Today, we discuss Figma preparing for NYSE launch, while the Bitcoin buying mania continues, fueling projects like BTC Bull Token ($BTCBULL).

Design software firm, Figma, plans to go public on the New York Stock Exchange (NYSE) under the ticker FIG, just as it has revealed a $55M investment in a Bitwise-managed Bitcoin ETF.

Figma’s board of directors filed the S-1 form with the SEC, revealing the $55M planned investment and another $30M ready to be converted from USDC stablecoins into Bitcoin.

This is despite the company having no history in the digital asset market and, at some point, even disparaging Bitcoin’s volatility, suggesting a lack of trust in the crypto space.

Things took a turn in a different direction in April, when Figma filed a confidential SEC filing, laying out its IPO plans.

What Figma’s Move Means in the Wider Context of Increased Bitcoin Adoption

Figma’s upcoming Bitcoin investment will only reinforce investor trust in Bitcoin and the crypto market as a whole, which is already riding a bull wave.

If the bet pays off and Figma breaks into the NYSE, the company may become a landmark in the Bitcoin adoption market. The signs are good, given the company’s visible growth heading into its NYSE debut.

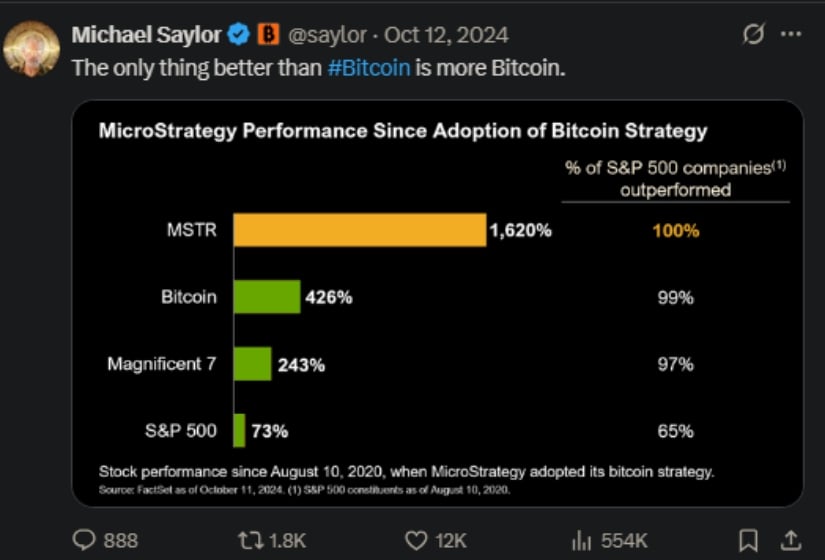

Figma’s NYSE filing comes in the context of increased Bitcoin adoption, with names Strategy (MSTR), MARA Holdings (MARA), and Twenty One (CEP) leading the charts with growing Bitcoin reserves.

Strategy is currently pushing for a 600K-Bitcoin reserve, operating based on the philosophy that the only thing better than Bitcoin is more Bitcoin.

Based on data from Bitcoin Treasuries, public companies have officially bought more Bitcoin than ETFs for the third quarter in a row.

Nick Marie, head of research at Econometrics, explained this surge in interest in terms of profit-stacking:

‘The institutional buyer who is getting exposure to bitcoin through the ETFs are not buying for the same reason as those public companies who are basically trying to accumulate bitcoin to increase shareholder value at the end of the day.’

Nick Marie, Public Statement

This shows sustained pressure in Bitcoin adoption across the board, which could suggest the Bitcoin bull is chomping at the bit.

And it may be about time, given that Bitcoin is up by 3% over the past month and has been hovering around the $107K mark for over a week now.

More importantly, if Bitcoin surges, we should expect the entire market to react accordingly, pushing projects like BTC Bull Token at the forefront of the chart race.

5 Days Left to Buy BTC Bull Token ($BTCBULL) at Presale Price Before Public Listing

The BTC Bull Token ($BTCBULL) presale is over, but you still have five days to buy the token at its final presale price of $0.002585 before the project goes public.

BTC Bull Token is Bitcoin’s most ardent cheerleader, supporting Bitcoin’s run to a $250K price point and beyond. This is one of the best meme coins on the market at the moment, in terms of presale performance and community support.

$BTCBULL has accumulated over $7.8M during its presale phase, with almost 20% of the total supply (2B) filling the staking pool.

According to the whitepaper, though, this is just the beginning, because BTC Bull Token plans to become the ‘unstoppable force’ that carries Bitcoin to $1M and beyond.

To that end, BTC Bull Token offers $BTC airdrops each time Bitcoin reaches key price points ($150K, $200K) to rally the community and garner long-term support.

If you’re interested in joining the FOMO gang, go to the presale page and buy your $BTCBULL today.

Is the Bitcoin Bull Here?

Based on the growing adoption rate and increased institutional interest in the crypto market, it’s likely that Bitcoin will enter its next bull phase at any moment, especially after last week’s consolidation phase around the $107K-mark.

When that happens, keep your eyes on $BTCBUL; It has just completed its presale phase and will likely witness a massive post-launch surge.

Don’t take this as financial advice. Do your own research, have solid risk-management strategies in place, and invest wisely.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.