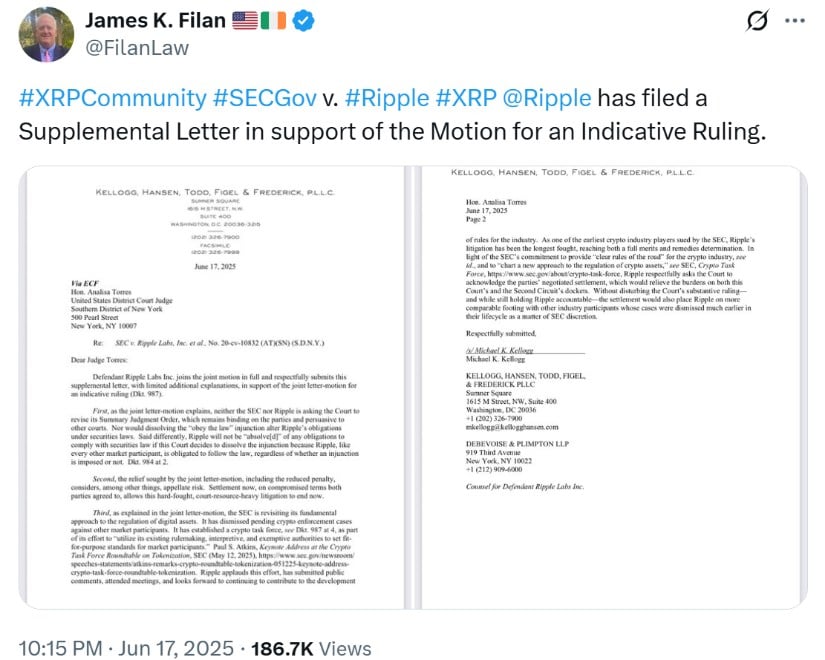

Ripple has submitted a supplemental letter to U.S. District Judge Analisa Torres, intensifying its push for a favorable outcome in the high-profile Ripple vs. SEC lawsuit.

The letter supports the company’s earlier joint motion with the Securities and Exchange Commission (SEC) requesting an indicative ruling — a legal step that could potentially conclude the years-long legal battle.

Ripple Seeks Indicative Ruling to End XRP Lawsuit

In the supplemental letter, Ripple affirms that it joins the SEC’s motion “in full,” and urges Judge Torres to consider three core arguments in support of modifying the final judgment. The motion, filed earlier this month, asks the court to dissolve the longstanding injunction against Ripple’s institutional XRP sales and reduce the penalty from $125 million to $50 million.

Ripple has submitted a Supplemental Letter supporting its Motion for an Indicative Ruling in the ongoing SEC v. Ripple case. Source: James K. Filan via X

Ripple asserts that the indicative ruling would not alter the court’s original summary judgment but only adjust the penalties and injunctive relief granted. “The summary judgment will remain binding on both parties and instructive to other courts,” Ripple stated in the letter, emphasizing that the essence of the case remains intact even as they seek resolution on its final elements.

Ripple Cites Appellate Risk and Fairness Concerns

A key argument in the letter centers on the risk associated with continued appeals. Ripple claims the proposed settlement accounts for appellate uncertainties and would help end what it describes as a “hard-fought, court-resource-heavy litigation.”

The company also argues that dissolving the injunction would bring it in line with other crypto firms whose cases were dismissed by the SEC, thereby ensuring fairness across the regulatory landscape. “Ripple believes it should be treated equitably, especially as the SEC shifts toward a more inclusive and clearer regulatory approach for the crypto industry,” the letter notes.

This sentiment echoes Ripple’s broader criticism of regulatory inconsistencies, with CEO Brad Garlinghouse previously voicing support for tailored digital asset legislation and a level playing field.

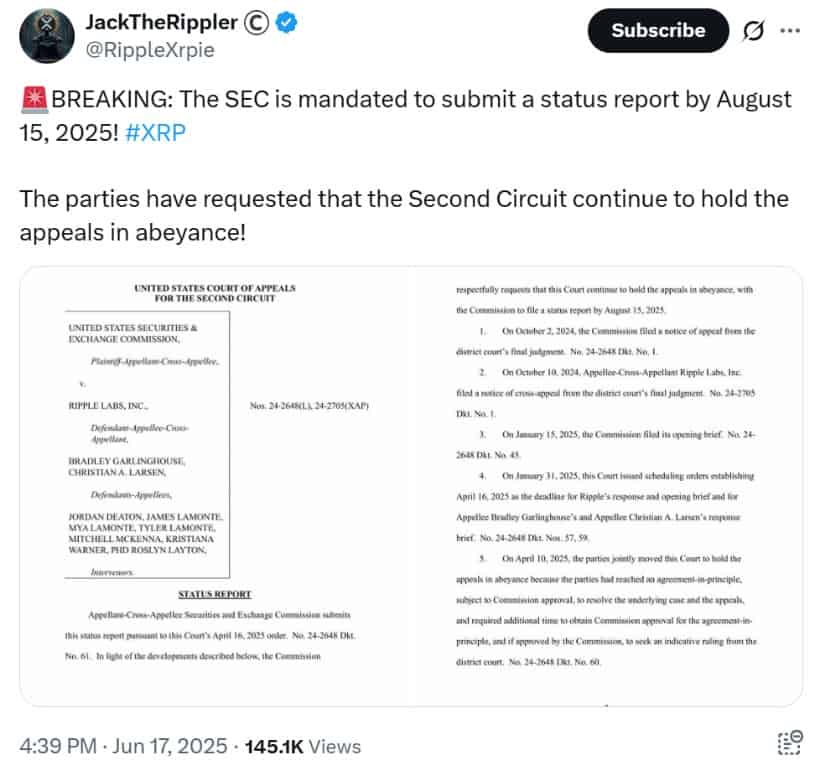

Second Appeal Pause Requested Until August 15

As Ripple and the SEC await Judge Torres’s ruling, both parties have jointly requested a continuation of the appeal pause in the Second Circuit Court until August 15, 2025. This follows an earlier 60-day extension granted in April, and reflects ongoing efforts to finalize a settlement.

The SEC must file a status report by August 15, 2025, as both parties request the Second Circuit to keep the appeals in abeyance. Source: JackTheRippler via X

The pause gives the court additional time to rule on the joint motion, and if granted, the appeals process could be dismissed entirely — bringing long-awaited closure to the XRP lawsuit.

However, if the motion is denied, the lawsuit could either return to active litigation or proceed to further appeals. For now, no further movement is expected in the appeal court until Judge Torres responds.

XRP Price Holds Steady Amid Legal Developments

Despite the legal overhang, XRP price remains resilient. As of June 17, the Ripple crypto token is trading at $2.21, showing minor recovery after recent volatility. With market capitalization hovering around $130 billion, traders are closely watching for signs of a breakout.

XRP is trading at around $2.17 at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Notably, popular analyst Mikybull Crypto recently pointed out that XRP’s chart is mimicking its legendary 2017 bull pennant setup — a formation that preceded a 1,300% surge. “I’ve seen this movie before,” the analyst noted, suggesting that XRP value could rally significantly if the legal clouds clear.

A successful settlement could reignite investor interest, potentially driving Ripple market momentum and improving XRP price prediction models going forward.

Ripple Pushes for Closure as Crypto Regulation Evolves

As the broader Ripple XRP news landscape shifts, this legal update marks another chapter in the company’s effort to emerge from regulatory uncertainty. The firm has long advocated for regulatory clarity and has been in dialogue with lawmakers, financial institutions like Ripple Bank of America, and international regulators about the evolving role of digital assets.

While the outcome of the current motion remains pending, the case continues to be a defining moment for Ripple currency price, Ripple exchange operations, and broader XRP SEC lawsuits.

This ongoing legal saga underscores the stakes not just for Ripple, but for the entire crypto industry as it navigates its relationship with U.S. regulators. The coming weeks could prove pivotal for Ripple — and for the future of crypto regulation in America.