Metaplanet Inc., a Tokyo-based company positioning itself as a major Bitcoin treasury, has announced plans to acquire 21,000 Bitcoin by the end of 2026.

This move comes amid a meteoric rise in its stock price, reflecting a year of aggressive Bitcoin accumulation that has reshaped the company’s financial strategy. The announcement signals a deepening commitment to its “Bitcoin-first” approach, mirroring similar strategies by corporate players in the U.S.

The company plans to accumulate 10,000 Bitcoin by the close of 2025 before expanding its holdings to 21,000 the following year. Metaplanet CEO Simon Gerovich emphasized the company’s ambition to build one of the world’s largest corporate Bitcoin reserves, dismissing competitors as though “Strategy (formerly MicroStrategy) doesn’t exist.”

A Year of Unprecedented Growth

Metaplanet Announces its Plan to Stock on Bitcoin. Source: Metaplanet Inc on X

Metaplanet’s pivot to a Bitcoin-centric model in April 2024 marked a turning point for the firm. By the end of the year, the company held 1,761 Bitcoin, acquired at an average price of ¥11.85 million per coin. The value of these holdings has since surged, surpassing ¥27.7 billion ($206 million), underscoring the success of its investment approach.

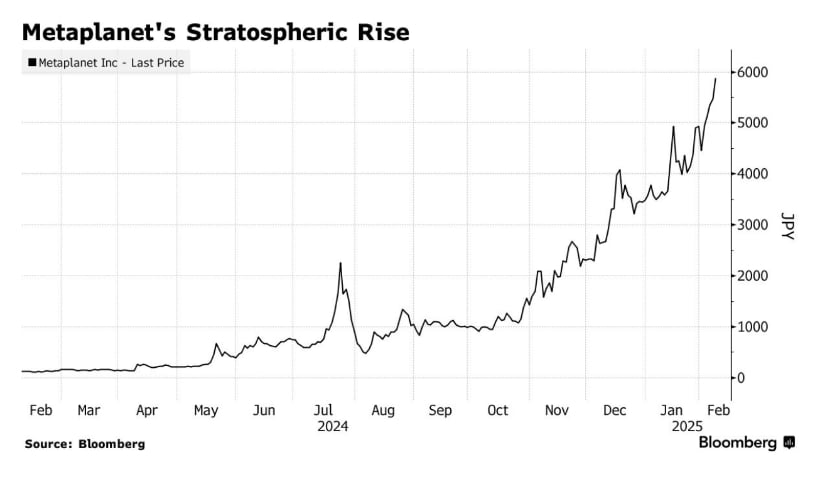

The company’s stock market performance has been equally dramatic. In 2024, Metaplanet’s market capitalization soared by 7,000%, and trading volume surged 430-fold in yen terms. Its shareholder base expanded by 500%, now exceeding 50,000 investors. Over the past 12 months, shares have skyrocketed over 4,000%, making it the biggest gainer in the Japanese stock market and a standout performer globally.

The broader market environment has also played a role in fueling Bitcoin’s ascent. The cryptocurrency hit a record high of $109,241 on January 20, 2025, coinciding with U.S. President Donald Trump’s pro-crypto policies and a shifting investment landscape in Japan that has increasingly embraced digital assets.

Metaplanet’s share price has skyrocketed thanks to its Bitcoin strategy. Source: X

The Mechanics of the 21,000-Bitcoin Strategy

Metaplanet’s new initiative dubbed the “21 Million Plan,” will be financed through the issuance of 21 million shares via moving strike warrants. The company aims to raise ¥116.65 billion ($870 million) through this strategy, setting it apart from traditional Japanese equity raises, which often dilute shareholder value. Instead, the warrants will be pegged to 100% of the previous day’s closing price to prevent shares from being sold below market value.

Dylan LeClair, Metaplanet’s Director of Bitcoin Strategy, stressed the company’s focus on maximizing Bitcoin per share while protecting shareholder interests. “We’ve designed this plan to protect our shareholders,” he said. “We have the flexibility to pause or resume share issuance depending on Bitcoin market conditions.”

Gerovich credited Strategy’s Michael Saylor as an inspiration for the firm’s pivot to Bitcoin, acknowledging that Metaplanet was previously a struggling hotel developer under the name Red Planet Japan. The COVID-19 pandemic forced the company to close nearly all its hotels by early 2024, leading to its transformation into a Bitcoin-focused entity. The transition has yielded massive gains, drawing investors such as Capital Group, a key backer of Strategy, though retail traders make up the majority of its shareholder base.