1/ Positive Seasonality.

Bitcoin was poised to go up in November from a pure seasonality perspective. November has historically been the best performance month for Bitcoin. Q4 is generally a very good quarter for Bitcoin.

Source: X

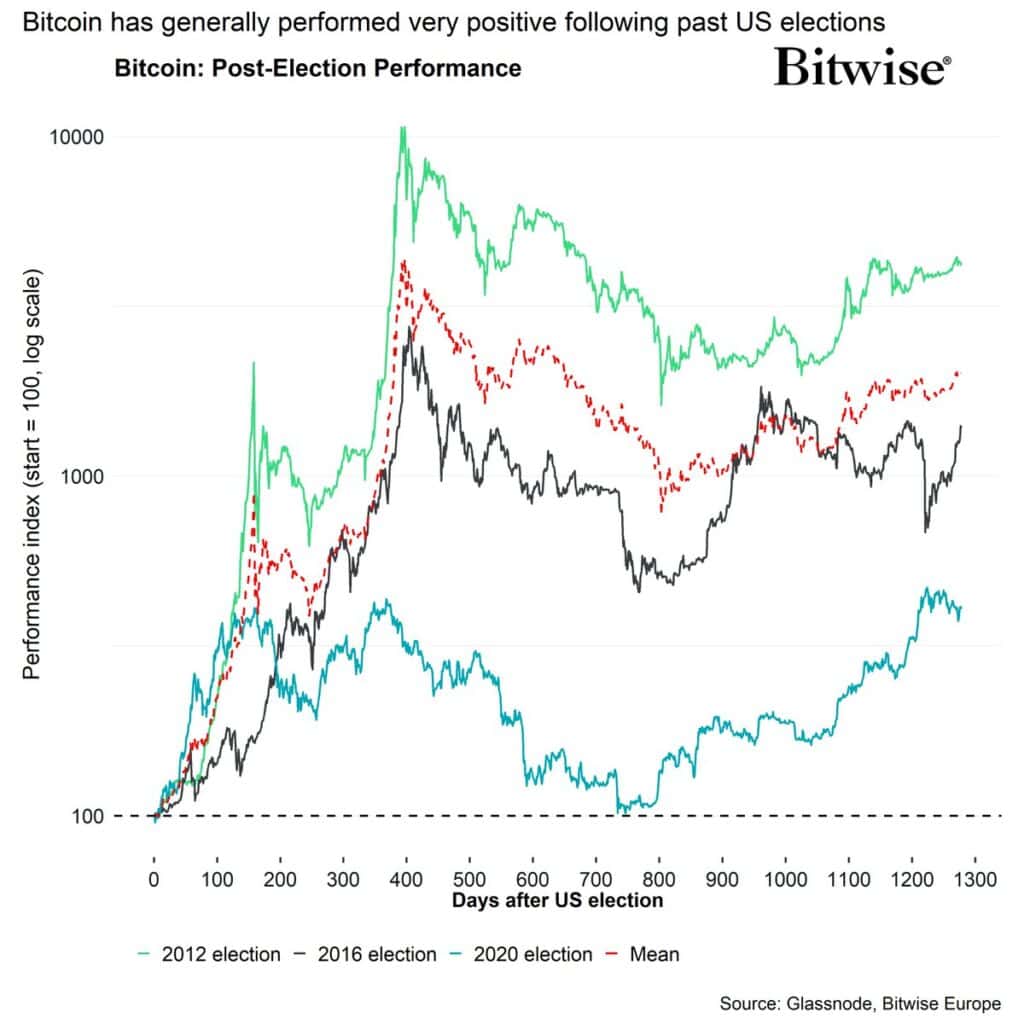

2/ US elections.

Although there were clearly nuances between both Harris and Trump, bitcoin would probably have rallied regardless of the election outcome based on past US election cycles. That being said, the decline in US regulatory uncertainty, pro-crypto US balance of power, and the BTC strategic reserve narrative are all going to accelerate the mainstream adoption of Bitcoin & crypto assets going forward.

Source: X

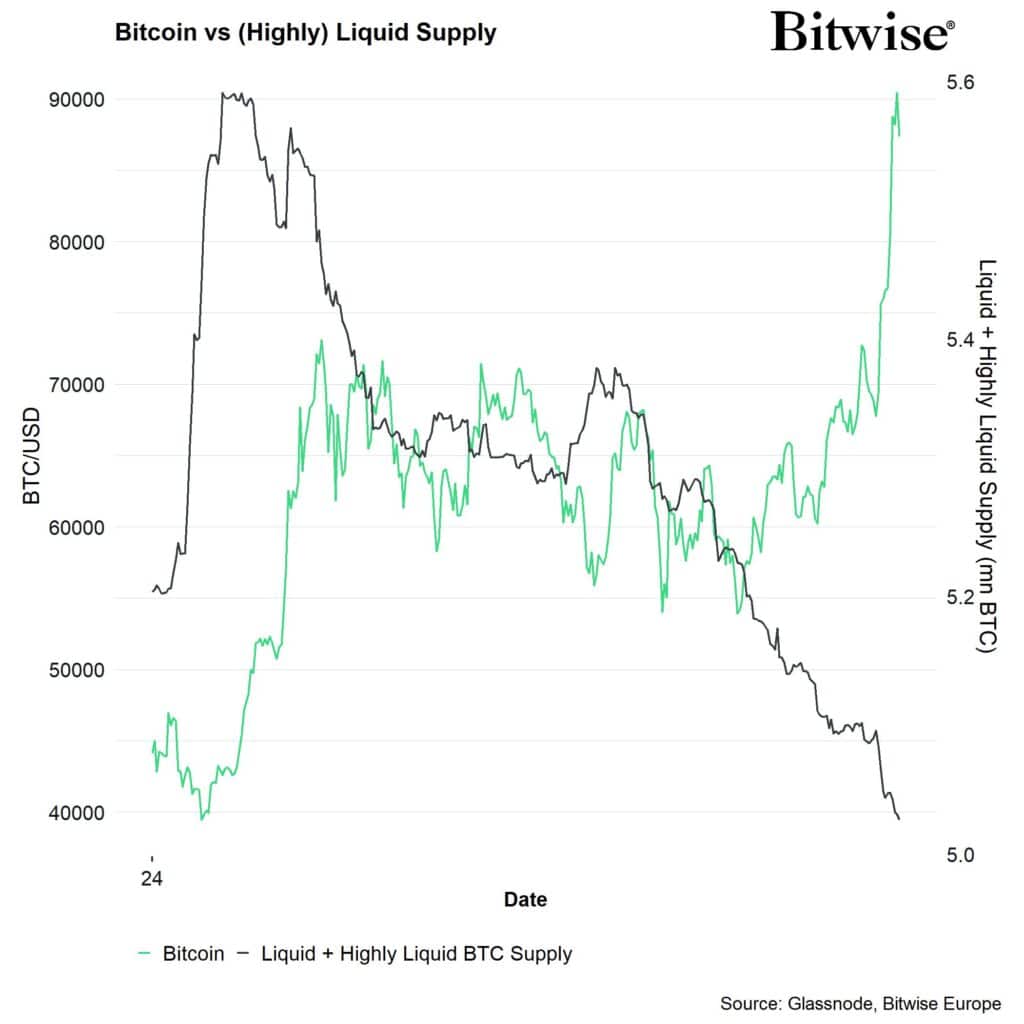

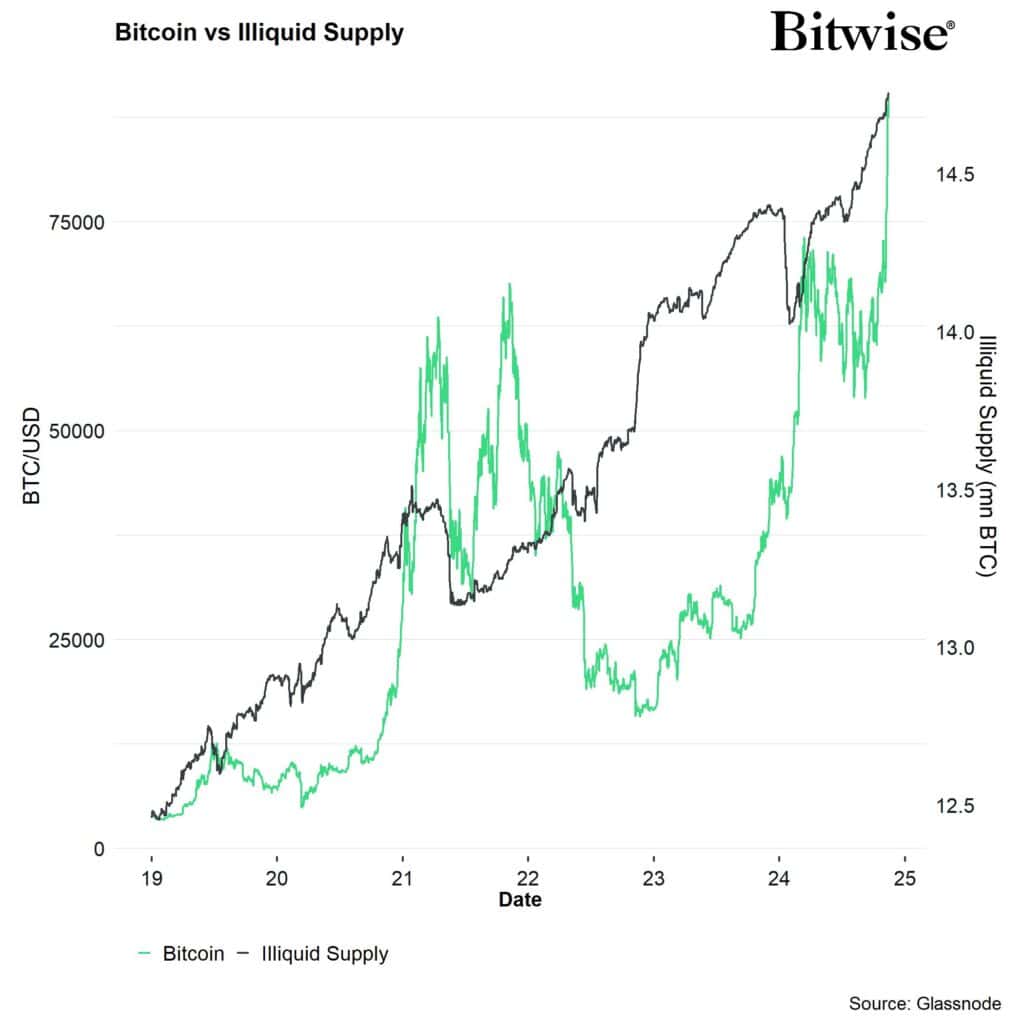

3/ The supply shock is here and it’s real. There is increasing evidence that the BTC supply shock has really been intensifying lately. For instance, measures of liquid + highly liquid BTC supply provided by @glassnode have reached a new year-to-low while measures of illiquid supply have reached a new all-time high. In other words, there have never been more bitcoins deemed as “illiquid”.

Source: X

4/ US spot Bitcoin ETF demand is exacerbating the supply shock. The supply shock emanating from the Halving is even exacerbated by the demand overhang coming from US spot Bitcoin ETFs. Since trading launch in Jan 2024, net flows into US spot Bitcoin ETFs have been 2.5 x higher than the rate of BTC production in the same period. This factor has recently even increased. Over the past 5 trading days, ETF demand has outsized supply by a factor of 12.3 x.

Source: X

5/ Risk of a temporary pull-back due to high sentiment = could create an attractive entry point. To be honest, many institutional investors in Europe have been surprised by the very positive reaction of cryptoassets to the US election outcome. What is more is that a large part still remains underexposed but increasingly wants to gain exposure. The truth is that there is a heightened risk for a temporary pull back as our Cryptoasset Sentiment Index has recently reached to a 3-year high signalling euphoric sentiment & skewed one-sided positioning already. However, a temporary pull-back should be used to increase or gain exposure in what will most-likely be the main part of the bull market.

Source: X