum.

- RSI is above 50, indicating strengthening buying pressure.

This technical stability suggests a controlled, potentially bullish environment, despite underlying volatility.

Whales Out, Institutions In: A New Era for Bitcoin

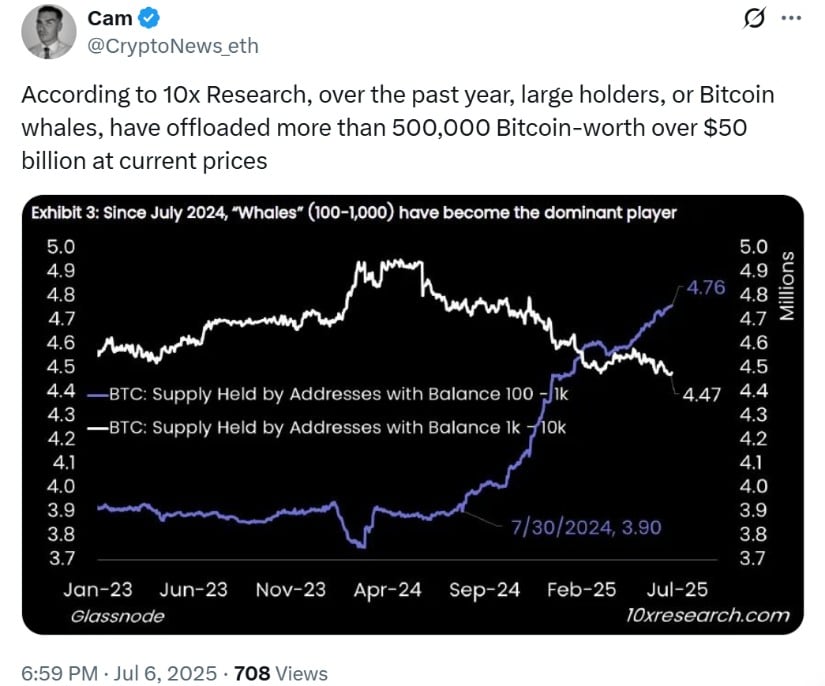

While traditional Bitcoin whales have been reducing their exposure, institutional buyers have not only matched but exceeded this selling pressure. According to 10x Research, institutional entities—including spot Bitcoin ETFs, asset managers, and corporate treasuries—have accumulated nearly 900,000 BTC over the past year.

According to 10x Research, Bitcoin whales have sold over 500,000 BTC in the past year, totaling more than $50 billion at current prices. Source: Cam via X

“We’re seeing whales convert BTC into equity exposure through in-kind contributions,” said Edward Chin, co-founder of Parataxis Capital, highlighting the rise of crypto-to-stock financing deals and structured BTC holdings.

Rather than trigger a collapse, the whale exodus has quietly accelerated Bitcoin’s shift from a speculative asset to institutional-grade investment. BTC is increasingly being used as collateral or integrated into equity-based financial products, reducing market noise and enhancing price stability.

This evolution may mark a critical transition point, setting the foundation for Bitcoin ETF news and long-term investor interest—especially with Bitcoin halving 2025 just around the corner.

Prediction Markets Turn Bullish: $150K in Sight

As the institutional narrative strengthens, prediction markets are echoing this optimism. Data from Kalshi and Polymarket show a notable surge in bullish bets on Bitcoin:

- Kalshi traders assign a 67% probability of BTC reaching $125,000 by December 2025.

- Odds for a $150,000 price tag have risen to 31%, while a move beyond $160,000 sees 23% confidence.

- On Polymarket, sentiment is even more bullish, with a 75% probability that Bitcoin hits $120,000 or more this year, and 55% odds for $130,000.

Confidence drops sharply beyond those levels, but bets on a dramatic collapse (e.g., a return to $20K) remain minimal—less than 5%.

These platforms, often viewed as crowd-sourced barometers of investor sentiment, reveal a growing belief in Bitcoin as an inflation hedge and a safe haven in times of macroeconomic uncertainty.

Expert Outlook: Bitcoin’s Institutional Future Looks Bright

Bitcoin’s emerging identity as a structured financial asset is reshaping how analysts approach long-term forecasts. The stability brought by ETFs, alongside increased use of Bitcoin Lightning Network and potential upgrades like Taproot, are fueling a new wave of confidence.

Bitcoin is forming a bullish inverse head and shoulders pattern, signaling a potential trend reversal that could support a price surge toward the $150K target. Source: feed4success on TradingView

Many analysts view Bitcoin’s current range-bound behavior as healthy consolidation rather than stagnation. As institutional players build long-term positions, the speculative volatility that once defined BTC appears to be subsiding.

With Bitcoin miner revenue stabilizing and volatility compressing, the stage may be set for Bitcoin’s next major move. Some experts argue that institutional control could dampen extreme price swings but also fuel sustainable upward momentum.

Looking Ahead: BTC Eyes New Highs as 2025 Unfolds

The question on every investor’s mind is: what’s Bitcoin’s next move? After withstanding a massive whale exit, Bitcoin is now in the hands of institutions who are playing a longer, more calculated game.

Bitcoin (BTC) was trading at around $108,851, up 0.86% in the last 24 hours at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

With Bitcoin ETF approval by the SEC already in motion, Bitcoin halving 2025 drawing closer, and retail sentiment recovering, BTC could be preparing for its next leg up. Whether it’s $120K, $150K, or even beyond, the odds are shifting in Bitcoin’s favor.

For now, all eyes are on $110K—a psychological and technical barrier that may determine the direction of the world’s largest cryptocurrency in the second half of 2025.