Charles Hoskinson, the founder of Cardano, has clarified the distinction between private capital held by Input Output Global (IOG) and the allocation of funds overseen by the Cardano Foundation, a Switzerland-based entity responsible for supporting the blockchain’s ecosystem.

His remarks come amid renewed debate over the blockchain’s ability to integrate stablecoins such as Circle’s USDC and how those initiatives should be financed.

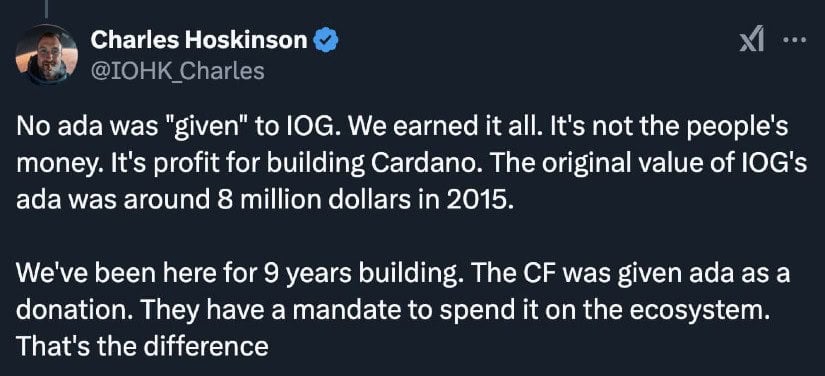

In a series of public statements, Hoskinson emphasized that IOG, the research and engineering firm behind Cardano, will not deploy its private earnings in order to fund external projects. He argued that any such financial responsibility lies primarily with the Cardano Foundation, which holds ADA tokens that were granted as a donation specifically to nurture the network’s growth.

Source: X

“They have a mandate to spend it on the ecosystem. That’s the difference,” Hoskinson remarked in response to recent discussions regarding the potential integration of Circle’s USDC. According to his account, a proposal to bring the stablecoin to Cardano surfaced at a time when the foundation reportedly possessed assets worth around $2 billion. The plan, valued at $3 million, was ultimately declined, fueling questions about the foundation’s decision-making process.

IOG’s stance highlights a key governance issue within Cardano: Hoskinson notes that no ADA tokens were “given” to IOG free of obligation. Instead, the company earned its holdings—initially valued at approximately $8 million in 2015—through years of work building the Cardano blockchain. By contrast, the Cardano Foundation’s assets stem from a donation meant for ecosystem development. This distinction, in Hoskinson’s view, releases IOG from the expectation that its private profits should be used to fund community-driven initiatives.

Observers say this funding debate underscores the growing concerns about how major blockchain projects allocate resources to enhance network utility. Cardano supporters have expressed interest in USDC integration to bolster liquidity and attract more developers. However, stablecoin providers, including Circle and Tether, have reportedly hesitated to support Cardano, pointing to the platform’s relatively limited transaction volume and the perceived scarcity of successful decentralized applications.

Despite the setback, Cardano’s leadership insists that its research-first approach will eventually enable a robust decentralized finance ecosystem.

While stablecoins like USDC are already operational on 16 other blockchain networks—including Arbitrum, Polkadot, and Stellar—analysts say Cardano could still secure stablecoin partnerships if it manages to demonstrate consistent growth in its transaction volume and application use cases.

Cardano’s Growing Momentum: A Promising 2025 for ADA

Cardano’s network activity is surging, which could drive significant price gains for its native cryptocurrency, ADA. The platform has seen a 33% year-to-date increase in Total Value Locked (TVL), reaching $595 million, alongside transaction volumes exceeding $10 million. Additionally, over 10,000 new wallets have joined the network since December 19th, signaling robust market sentiment.

Price Outlook: ADA to Reach $7?

Analysts, including Javon Marks, predict ADA’s price could exceed $7 by the end of 2025, supported by innovation and ecosystem growth. The recent Chang Hard Fork upgrade highlights Cardano’s commitment to decentralization and governance improvements. These advancements, combined with an expanding DeFi ecosystem, position ADA as a lucrative investment opportunity.

The incoming U.S. administration under Donald Trump has pledged to embrace cryptocurrency, aiming to make the U.S. a global crypto leader. Regulatory support could unlock new use cases and attract institutional capital, propelling Cardano’s ADA token toward new all-time highs.

Why Invest in Cardano Now?

Cardano’s improving scalability, growing DeFi applications, and increased adoption suggest substantial upside in 2025. Bullish technical indicators and favorable market conditions further strengthen this outlook.

As institutional investors take notice and positive sentiment builds, Cardano is well-positioned to continue its rally, making 2025 a potentially landmark year for ADA.