Hyperliquid presses near all-time highs with strong buybacks, rising income, and bullish chart signals hinting at a breakout past key resistance.

Hyperliquid’s price is pressing against its all-time high, and fundamentals are standing strong. HYPE is riding a wave of strong momentum, majorly driven by massive buybacks, rising income, and renewed staking activity, all while forming a bullish channel on the 2H chart.

Hyperliquid Buy-Back Hit Major Numbers

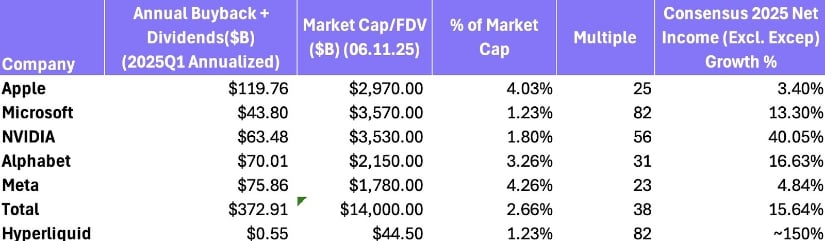

A recent tweet by Artemis highlights something surprising: Hyperliquid is showing signs of real financial strength, with projected buybacks between $500 million to $1 billion this year. That’s the kind of number you usually see from companies like Apple and Meta. Even more impressive, Hyperliquid is growing income at a rate of around 150% year-over-year, far outpacing many traditional tech giants. Hyperliquid is bringing fundamentals into focus, and that could be a game-changer.

Hyperliquid signals strength with $500M–$1B in projected buybacks and 150% annual income growth. Source: Artemis via X

Chart Structure Hint at Breakout Potential

After fundamentals made the case, the charts are now supporting it. Analyst LordOfAlts points out that HYPE is currently trading just under its all-time high near $43, and the price action is respecting a rising parallel channel on the 2H chart. The structure shows clean higher highs and higher lows.

HYPE trades near ATH with rising channel support and breakout potential toward $55. Source: LordOfAlts via X

If this channel continues to hold, the projected breakout zone could stretch toward the $50 to $55 range. More importantly, Futures activity is spiking. That’s a clear signal that participants are actively positioning, not just passively watching. With capital flowing in and open interest climbing, the technical setup supports what the fundamentals already hinted at.

Hyperliquid Technical Analysis

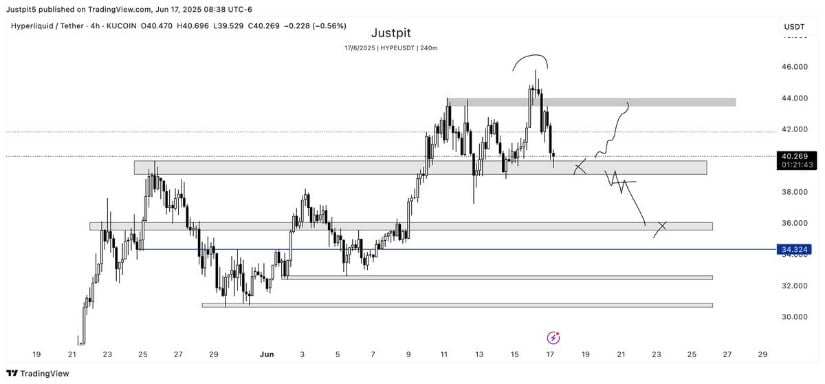

After strong buyback numbers and a healthy uptrend, HYPE is now facing a key support level near $40. As shown in Justpit’s chart, this zone has been tested a few times already, and each time, buyers stepped in. But this time, things are looking a bit more uncertain. If price can hold this level and bounce, it might push back toward the $44 zone. If not, a drop to $36 or even $34.50 could be next.

HYPE hovers near key $40 support with potential bounce toward $44 or drop to $34.50 amid rising buyback-backed momentum. Source: Justpit via X

The chart lays out both paths clearly. There’s also a chance of liquidity sweeps below support, which could trap late sellers before a bounce. While the short-term direction remains uncertain, Hyperliquid’s strong fundamentals, backed by rising income and major buybacks, continue to paint a promising picture for the long term.

HYPE Staking Activity Remains Strong

HYPE is showing another promising signal, this time from the staking side. As pointed out by Holosas, the correlation between staked HYPE and price action is starting to firm up. When HYPE crossed $35 earlier this month, 5 million tokens were unstaked, likely anticipating sell pressure. But the market held steady, suggesting a shift in how it’s absorbing liquidity. Now, with price consolidating above $40, over 4 million HYPE have been restaked in just the past week.

Over 4M HYPE restaked as price consolidates above $40, signaling strong holder conviction and reduced liquid supply. Source: Holosas via X

Staking reduces the liquid supply, which historically sets the stage for upward moves when demand holds. With both price and staking moving in sync, and volatility relatively reduced, there is now room for price to rally higher.

Hyperliquid Faces Key Hurdle at $50 Due to Heavy Order Book

As HYPE inches closer to its all-time high, fresh data from Tobias Reisner shows a cautious outlook, suggesting that any strength would face a hurdle at the $50 mark due to thick order books. With over $50 million in sell-side liquidity sitting right at the round-number resistance, any push higher will need serious volume to break through.

HYPE faces $50 resistance with $50M in sell-side liquidity stacked, posing a key challenge despite bullish structure. Source: Tobias Reisner via X

This comes at a time when buybacks are ramping, staking is increasing, and the price structure is technically sound. But thick order books at a psychological level would be a hurdle for the bulls. Hyperliquid could need more than 1 attempt to break past this resistance ceiling.

Final Thoughts

HYPE is shaping up to be one of the rare plays where strong fundamentals and technicals are in sync. The price structure remains bullish, with a clean rising channel on the 2H chart and higher lows holding near the $40 support zone. Despite short-term uncertainty, the setup hints at a breakout toward $50-$55, if it can clear the heavy order block sitting right at $50.