The ongoing legal battle between the SEC and Ripple Labs may be reaching a pivotal moment as new reports suggest that the U.S. Securities and Exchange Commission is considering classifying XRP as a commodity in its settlement talks with Ripple.

This development could have far-reaching implications for the XRP lawsuit, regulatory clarity, and the broader cryptocurrency market.

SEC Weighs Commodity Classification for XRP

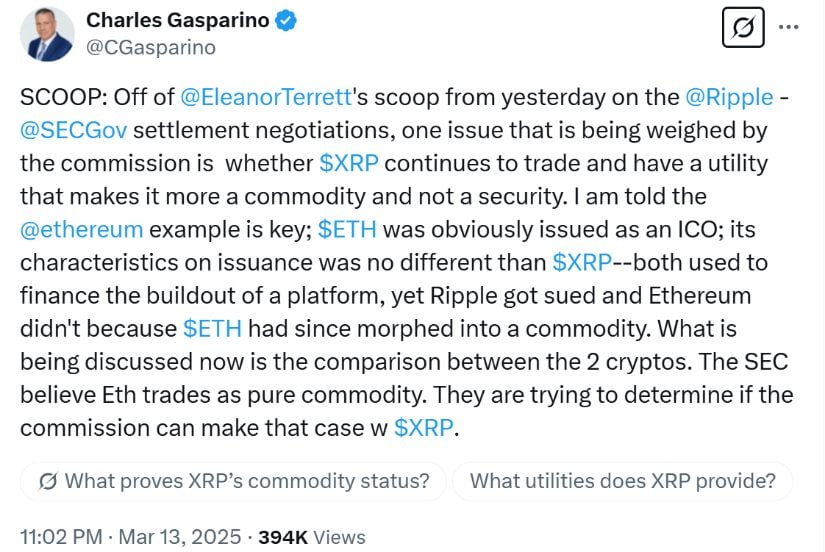

According to FOX Business reporter Charles Gasparino, the SEC Ripple discussions are focusing on whether XRP should be classified similarly to Ethereum, which is currently regarded as a commodity. Despite Ethereum’s initial fundraising through an ICO, the SEC has since deemed it a commodity rather than a security.

Eleanor Terrett reported that the SEC is debating whether XRP, like Ethereum, can be classified as a commodity instead of a security. Charles Gasparino via X

Gasparino noted that SEC officials are debating whether XRP, like ETH, has evolved beyond its initial sale structure and now functions primarily as a Ripple cryptocurrency. If the SEC reaches this conclusion, it could mark a major victory for Ripple Labs and significantly alter the regulatory landscape for digital assets.

Ripple Negotiating Better Terms

Reports indicate that Ripple’s legal team is pushing for more favorable settlement conditions, arguing that the SEC has shown leniency toward other crypto firms. In particular, Ripple’s defense points to the fact that XRP was already ruled “not inherently a security” by Judge Analisa Torres in July 2023. The company contends that agreeing to the settlement under the SEC’s current terms would amount to an admission of wrongdoing, even as the regulator appears uncertain about its own legal arguments.

Ripple is negotiating a $125M settlement, potentially lifting the XRP sales ban and enabling unrestricted institutional adoption. Source: Steph Is Crypto via X

FOX Business journalist Eleanor Terrett also revealed that ongoing negotiations include discussions on reducing the $125 million fine imposed on Ripple Labs and revising restrictions related to XRP sales to institutional investors.

Impact on XRP Price and Market Sentiment

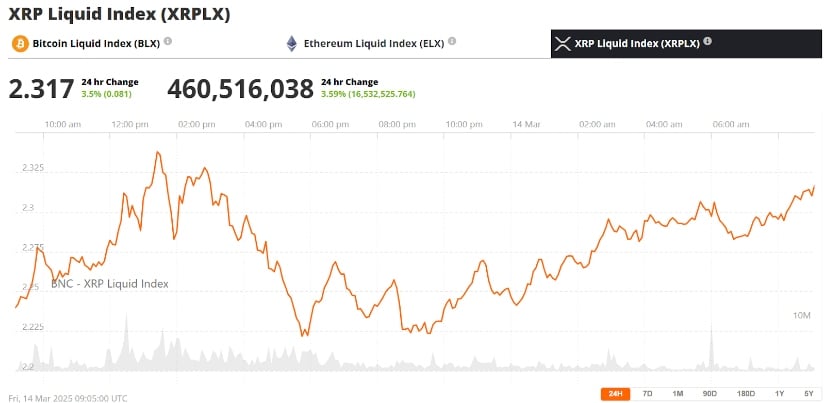

The XRP price has reacted positively to the reports of a potential settlement, surging past $2.34, reflecting a 23% gain over the past week. The possibility of an SEC settlement and clearer regulatory status has fueled optimism among investors, prompting some to buy XRP in anticipation of a bullish breakout.

Market analysts believe that a favorable settlement could pave the way for an XRP Spot ETF, further driving institutional interest. According to Bloomberg ETF analyst James Seyffart, the approval of an XRP ETF hinges on regulatory clarity. If the SEC XRP case concludes with a commodity classification, it could open the door for institutional investments in Ripple exchange-traded funds.

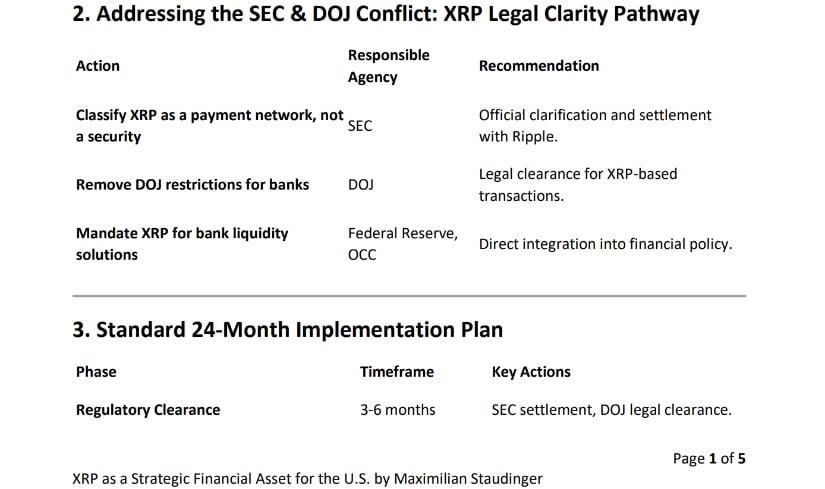

Could XRP Become a Payment Network?

Escalating the argument to the next level, a proposal submitted to the SEC recently suggests reclassifying XRP as a payment network rather than a security. The proposal details how Ripple XRP news can be instrumental in releasing liquidity in Nostro accounts, which has the potential to free $1.5 trillion of stuck capital.

Maximilian Staudinger’s new proposal aims to classify XRP as a payment network to resolve the SEC-Ripple dispute. Source: SEC/GOV

This move could revolutionize cross-border payments, making Ripple’s ledger a central piece of financial infrastructure. The proposal even suggests that some of the released capital could be used to buy Bitcoin, positioning Ripple USD as a key component of the U.S. digital economy.

What’s Next for Ripple and XRP?

While settlement negotiations continue, many in the crypto community await a formal announcement from the SEC Ripple negotiations. A successful result would help to legitimize XRP, and banks will be able to include Ripple USD more easily in mainstream banking solutions.

XRP was trading at around $2.31, up 3.5% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Besides, some analysts are of the opinion that a definite victory in Ripple lawsuits could witness exponential Ripple adoption in the market. If XRP is classified as a commodity, it would open the door for financial institution collaborations such as Ripple Bank of America, increasing the asset’s utility in cross-border transactions.

As the legal landscape continues to change, investors are observing intently, many considering if they should buy or sell XRP before the verdict is reached. The Ripple suit has impacts not only on Ripple’s currency value but also on the general regulatory climate for digital currencies in the United States.

Watch – XRP Price Analysis Video