Pudgy Penguins (PENGU) is trading in a tight consolidation zone after a major rally, with technicals and order book data hinting at a potential breakout toward $0.031.

Pudgy Penguins (PENGU) is lining up for a potential 20–30% quick move as its consolidation phase nears completion. After a sharp rally from the lows, the price has been cooling off in a tight range, exactly the kind of setup that often leads to the next continuation phases.

Technical Outlook: Pudgy Penguins Lining Up For Continuation Higher

Pudgy Penguins is holding up in a way that’s hard to ignore. After a strong upside move, the chart is showing classic ascending triangle consolidation, tight price action, fading volume, just above key moving averages. According to #1 Penguin, this kind of setup is less about retracement and more about controlled continuation.

Pudgy Penguins consolidates above key moving averages with fading volume, signaling a potential breakout ahead. Source: #1 Penguin via X

The MAs are now catching up to price, while sellers appear to be running low on supply. Volume has thinned out noticeably, which isn’t a red flag in this context rather a healthy one. The longer this base builds without breaking down, the more it supports the idea that pressure is building for a follow-through. If price continues to hold above this range and reclaims near-term resistance with volume, this setup could shift from consolidation to continuation fast towards $0.01850 and higher.

PENGU Liquidity Map Hints at Potential Short Squeeze

Following its tight consolidation phase, fresh data from Jesse Peralta shows PENGU is now sitting just below a notable short liquidation pocket, over $700K stacked above. On a 24-hour Binance heatmap, these zones light up as potential fuel for an upward move.

With price holding off local support, the setup is lining up for a potential squeeze if momentum pushes into that liquidation range.

PENGU sits just below a $700K short liquidation zone. Source: Jesse Peralta via X

The potential short-term liquidations support the PENGU’s broader continuation move. If PENGU moves through $0.0160 to $0.0165 with volume, it could easily trigger a chain reaction, which would cause panic short-coverings. That could send the price up towards the $0.0180 range with little resistance.

PENGU Approaches Decision Zone After Major Rally

After a 382% move off the lows, PENGU has now reached a key inflection point. Crypto analyst, First1Bitcoin, shows that PENGU Pudgy Penguins price is pressing up against a descending trendline that’s acted as resistance throughout the downtrend. Structurally, this is a classic test: either flip the level into support and continue higher, or face a rejection that sends it back to retest previous demand near $0.0150.

PENGU tests major descending trendline after a 382% rally, with bulls eyeing a breakout toward $0.031. Source: First1Bitcoin via X

So far, price action looks measured, and the lack of aggressive selling hints at control still being with the bulls. A breakout here, if sustained, would shift the larger structure into bullish continuation with upside potential toward $0.031. That aligns with recent liquidity data and the post-consolidation setup.

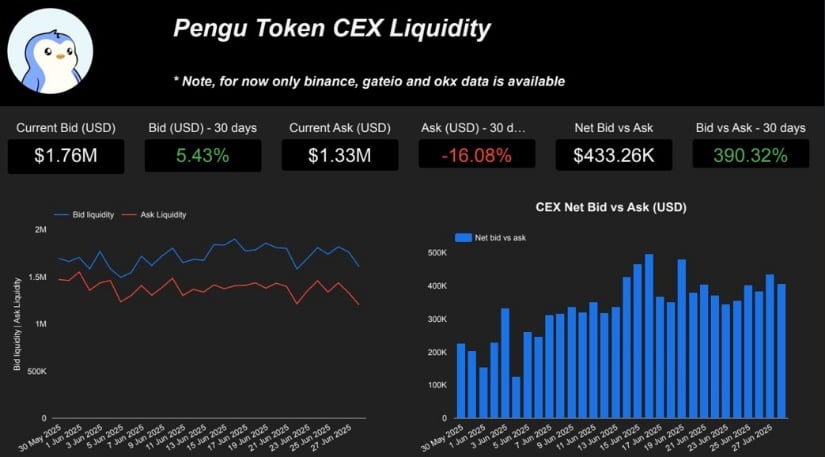

PENGU Order Book Data Confirms Bullish Bias

As PENGU hovers near a critical breakout zone, order book data from Binance, OKX, and Gate.io offers a deeper look. Analyst ahkek4 highlights a sharp 80% rise in the net bid/ask difference over the past 30 days, with bids increasingly outweighing asks. That’s a strong show of buyer interest building quietly in the background.

Order book data shows an 80% rise in net bid/ask spread. Source: ahkek4 via X

On top of that, the ask side (sell wall) has dropped 18%, indicating sellers may be stepping back or are already exhausted after seeing the bullish strength. This shift in order book dynamics adds another layer of confidence to the broader setup. With buyers consistently stacking bids and the sell-side pressure thinning out, it reflects a market more interested in absorbing dips than fading strength.

When paired with the tightening chart structure and nearby short liquidation pockets, the PENGU price prediction starts leaning bullish. If key resistance levels are flipped into support, this order book strength could help fuel the next leg higher

Final Thoughts: Will Bullish Developments Push PENGU Towards $0.031?

PENGU is having bullish developments across the board. From technical structure to order book flows and even liquidation data, the pieces are aligning for what could be a powerful follow-through. Consolidation near highs, strong bid support, and a thinning sell wall all point to a market that’s absorbing pressure.

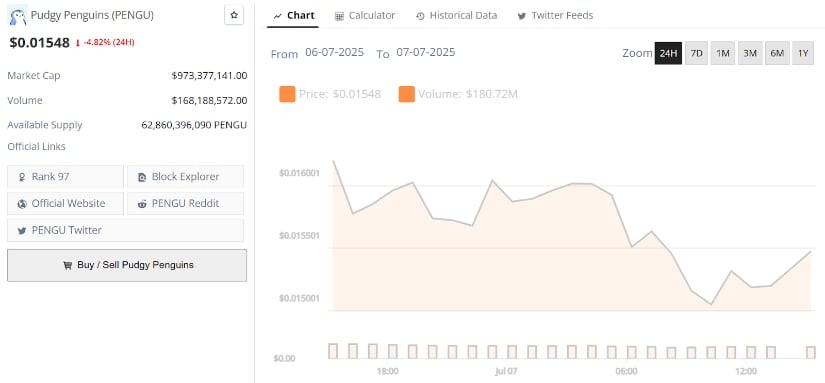

Pudgy Penguins’ current price is $0.1548, down -4.82% in the last 24 hours. Source: Brave New Coin

If bulls manage to reclaim key resistance with volume, the setup favors an extension toward $0.0180 first, and potentially even $0.031 in the coming days.