Shiba Inu (SHIB) remains in a clear downtrend, with bearish momentum dominating both the daily (1D) and four-hour (4H) timeframes. Traders and investors should closely monitor key technical levels to assess potential reversals or further declines.

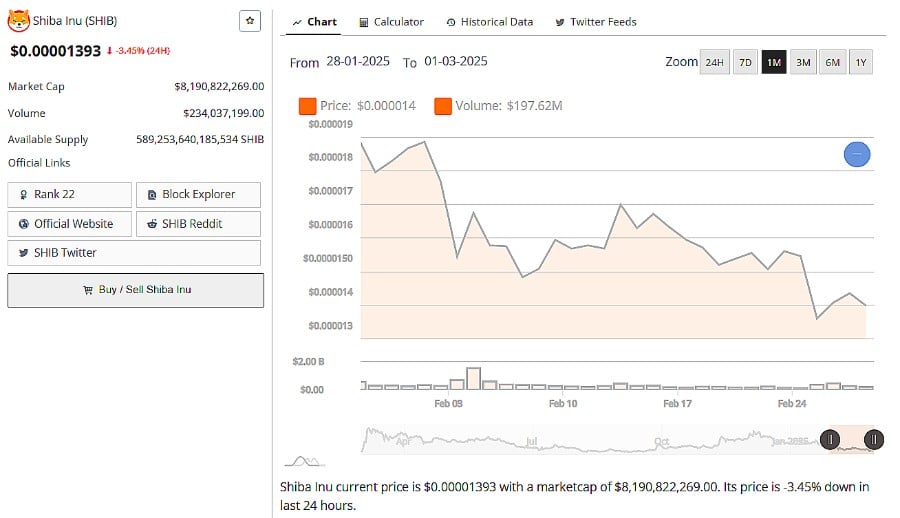

As of the latest data, SHIB is trading at $0.00001393 and continues to exhibit bearish price action. The asset is currently below both the 50-day Exponential Moving Average (EMA) and the 200-day EMA, reinforcing the strength of the ongoing downward trend.

-

- Moving Averages: SHIB’s price remains below the 50 EMA and 200 EMA, which signals sustained bearish momentum.

- Relative Strength Index (RSI): The RSI hovers around 40, indicating that there is room for further downside before SHIB reaches oversold conditions.

- Key Resistance Zones: Two significant order blocks are forming in this structure, which may act as strong resistance levels should SHIB attempt a breakout.

WATCH SHIBA INU PRICE ANALYSIS

Four-Hour Timeframe Analysis

SHIB is just touching the 50 EMA

On the 4H timeframe, the bearish trend persists, with SHIB making contact with the 50 EMA but still failing to break above it.

- Key Technical Levels:

- SHIB is trading below both the 50 EMA and 200 EMA, indicating that sellers remain in control.

- There is a weak breaker block aligning with the 50 EMA that could provide temporary resistance, but it may not hold against strong selling pressure.

- A resistance block near the top of the current price leg could serve as another key level to watch.

SHIB Relative Strength Index is Neutral

RSI Levels: Currently at 55, the RSI suggests neutral momentum. However, since SHIB remains below crucial moving averages, bullish confirmation is still lacking.

- Potential Scenarios:

- If SHIB successfully breaks above the 50 EMA and holds it as support, the next major resistance level would be the 200 EMA.

- If the price fails to hold above the 50 EMA and drops below recent lows, the next strong support zone will come into play.

Final Verdict: Trend Remains Bearish

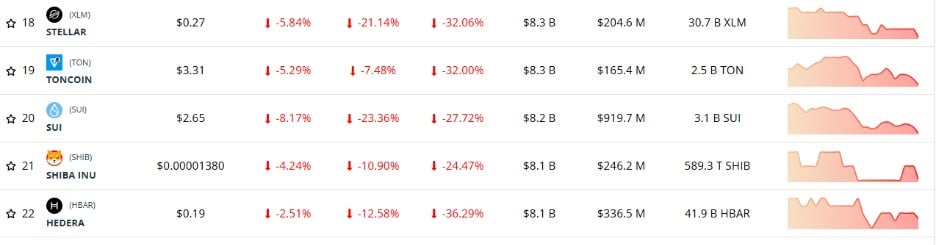

SHIB’s bearish trend is reflective of the entire crypto sector currently

Both the daily and four-hour timeframes confirm that SHIB remains in a downtrend. Until the price decisively breaks above the 50 EMA on higher timeframes and holds it as support, there is no confirmation of a shift in momentum. At the same time, as SHIB continues its burn strategy, its overall price movement is not out of step with the entire crypto market which is currently in short-term bearish territory and red across the board.

For a potential bullish reversal, the following conditions would need to be met:

- SHIB must push above the 50 EMA and establish it as a support level.

- RSI should rise above 60 on both the 1D and 4H charts.

- Broader market sentiment, particularly Bitcoin’s price movement, should remain favorable, as altcoins like SHIB are heavily influenced by overall crypto market trends.

Strategic Considerations

- Short-term traders may want to wait for a confirmation above key resistance levels before entering positions.

- Long-term investors could consider a dollar-cost averaging (DCA) strategy at historical support levels but should remain patient given the ongoing bearish trend.

As always, market participants should keep an eye on Bitcoin’s movements, as it often dictates the overall market direction for altcoins.