Bitwise Asset Management, a prominent player in the cryptocurrency investment space, has filed for a Solana (SOL) exchange-traded fund (ETF) in Delaware.

This move positions Bitwise alongside other firms like VanEck and Canary Capital, all vying to introduce the first U.S.-based Solana ETF.

Solana ETF 19b-4 filings, Source: X

The Significance of a Solana ETF

Solana has rapidly ascended in the crypto hierarchy, currently standing as the fourth-largest cryptocurrency by market capitalization. Known for its high-speed transactions and scalable infrastructure, Solana has become a favorite among developers and investors. An ETF centered on Solana would offer investors a regulated avenue to gain exposure to this dynamic asset without the complexities of direct cryptocurrency ownership.

Bitwise’s Strategic Maneuver

Bitwise’s filing is more than a mere addition to its product lineup; it’s a calculated step to capitalize on Solana’s growing prominence. The firm has a history of pioneering crypto investment products, including the Bitwise 10 Crypto Index Fund, which provides diversified exposure to leading cryptocurrencies.

By pursuing a Solana ETF, Bitwise aims to cater to the increasing demand for investment vehicles that focus on high-potential digital assets.

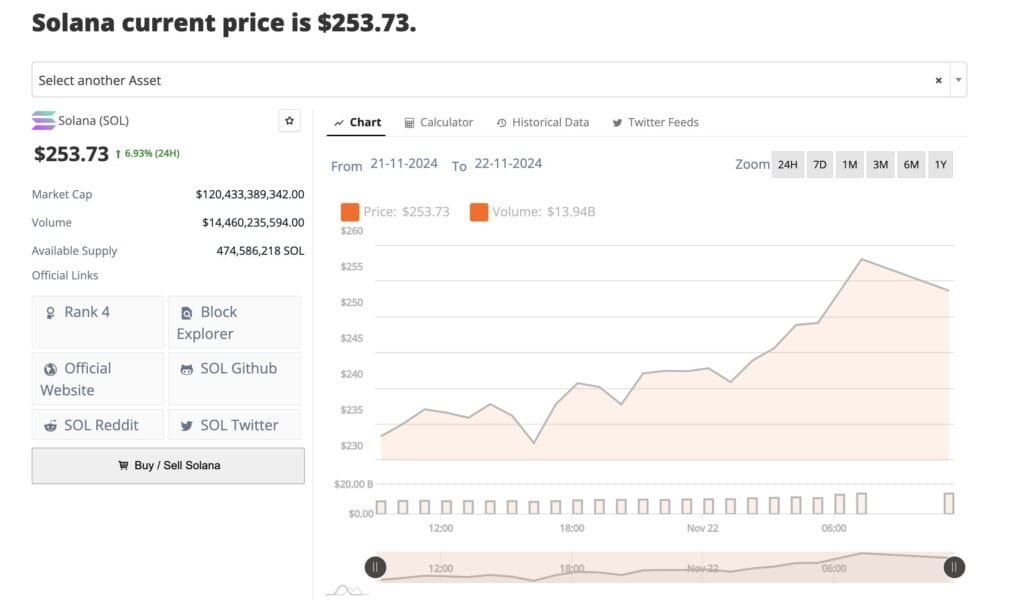

The announcement of Bitwise’s filing coincided with a surge in Solana’s price, pushing it above $253. This uptick reflects investor optimism about the potential approval of a Solana ETF and the broader acceptance of cryptocurrency-focused financial products.

Source: Brave New Coin

Regulatory Landscape and Future Prospects

The path to ETF approval in the U.S. is notoriously stringent, with the Securities and Exchange Commission (SEC) maintaining a cautious stance toward cryptocurrency ETFs. However, the recent approval of Bitcoin and Ethereum ETFs has set a precedent, potentially paving the way for other crypto assets like Solana. Bitwise’s proactive approach, coupled with its experience in managing crypto funds, positions it favorably in this evolving regulatory environment.

Bitwise’s filing for a Solana ETF underscores the growing institutional interest in diversified cryptocurrency investment products. As the regulatory framework continues to adapt to the burgeoning crypto market, the approval of such ETFs could significantly enhance investor access to digital assets, further integrating cryptocurrencies into mainstream financial portfolios.