Cardano is testing critical levels at $0.48 support and $0.70 resistance, with a breakout above $0.70 potentially signaling a bullish shift.

Cardano, one of the oldest and most established blockchain networks, is currently trading at a critical point. After enduring a prolonged downtrend, the token is finally showing signs of life with a recent green weekly close. Despite this, Cardano’s price remains in a tight range, hovering near key support levels.

Cardano Prints First Weekly Green

After six straight red weekly candles, Cardano finally posted a green close, a minor but welcome shift in tone. The move comes as price tests a key horizontal level near $0.48, which has held as support multiple times throughout 2023 and into 2024. RSI remains deep in the lower range but is starting to curve slightly upward, hinting at potential exhaustion in the selling pressure.

ADA tests crucial $0.48 support, with a potential breakout above $0.70. Source: Av_Sebastian via X

However, it’s too early to call it a confirmed bottom. As analyst Av_Sebastian points out, a reclaim of $0.70 would carry far more technical weight and could flip market sentiment more decisively. Until then, ADA remains range-bound with the $0.49–$0.52 area acting as the immediate battleground.

ADA Sentiment Still Struggling

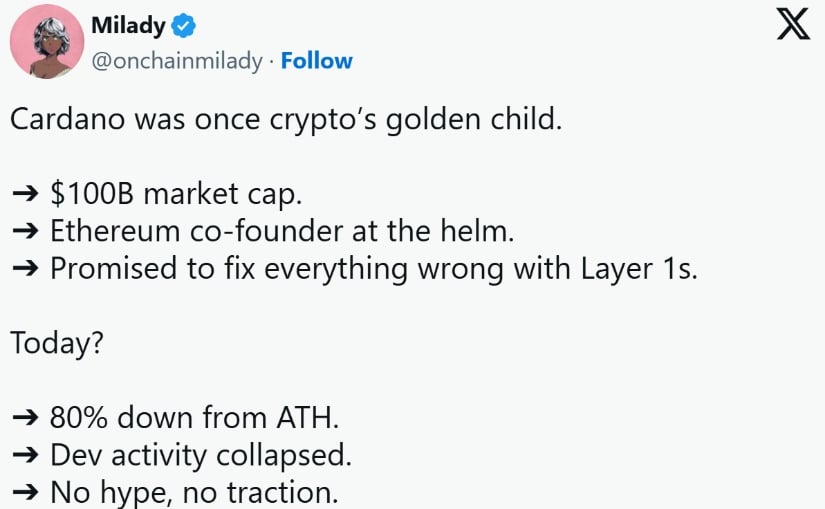

Last week’s green candle was a welcome change, but it hasn’t done much to shift the deeper concerns surrounding Cardano. As highlighted in a recent post by omnchainilady, the token is still down over 80% from its highs, with developer activity thinning out and community engagement noticeably quieter. Price may have found short-term footing, but the underlying momentum needs more strength to follow.

Cardano faces ongoing sentiment struggles, with a break above $0.70 needed to trigger a potential rebound. Source: omnchainilady via X

While others are evolving and pulling in liquidity and users, ADA’s ecosystem appears to be lagging. This has been one of the reasons for Cardano’s slow price. That said, a decisive break above $0.70, especially on volume, could act as a catalyst.

ADA Holds Its Spot in the Top Social Rankings

Despite recent price weakness and sentiment challenges, Cardano hasn’t vanished from the crypto conversation. As analyst JaromirTesar points out, ADA still ranks sixth in overall social dominance, holding 2.5% of total attention across tracked platforms.

While it’s a noticeable drop from the 35% dominance seen in 2021–2022, the current numbers show that Cardano remains in the mix, even if the spotlight has dimmed.

Cardano maintains its place in the top social rankings, holding 2.5% of total attention. Source: JaromirTesar via X

What’s more, the broader slowdown in on-chain activity isn’t a Cardano-only issue. Most chains right now are facing a demand drought, and engagement metrics are down across the board. The focus now is less about hype and more about substance, about building real utility and staying resilient while attention cycles shift. Cardano may not be leading the charge at this moment, but it’s still holding and performing better than most of its competitors.

ADA Cardano Price Chart Mirroring Previous Fractal

Against all the odds, Cardano is once again pressing up against a familiar trendline resistance that has capped rallies since early 2024. According to analyst CryptoSmith, the current structure is beginning to resemble the setup that led to a 240% rally in late 2023. With the price now trading below this long-standing descending resistance, participants are watching closely for signs of breakout confirmation.

ADA is establishing a fractal similar to its 240% surge in late 2023. Source: CryptoSmith via X

If ADA manages to break above this structure, the next key zones to watch are $0.60 and $0.70. Clearing those levels would not only reclaim crucial ground but could also re-ignite momentum towards $1.20, followed by $2.60 region, where fractal completes.

Cardano Price Analysis

Crypto analyst Jesse Peralta highlights key facts that are being missed. Cardano has held its range support for a solid 77 days. That base, built around the $0.50 level, has held strongly, absorbing multiple tests. On the chart, there are clean touches of this zone, followed by rebounds, suggesting that buyers are stepping in quietly but consistently.

Cardano holds steady at the critical $0.50 support, with a potential move towards $0.70 if this level continues to hold. Source: Jesse Peralta via X

If ADA can continue defending this level, the next logical move is a climb toward $0.70, right where resistance has capped upside. A clean break above that could set the stage for a broader recovery, but for now, $0.50 remains the must-hold line.

What Lies Ahead for Cardano?

Cardano is showing some resilience despite its ongoing struggles, and the recent weekly green close is a step in the right direction. However, the journey to recovery will require more than just short-term price movements—it needs a consistent shift in underlying momentum. A reclaim of the $0.70 mark would be a game-changer, potentially signaling a shift in market sentiment. But for now, the $0.50 support remains a critical level to hold.