Block Inc., the financial services and digital payments giant founded by Jack Dorsey, is making headlines as a potential trailblazer in cryptocurrency adoption.

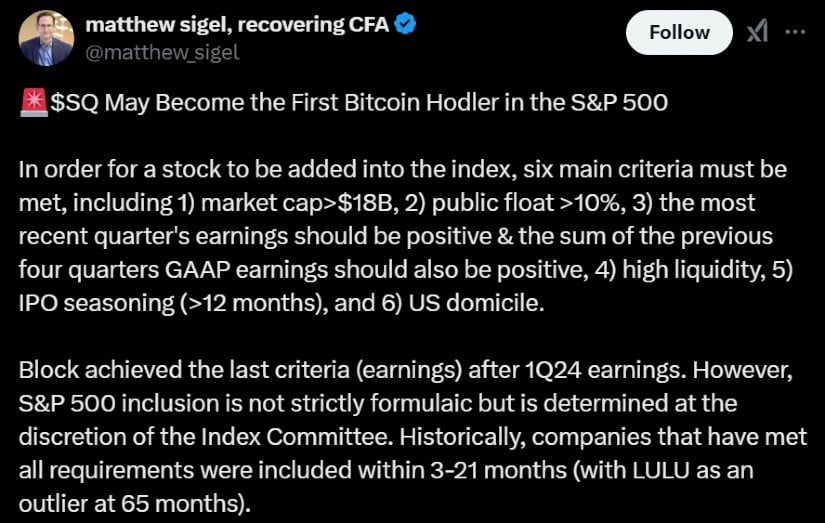

The company, known for its innovative approach, could become the first in the S&P 500 index to implement a clear and explicit Bitcoin strategy. This projection comes from Matthew Sigel, VanEck’s Head of Digital Asset Research, who highlighted Block’s unique positioning and adherence to the index’s stringent requirements.

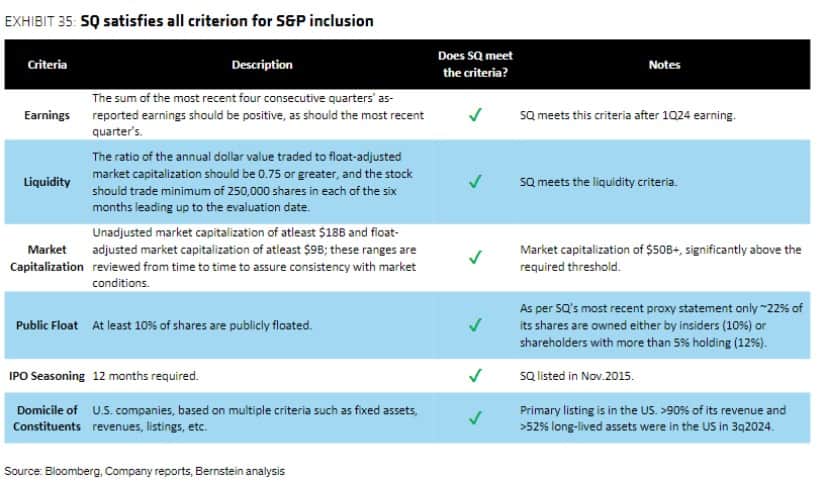

Meeting S&P 500 Criteria

The S&P 500 index represents the 500 largest publicly traded U.S. companies by market capitalization. Inclusion requires meeting six criteria.

Source: Matthew Sigel via X

Block met these benchmarks in Q1 2024, making it eligible for inclusion. However, inclusion depends on the discretion of the S&P Index Committee, which considers various factors, including sector diversity. Historically, eligible companies have been added to the index within three to 21 months of meeting the criteria.

A Distinct Bitcoin Strategy

What sets Block apart is its methodical and recurring approach to Bitcoin investments. Unlike Tesla, which holds Bitcoin without a defined strategy, Block allocates 10% of its monthly Bitcoin gross profits to acquiring more of the cryptocurrency. This systematic accumulation ensures consistent exposure while mitigating market timing risks.

Currently, Block holds 8,363 BTC, valued at approximately $775 million, making it the eighth-largest corporate Bitcoin holder, according to BitcoinTreasuries.NET.

Potential Impact of Inclusion

Inclusion in the S&P 500 is more than just a milestone. It signals financial stability and market leadership while boosting investor confidence. Being listed alongside major corporations enhances a company’s visibility and credibility, especially in sectors like cryptocurrency, which often face skepticism.

Source: Matthew Sigel via X

Sigel remarked that Block’s inclusion would mark a pivotal moment for Bitcoin’s mainstream acceptance. “Block’s approach to Bitcoin sets it apart as a pioneer, potentially leading to broader institutional adoption,” he stated.

Other Contenders: Tesla and Coinbase

While Tesla and Coinbase are the most relevant players in the cryptocurrency space, they are sharply contrasting in their strategic alignment: Tesla, though an S&P 500 component, is not a serial Bitcoin accumulator, while Coinbase is crypto-native but has pure-play crypto exposure that may overcomplicate its case for inclusion.

With its balanced financial model and clear Bitcoin strategy, Block thus presents itself as a safer option for the S&P 500, offering investors indirect exposure to cryptocurrency without excessive risk.

Crypto’s Rising Influence in Traditional Finance

Block plans to release its Q4 2024 financial results on February 20, a key moment that could bolster its chances of inclusion. Despite recent market fluctuations—its stock price dropped 1% over the past five days—Block remains a strong candidate for the index.

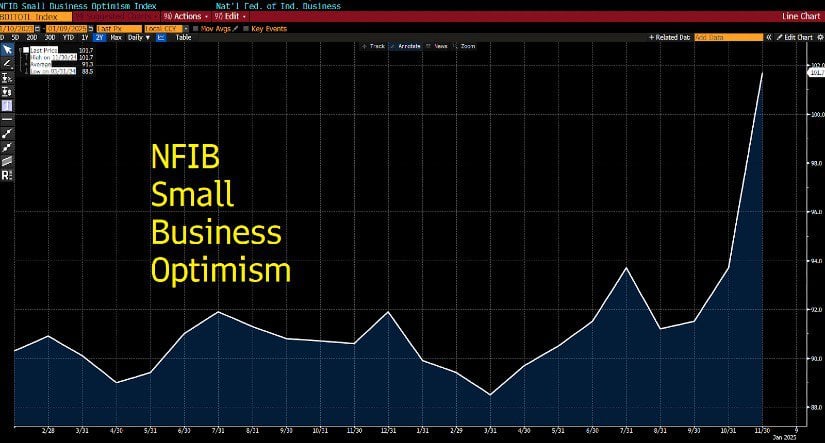

Small business optimism under the new administration could benefit $SQ. Source: Matthew Sigel via X

Block’s potential inclusion echoes a broader trend of integrating cryptocurrency into traditional financial markets. In December 2024, MicroStrategy, another Bitcoin advocate, joined the Nasdaq 100, highlighting the increasing acceptance of crypto-linked companies in prestigious indices.

Block’s journey represents a milestone in bridging the gap between traditional finance and digital assets, signaling renewed confidence in Bitcoin’s long-term prospects despite ongoing market uncertainties.

The growing interest from corporates such as Block provides a clear signal that Bitcoin will continue to do well in 2025. Act accordingly.