As institutional capital flows in and long-term investor confidence strengthens, Ethereum appears poised for a decisive breakout from its current range.

ETH Price Holds Steady Amid Symmetrical Triangle Setup

Ethereum price today remains largely range-bound, trading at around $2,559 on July 7, 2025. After a brief dip earlier this week toward $2,450, ETH bounced back to reclaim critical moving averages, including the 100 EMA near $2,486.

Ethereum is consolidating above $2,478 support, with a flat RSI, 50-SMA holding trend, and key breakout zone at $2,560. Source: @forex_arslan via X

According to the 4-hour chart, Ethereum is compressing within a symmetrical triangle pattern, with clear resistance near $2,560 and support around $2,478. All four key EMAs (20, 50, 100, 200) have converged within a tight band between $2,486 and $2,525—indicating that the market is nearing a critical pivot point.

The current candle structure shows reduced volatility and tightening price action, signaling a classic setup for a potential breakout. If ETH breaks above the $2,560 ceiling with volume confirmation, upside targets of $2,639 and $2,723 are likely.

However, a drop below $2,478 could invite downside risk toward $2,388 or even $2,320.

The Ethereum RSI today is hovering around 49, suggesting neutral momentum as bulls and bears battle for short-term dominance.

Ethereum ETF Inflows Signal Long-Term Institutional Confidence

Beyond the charts, Ethereum ETF news continues to strengthen ETH’s long-term bullish outlook. According to Bitwise CIO Matt Hougan, ETH ETFs could attract as much as $10 billion in inflows by the end of 2025, signaling robust institutional appetite.

Ethereum ETF inflows hit $1.17B in June and could reach $10B in H2, driven by growing appeal among traditional investors. Source: Matt Hougan via X

So far this year, Ethereum-based ETFs have seen more than $1.5 billion in inflows, with $1.17 billion pouring in during June alone—a record month. Hougan attributes this rising interest to Ethereum’s growing role in tokenizing real-world assets like stocks, bonds, and stablecoins.

“As Ethereum increasingly becomes the settlement layer for regulated finance, traditional asset managers are taking notice,” Hougan explained. This structural evolution positions Ethereum not just as a cryptocurrency, but as an integral layer in the future of global finance.

Recent regulatory developments are also adding fuel to Ethereum’s current bullish momentum. A favorable SEC stance on crypto staking—confirming it is not classified as a securities offering—could pave the way for staking-enabled ETH ETFs, drawing in even more institutional capital hungry for yield.

Long-Term Chart Structure Points to $8,500 Target

From a macro perspective, ETH has been consolidating for over two months above the key $2,425 support level. The market has formed a rounded bottom since its April 2025 low, forming the cycle’s bottom.

Improving fundamentals and ETF momentum support a minimum Ethereum target of $5,791, with $8,500 in play amid the 2025 bull market. Source: MasterAnanda on TradingView

“Ethereum is due for a major bullish wave,” reads one technical report, adding that $5,791 is the next logical milestone, followed by a potential rally to $8,500 by late 2025. These projections are supported by a rising long-term base and improving fundamentals—especially as the bear market that began in 2022 is now firmly behind us.

What’s particularly notable is that Ethereum hasn’t posted a new high since March 2024, but the structure of higher lows and steady accumulation suggests that a breakout is a matter of “when,” not “if.”

Ethereum Layer 2 and Ecosystem Growth Add to the Bullish Case

While the ETF narrative garners most headlines, Ethereum’s Layer 2 ecosystem continues to expand. Networks like Arbitrum, Optimism, and zkSync are helping to decouple Ethereum gas fees and boost transaction levels, making ETH more efficient and scalable for DeFi, gaming, and B2B applications.

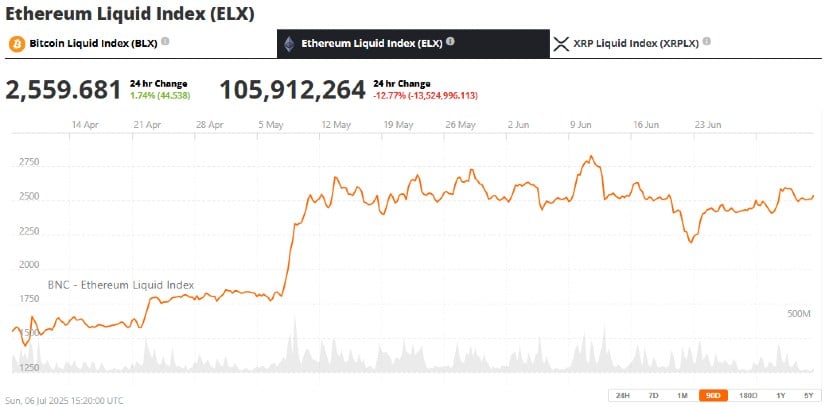

Ethereum (ETH) was trading at around $2,559.79, up 1.76% in the last 24 hours at press time. Source:Ethereum Liquid Index (ELX) viaBrave New Coin

ETH Layer 2 transaction volume remains elevated, and total value locked (TVL) on L2s has gone up steadily over the past month. Such growth for the network backs up Ethereum as a market leader in the smart contract sector.

Aside from this, Ethereum staking rewards and validator incentives have grown more attractive with recent protocol enhancements. With more staked ETH, the circulating supply is reduced, putting additional pressure on the price upwards.

Ethereum Price Outlook: Can $8,500 be a Reality?

With multiple catalysts at work—from Layer 2 growth and staking incentives to ETF momentum—Ethereum appears poised for bullish continuation. Defying the $2,560 resistance is the priority in the short term, but medium-term predictions point toward a path toward $5,791 and ultimately $8,500 by 2025’s end.

Ethereum is in a consolidation phase presently, but fundamentals are coming into place. A strong breakout would potentially start a strong trend, much like the start of previous bull cycles.

Ethereum models today increasingly indicate institutional adoption, staking mechanisms, and on-chain construction as key aspects that can drive Ethereum to its next all-time high.