BlackRock, the largest asset manager globally, with an impressive $11.5 trillion under management, has proposed a modest Bitcoin allocation of 1-2% for portfolios. According to BlackRock, this allocation range is a balanced approach for those seeking exposure to the cryptocurrency without taking excessive risks.

In a report titled “Sizing Bitcoin in Portfolios,” published on December 12, BlackRock highlighted that this percentage allocation carries a similar level of portfolio risk as investing in leading tech stocks, including giants like Amazon, Microsoft, and Nvidia. These companies belong to what the report calls the “magnificent 7,” a group of mega-cap tech players.

The report warns against exceeding this suggested range, stating that larger allocations could drastically increase Bitcoin’s risk contribution to a diversified portfolio. While Bitcoin offers unique opportunities, investors must tread carefully when deciding how much of their portfolio to commit.

Bitcoin’s Value Hinges on Adoption, Not Cash Flows

BlackRock’s report shifts focus from traditional valuation metrics, emphasizing that Bitcoin lacks cash flows to predict future returns. Instead, its long-term value is rooted in adoption trends and its role as a diversified asset.

“Bitcoin may also provide a more diversified source of return,” the report explains. The company adds that over time, Bitcoin’s correlation with major risk assets might decline due to its distinct drivers of value. This unique positioning makes Bitcoin a potentially compelling hedge against specific risks akin to gold.

However, BlackRock cautions that Bitcoin’s risk profile could diminish as adoption grows, potentially leading to fewer structural price catalysts. The cryptocurrency might then evolve into a more tactical investment rather than a driver of high returns.

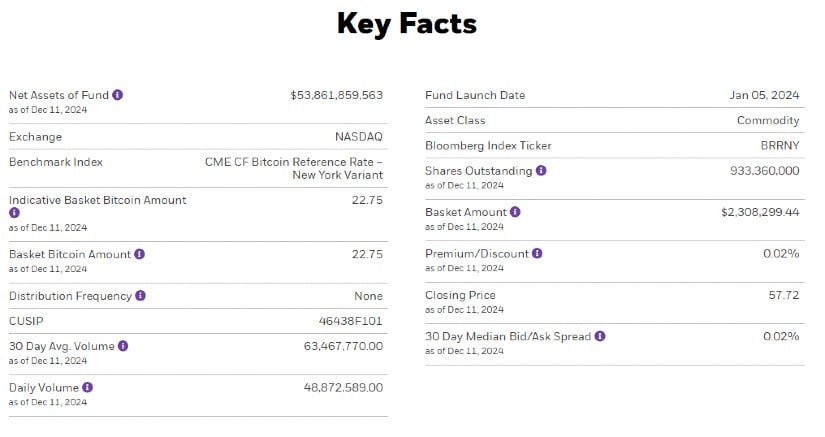

Institutional interest in Bitcoin has surged in 2024, driven largely by the growing popularity of spot Bitcoin ETFs. These funds, which debuted in January, crossed $100 billion in net assets by November, marking a significant milestone.

BlackRock’s iShares Bitcoin Trust (IBIT), the largest spot Bitcoin ETF, holds nearly $54 billion in net assets. Collectively, spot Bitcoin ETFs now manage over 1.104 million BTC, surpassing the balance held by Bitcoin’s anonymous creator, Satoshi Nakamoto. BlackRock’s ETF alone accounts for approximately 529,000 BTC under Coinbase Custody.

Source: BlackRock

Such institutional activity is reshaping the crypto landscape. Sygnum Bank’s analysis predicts that even small institutional allocations could create “demand shocks” by 2025, potentially driving Bitcoin prices higher. These developments hint at a rapidly evolving ecosystem where institutional players wield significant influence.

Trump’s Crypto-Friendly Stance Adds Momentum

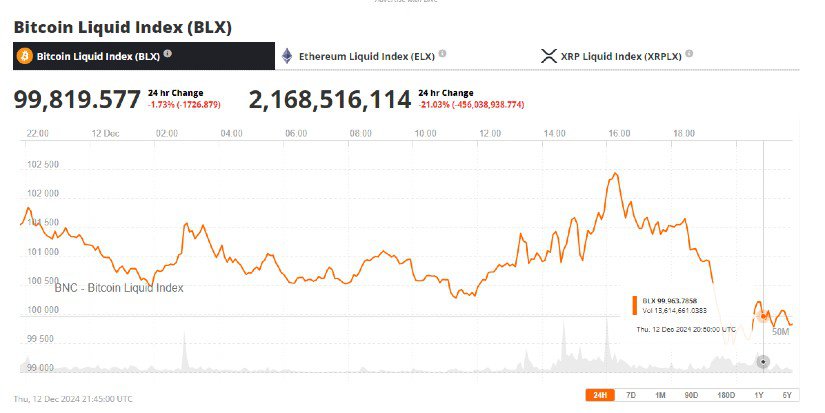

The recent surge in Bitcoin’s price—breaking $100,000 for the first time—coincides with a notable political shift. Donald Trump, who is viewed as supportive of cryptocurrency, secured the U.S. presidency last month. At the time of writing, Bitcoin is trading at $99,819, marking a 1.71% gain in the last 24 hours, according to Brave New Coin’s Bitcoin Liquid Index.

The broader crypto market has gained newfound legitimacy under this pro-crypto administration. Banks like Goldman Sachs, already holding nearly $1 billion in Bitcoin ETF shares, have expressed interest in expanding their participation amid anticipated regulatory clarity.

At the state level, places like Alabama and Pennsylvania are exploring laws to establish Bitcoin reserves. On a broader scale, governments in countries like the U.S., Brazil, and Canada are reportedly considering similar legislative moves to integrate Bitcoin into strategic reserves.

Still, the report underscores the importance of moderation. A 1-2% allocation, while modest, reflects Bitcoin’s volatility and the uncertainty surrounding its adoption trajectory. Going beyond this range might expose portfolios to disproportionate risk.

The question now is whether Bitcoin can continue its upward trajectory without losing its unique edge. With institutional demand climbing and governments warming to crypto, the stage is set for Bitcoin to solidify its position in the financial mainstream.