Ripple confirmed a strategic partnership with Ondo Finance, a real-world asset tokenization firm, to launch Ondo’s tokenized U.S. Treasury product, OUSG, on XRPL.

Ripple CEO Brad Garlinghouse has made waves in the crypto community by advocating for a diversified U.S. digital asset reserve rather than one centered solely on Bitcoin. His stance has drawn support from some and criticism from Bitcoin maximalists, sparking debates on the future of crypto reserves at a national level.

Ripple and Ondo Finance Partner for Tokenized U.S. Treasuries

Ripple’s latest move involves collaborating with Ondo Finance to expand access to tokenized short-term U.S. Treasury securities through XRPL. OUSG, the tokenized treasury product, is backed by BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), offering institutional investors an efficient way to hold and redeem U.S. Treasuries around the clock.

Ondo Finance brings tokenized US Treasuries to XRPL in collaboration with Ripple. Source: Ondo Finance via X

Tokenized real-world assets (RWAs) have been gaining significant traction in the blockchain space, bridging the gap between traditional finance and decentralized systems. The introduction of OUSG to XRPL is expected to enhance liquidity, providing an alternative to Ethereum, Polygon, and Solana—where OUSG is already available. It’s big news for XRP investors.

Markus Infanger, Senior Vice President of RippleX, emphasized the significance of tokenized assets in transforming financial markets. “The 24/7 intraday settlement enabled by tokenized assets like OUSG marks a transformative shift in capital flow management, breaking free from traditional trading hours and slow settlements,” he said.

Ondo Finance’s Vice President of Partnerships, Katie Wheeler, echoed similar sentiments, highlighting XRPL’s institutional-grade infrastructure as a key reason for choosing the network. “This integration is the natural convergence of a compliance-first, yield-bearing product with a network purpose-built for institutional adoption, setting the groundwork for forward-thinking institutions to lead a new era of capital markets on-chain.”

The deployment of OUSG on XRPL is set to go live in the next six months, with both Ripple and Ondo Finance committing seed investments to ensure initial liquidity.

Ripple CEO Advocates for a Diversified U.S. Crypto Reserve

In a separate development, Ripple CEO Brad Garlinghouse has pushed back against the idea of a Bitcoin-only reserve for the United States. Instead, he has argued for a diversified approach that includes multiple cryptocurrencies, such as XRP.

“We live in a multichain world, and I’ve advocated for a level-playing field instead of one token versus another. If a government digital asset reserve is created, I believe it should be representative of the industry, not just one token—whether it be BTC, XRP, or anything else,” Garlinghouse stated.

Ripple CEO says Trump will be ‘profound’ for crypto, discusses XRP as a US strategic reserve asset. Source: Walter Bloomberg via X

His remarks were in response to claims that he had lobbied against a Bitcoin strategic reserve. He clarified that he had spoken with key policymakers and officials, advocating for a more inclusive approach that reflects the broader crypto market rather than favoring one asset over all others.

Bitcoin maximalists, including Pierre Rochard, have criticized Garlinghouse’s stance, accusing him of attempting to position XRP as a preferred asset over Bitcoin. In response, Garlinghouse dismissed these criticisms, arguing that such perspectives are outdated and fail to acknowledge the evolving nature of blockchain ecosystems.

“Maximalism remains the enemy of crypto progress, and I’m very glad to see fewer and fewer folks ascribe to this outdated and misinformed thinking,” he remarked.

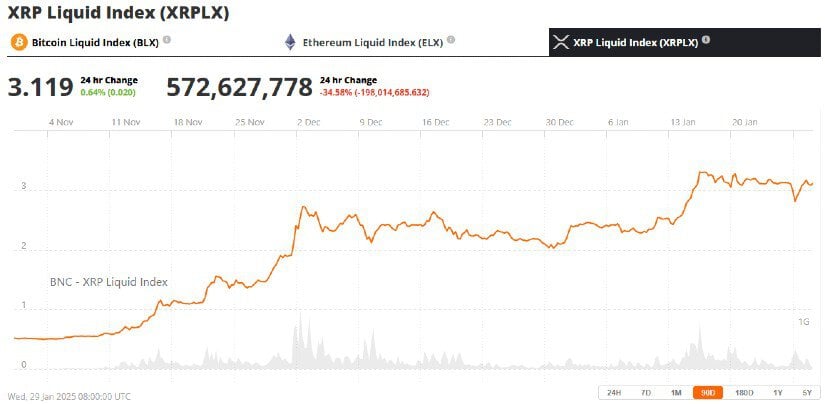

XRP’s Market Reaction and Potential Rally

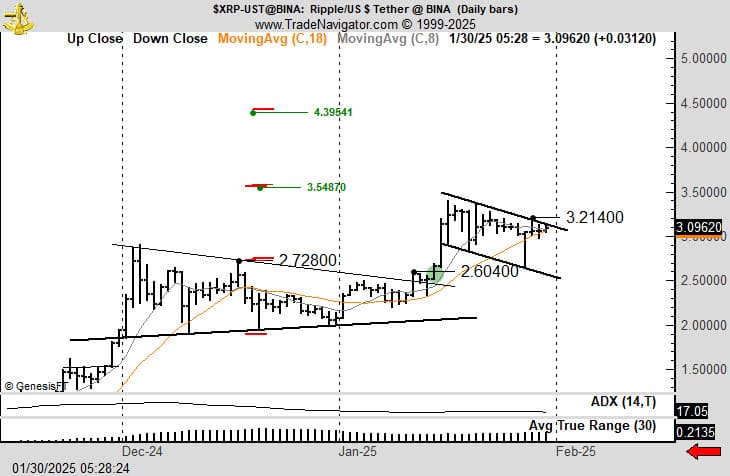

Following these announcements, XRP has experienced a modest uptick in price. The cryptocurrency is currently trading near $3.10, with an intraday high of $3.21 and a low of $3.02.

Ripple (XRP) price chart (90 days). Source:XRP Liquid Index (XRPLX) via Brave New Coin

From a technical perspective, XRP is testing key resistance levels within a bullish pennant pattern. Analysts suggest that if XRP successfully breaks out above this resistance, it could target $3.55, a level not seen since 2018. Beyond that, a rally to $4.23 is possible, based on the height of the flag’s pole projected from the breakout point. The developing bull flag is bullish news for XRP holders.

The $3.35-$3.50 range appears to be a critical resistance zone for the XRP price. Source: Urbanmove on TradingView

However, failure to sustain bullish momentum could see XRP retest support levels at $2.90 or lower at $2.62. Market indicators such as the Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) remain above neutral levels, suggesting strong bullish sentiment. However, the Moving Average Convergence Divergence (MACD) histogram indicates weakening momentum, which could lead to short-term price fluctuations.

Tokenized Assets and the Future of Blockchain-Based Finance

The integration of OUSG onto XRPL highlights the growing trend of tokenized assets, a market that has expanded significantly in the past year. Tokenized U.S. Treasuries, in particular, have become a $3.5 billion asset class, showing increasing institutional interest in blockchain-based financial instruments.

Ondo partners with BlackRock to tokenize US Treasuries on the XRP Ledger, offering 24/7 minting and liquidity. Source: NomadicPaura via X

By bringing OUSG to XRPL, Ripple is positioning itself as a leader in facilitating institutional-grade tokenization solutions. The ability to seamlessly mint and redeem U.S. Treasury-backed tokens on XRPL using the RLUSD stablecoin could make the network a preferred choice for financial institutions seeking blockchain efficiency without compromising regulatory compliance.

XRP Bull Flag on the Chart

Respected analyst Peter Brandt wrote on X today, in his own inimitable style, “To be clear: I could care less what XRP is going to do. If it goes up I want to be long. If it goes down I’ve never shorted it, but prefer to troll the poppers. No other way right now to define the chart other than a bull flag.”

A huge bull flag on the XRP chart, the XRP Price is going to fly! Source: X

Bottom Line

The XRP price’s recent market movement, combined with Ripple’s strategic partnership with Ondo Finance, marks a significant step in advancing blockchain-based financial instruments. Meanwhile, Garlinghouse’s push for a diversified U.S. digital asset reserve underscores the ongoing debate over the role of cryptocurrencies in national finance strategies.

As tokenization gains momentum and institutions explore blockchain-based solutions, Ripple’s initiatives position XRPL as a competitive platform for integrating traditional and digital finance. The coming months will be crucial in determining whether XRP can sustain its bullish momentum and whether its role in a potential U.S. digital asset reserve gains further traction.

Now, let’s sit back and watch this bull flag play out. XRP will fly.