OKX revealed that its license was granted through its crypto hub in Malta, while Crypto.com confirmed the same day that it had also received its license.

OKX and Crypto.com have successfully secured full licenses under the European Union’s Markets in Crypto-Assets Regulation (MiCA). Both exchanges announced the achievement on January 27, marking a pivotal step toward expanding their regulated services across the European Economic Area (EEA).

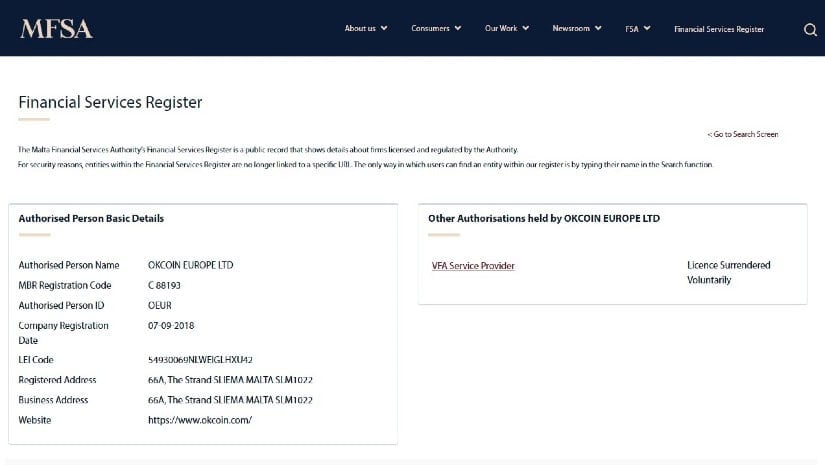

The Malta Financial Services Authority (MFSA) issued the licenses, which allow both companies to offer regulated crypto services to users throughout Europe.

Source: MFSA

OKX and Crypto.com – Regional Expansion

One standout feature of MiCA is the concept of “passporting.” This enables licensed businesses to extend their services seamlessly across the EU, thanks to a unified regulatory framework. The passporting system simplifies crypto access for millions of users across the EEA, breaking down traditional barriers.

Both exchanges are taking full advantage of this benefit. OKX plans to offer services such as over-the-counter (OTC) trading, spot trading, and bot trading alongside a user-friendly platform tailored to local languages and currencies. Crypto.com similarly promises a wide range of crypto-related services to European customers and plans to launch banking, credit cards, and stock services.

The licenses also open doors for users to explore regulated access to over 240 cryptocurrency tokens and more than 260 trading pairs. OKX, in particular, boasts 61 euro-crypto trading pairs, enhancing the platform’s appeal to eurozone users.

Executive Insights and Regional Promise

Erald Ghoos, CEO of OKX Europe, expressed enthusiasm for the achievement, emphasizing Malta’s globally respected regulatory framework. Through the Malta Hub, OKX aims to deliver a secure, compliant, and reliable digital asset platform to its users. Ghoos underscored the importance of the MiCA license in laying a solid foundation for expansion across Europe.

“The Malta Financial Services Authority (MFSA) is renowned for its thorough regulatory framework and is at the forefront of global regulatory standards. Through our Malta Hub, OKX customers will be offered the best, most secure and fully compliant digital asset platform,” said Ghoos.

Similarly, Eric Anziani, president and COO of Crypto.com, commended the European Union for its regulatory foresight. He highlighted how the MiCA license streamlines operations, ensures compliance and facilitates seamless cross-border transactions.

The MiCA framework enhances user safety by establishing secure connections to banks for deposits and withdrawals. It also provides free euro deposits through bank transfers, enabling customers to purchase cryptocurrency using trusted local payment methods like cards. This approach improves accessibility and convenience for users across the region.

MiCA’s Long-Term Impact on the Crypto Industry

The final phase of MiCA’s implementation was completed in late December 2024, bringing additional regulatory requirements for crypto firms operating in Europe. Companies must now delist non-compliant assets, adjust fee structures, and enhance customer services to align with the new guidelines.

While these strict requirements increase compliance costs and demand advanced technology for anti-money laundering (AML) measures, firms like OKX and Crypto.com are embracing the challenge. Both exchanges have positioned themselves to thrive under the framework, solidifying their status as trusted, regulated entities in the region.

In contrast, some global players like Binance have opted to explore opportunities in other regions due to the high costs of compliance. For instance, the United States has seen renewed interest in its crypto landscape, bolstered by a supportive stance from the administration.