Solana’s decentralized application (DApp) ecosystem has experienced a decline in activity but the intense bullishness in the market is driving the price upward.

Now Solana price predictions for 2025 suggest a new all-time high is imminent.

Despite this Dapp downturn, analysts remain optimistic that Solana’s native token, SOL, could rally to $230 in the near future, bolstered by strong network fundamentals, a raging bull market, and growing institutional interest.

DApp Activity Slumps Amid Broader Market Challenges

During the week from Jan. 8 to 15, on-chain activity in the dapps running on Solana decreased by 10.3%, DeFi analytical platformsreported. Whereas Raydium dropped by 23.3% and Orca even by 2%, the greatest growth was reported for Lifinity (27.7%) and Stabble (29.7%).

Despite a 10% drop in DApp volumes, analysts remain bullish on Solana’s $230 target. Source:IBC Group via X

While Solana suffered from a decline, its competitors, Ethereum and Arbitrum, saw an increase in on-chain volumes during the same period: Ethereum’s on-chain volumes rose 9%, courtesy of Curve Finance, Pendle, and Fluid. Arbitrum booked a 20% gain thanks to Uniswap and Camelot.

Total value locked-in, a metric estimating the sum of all deposits across a blockchain ecosystem, perhaps illustrates the performance of this blockchain network a bit better. In this sense, Solana’s TVL fell 5.9% month-over-month to reflect broader market challenges. Comparatively, leading blockchain Ethereum suffered an 18.1% drop in its deposits during this period.

Analysts believe Solana could retest the resistance zone between $223 and $243 following the current momentum. Source:TradingView

Large facilities like Jito and Marinade decreased by 14.1% and 12%, respectively, thus leading to Solana’s decline in TVL. On the other hand, the downturn happens in line with general market trends and does not necessarily indicate long-term issues.

Key Developments Bolstering Solana’s Outlook

Despite recent challenges, several developments continue to strengthen Solana’s position in the crypto ecosystem:

- Institutional Interest Grows: Analysts and investors remain optimistic about the potential approval of aSolana spot exchange-traded fund (ETF) in the United States. Such an approval could attract significant institutional investments, further solidifying Solana’s market presence.

- USD Coin (USDC) Adoption: Recent data revealed that $1.5 billion worth of USDC was minted on Solana’s network within 15 days. This surge highlights the network’s low transaction fees, which are increasingly attracting users and institutions. Analysts note that Solana’s ability to process cross-chain USDC transfers efficiently could further enhance its adoption.

- Strategic Partnerships: Solana has been actively forging partnerships to expand its ecosystem. Recent collaborations with gaming and Web3 platforms have positioned the network as a leader in these emerging sectors. For example, Solana’s integration with major gaming protocols is expected to drive user adoption and bolster its DApp activity.

- Technological Advancements: Solana’s high-performance blockchain infrastructure continues to attract developers. With its capability to handle over 65,000 transactions per second, Solana remains a preferred choice for developers building scalable applications. Additionally, recent updates to its validator network have improved security and efficiency, addressing concerns about centralization.

SOL Price and Market Sentiment

As of January 16, 2025, SOL is trading at approximately $201.01, reflecting a 7.68% increase from the previous close. The intraday high reached $206.13, which points to renewed investor interest in the token. According to analysts, if the network keeps growing and if market conditions remain favorable, SOL’s price can be pushed above $230.

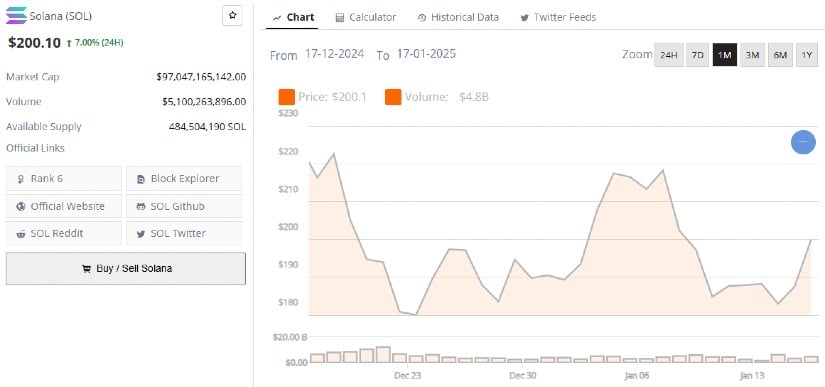

Solana (SOL) price is still holding above the psychological support at $200. Source:Brave New Coin

The strong resilience of the network, coupled with the fact that developments are in progress, provides a very strong foundation for growth. Increased institutional interest, strategic partnerships, and technological advancements position Solana as one of the important chains in the blockchain ecosystem. With these elements in place, a rally towards $230 is very possible, which shall keep investors hopeful of its long-term prospects. That’s right, $230 is a reasonable price prediction for Solana in the short term. Traders should consider Solana for their alt coin portfolio.