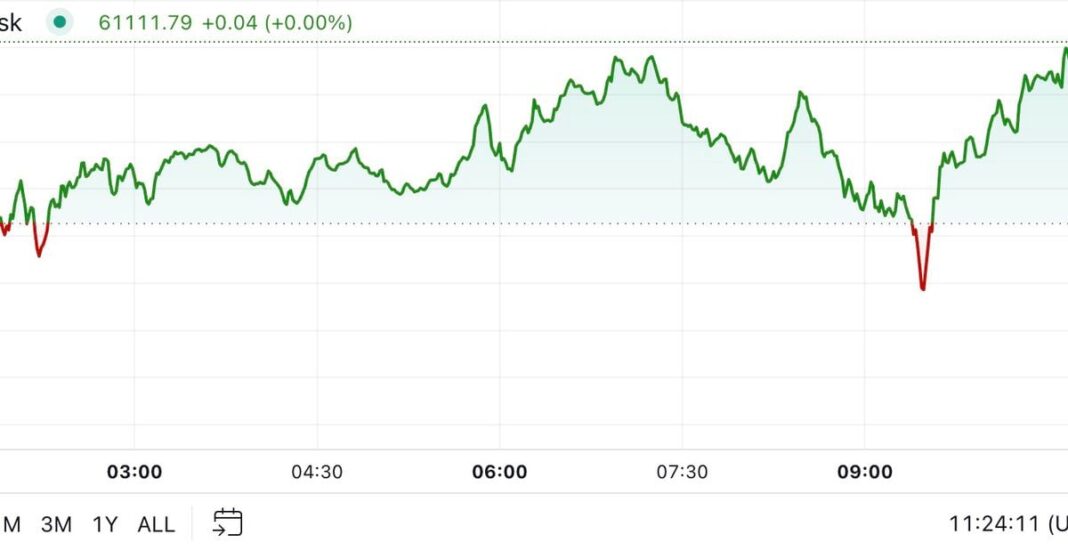

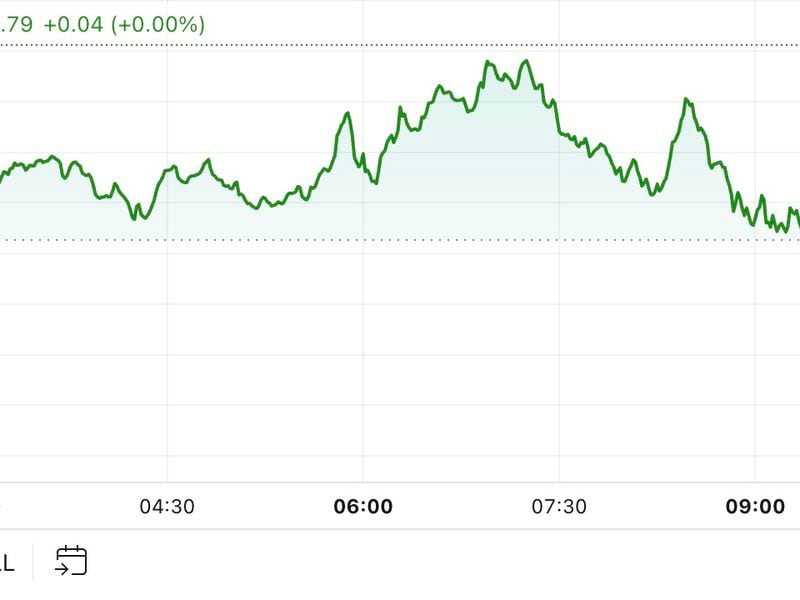

The minutes from the September Fed meeting, released Wednesday, showed policymakers were divided on how aggressive the central bank should be. “A substantial majority of participants” favored cutting the interest rate by half a percentage point, though some expressed misgivings about going that large, the minutes said. “Crypto sentiment has moved back into the fear zone (39), reinforcing the contrast with 72 (greed) in equities,” said Alex Kuptsikevich, a senior analyst at FxPro. “This dynamic is easily explained by the appreciation of the dollar and the increased attractiveness of bonds, which reduces institutional traction in bitcoin.” The dollar index (DXY), rose to 102.97, the highest since Aug. 16, taking the cumulative gain since the Sept. 30 low of 100.18 to 2.7%, according to data source TradingView.