Ethereum price today is regaining strength, rebounding from recent lows and showing signs of a potential breakout amid renewed momentum in ETF activity and growing altcoin momentum.

Analysts suggest that if key resistance levels are breached, Ethereum could be on track to hit $3,000 in the coming weeks.

Market Overview: Ethereum Bounces from $2,400, Targets $3,000

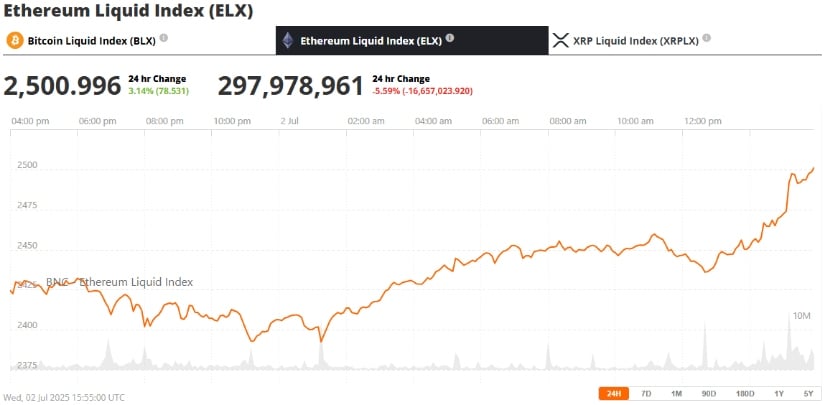

Ethereum (ETH) is showing renewed strength after successfully retesting the $2,400 support zone. As of July 2, 2025, the Ethereum price today is hovering around $2,500, reflecting a bullish bounce that has revived market optimism.

If Ethereum breaks above its current rising channel, analysts suggest the price could rally to $3,000 and potentially beyond toward $3,600. Source: bradc1984 on TradingView

Renowned analyst Michaël van de Poppe shared on X that Ethereum is well-positioned to retest the $3,000 region, calling the recent price dip a bullish “liquidity grab” ahead of a major rally. “Let’s get to $3,000 per $ETH,” he posted, noting that Ethereum has tested resistance between $2,700 and $2,900 multiple times, signaling growing strength.

Technical indicators also support this outlook. Analysts have observed an ascending triangle pattern forming on the daily ETH/USD chart, with the upper boundary aligning with June’s high. This technical setup is often a precursor to a major breakout. “Clearing this level could signal the beginning of a strong uptrend,” one analyst noted.

Ethereum ETF Momentum and Short Squeeze Potential

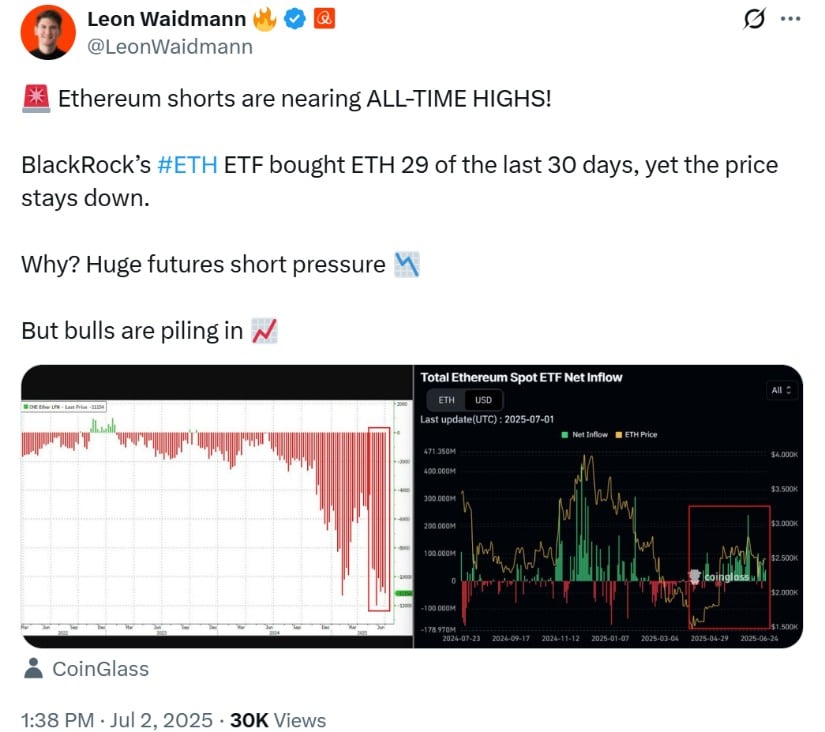

The Ethereum ETF news continues to play a key role in investor sentiment. BlackRock’s ETH ETF has been consistently bought throughout June, despite the current short futures pressure reaching near-record highs.

Ethereum futures shorts are nearing all-time highs despite consistent ETH buying by BlackRock’s ETF, creating potential for a bullish squeeze as long positions build. Source: Leon Waidmann via X

Leon Waidmann, Head of Research at OnChainHQ, highlighted that this dynamic could result in a short squeeze, where bearish traders are forced to exit positions rapidly—driving the price even higher. “Bulls are loading up. A short squeeze might be just around the corner,” Waidmann tweeted.

The increased activity around ETH ETF accumulation, combined with historically high short positions, has created the ideal conditions for explosive price movement in the near term.

Layer 2 Ecosystem and Altcoin Market Strength

Ethereum’s price momentum is also supported by the broader strength in the altcoin market, with many expecting a parabolic rise in the coming weeks. Analysts suggest that Ethereum Layer 2 growth, especially in platforms like Arbitrum and Optimism, could further support ETH’s rally.

Forbes recently noted that while Layer 2 solutions enhance scalability and cost efficiency, they largely depend on Ethereum’s existing validator set and security framework. Source: Seymirel via X

Altcoin analysts are pointing to a decade-old support trendline that was recently retested—an event often seen before major market expansions. Ethereum, as the flagship altcoin, is expected to lead the charge. With altcoin season potentially unfolding, ETH is positioned at the center of the action.

Fundamental Catalysts: Staking, Gas Fees, and Treasury Adoption

On the fundamental side, Bitwise’s mid-year prediction report offered a cautiously optimistic outlook for Ethereum. While the firm initially forecasted that ETH would reach new all-time highs by the end of 2025, its current stance is slightly more conservative compared to Bitcoin.

Ethereum (ETH) price today hit $2,500, up 3.14% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Still, Bitwise CIO Matt Hougan and Head of Research Ryan Rasmussen remain confident that Ethereum staking rewards, increasing interest in stablecoins, and emerging ETH treasury companies will act as long-term price drivers.

“The fundamentals are improving,” Rasmussen noted. “Whether it’s staking growth or ETF expansion, Ethereum remains a core part of the digital asset ecosystem.”

Additionally, Ethereum gas fees, often seen as a bottleneck for user adoption, have remained relatively stable in recent weeks, creating a more favorable environment for transaction volume and DeFi activity.

Looking Ahead: Will Ethereum Break $3,000 in July?

With Ethereum holding above critical support levels and gaining traction at $2,500, analysts remain optimistic. The technical setup, bullish ETF activity, and broader altcoin resurgence suggest that Ethereum could be gearing up for a breakout past $3,000.

Ethereum prediction models are aligning with this sentiment, and if the bulls continue to push, July could mark a turning point for ETH.