Solana edges closer to a possible ETF approval, with bullish price action and key technical levels hinting at a breakout ahead.

The Solana (SOL) price might be getting its big moment soon. With ETF approval possibly just weeks away, excitement is building quickly. The SEC is showing signs of being more open, and the price is starting to move in a strong direction. It’s the kind of setup that could lead to something bullish if everything lines up.

Solana ETF Approval Timeline Narrows

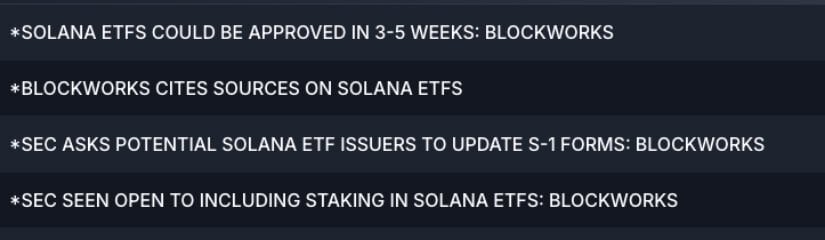

Momentum is building fast around Solana ETFs, and this time, it’s coming straight from the SEC’s desk. According to Blockworks, ETF approvals for Solana could arrive within just 3 to 5 weeks, marking a major shift in how regulators are approaching crypto. The SEC has asked potential issuers to revise their S-1 forms, specifically addressing in-kind redemptions and adding clarity around staking.

Solana gains momentum as ETF approval nears, with revised filings due and a potential SEC decision expected in July. Source: Jesse Peralta via X

Analyst Jesse Peralta says Sources familiar with the matter told Blockworks that the updated filings are due within a week, and the SEC is expected to respond within 30 days. This means that there can be a potential approval in July. If things move on that timeline, Solana’s price is likely to benefit, not just from the ETF itself, but from the institutional visibility and investor access that comes with it.

Bloomberg Now Sees 90% Chance of Approval

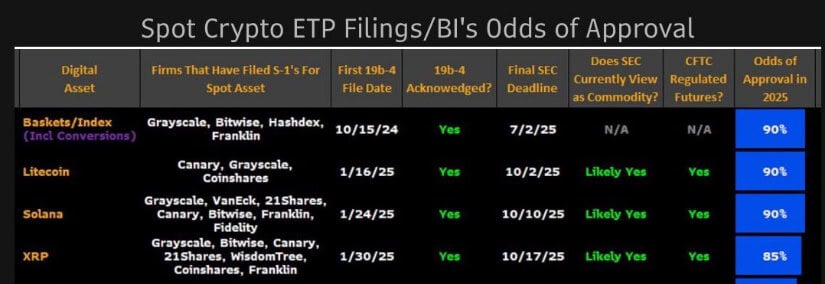

Building on the growing regulatory momentum, Bloomberg’s Eric Balchunas has now raised the approval odds for a Solana spot ETF to 90%, up from 70% just weeks ago. This reflects the SEC’s shifting stance, including signs it now views Solana more like a commodity than a security. This is a big deal because it clears a major hurdle for ETF approval and opens the door to smoother regulatory acceptance going forward.

Bloomberg raises Solana ETF approval odds to 90%, signaling a major shift in the SEC’s stance toward the asset. Source: SolanaFloor via X

This fresh outlook adds more weight to the previous updates from Blockworks, where filings are due this week, and feedback from the SEC could land within 30 days. If both timelines hold, approval could hit as early as July. For SOL Solana price, that means the market could start pricing in the upside sooner than expected.

SOL Solana Price Setup Looks Primed

While ETF momentum and regulatory signals are pointing green, Solana’s price chart is also starting to line up with the narrative. According to CryptoJelle, SOL has made a clean higher low and is now charging toward the upper range of its long-term structure. The chart shows one major resistance zone, highlighted in grey, that’s standing between the current move and a potential breakout to new all-time highs. If that level flips, Solana price pridiction could get interesting.

Solana forms a clean higher low and eyes key resistance between $160 to $165, with potential upside toward $210. Source: CryptoJelle via X

The key resistance to watch sits around the $160 to $165 zone. That’s the range capping recent rallies and acting as a psychological barrier. A confirmed breakout above this range could open the door to $178, with further upside potential toward $200 to $210 if volume holds up.

Shelby Spots a Clean Bullish Pattern in Solana

Shelby’s latest Solana chart adds more fuel to the bullish case, right as ETF momentum picks up speed. The 4-hour setup shows a clear bullish Gartley pattern, with SOL completing its final leg just above the $140 mark. Price is now approaching key Fibonacci extension targets, marked at $181.65, $187.97, and $194.61, levels that align well with prior resistance zones.

Solana completes a bullish Gartley pattern near $140, targeting levels around $182, $188, and $195. Source: Shelby via X

With ETF optimism bubbling in the background and Solana pushing past the $165 range discussed earlier, crypto analyst Shelby outlines a possible continuation ahead for Solana.

Sentiment Split: Solana’s Hated Rally Gains Structure

Adding to the growing momentum around Solana’s ETF prospects, 0xGumshoe points out a deeper layer to the current rally, calling it one of the most “hated” in crypto, despite no fundamental shifts in the project itself. 0xGumshoe highlights how Solana has faced heavy criticism and pressure across multiple fronts in recent months, yet the price has held strong and is now gaining a clear directional catalyst in the form of a 3–5 week ETF timeline.

Solana’s rally remains “hated” despite strong price action, fueled by growing ETF optimism and a clear catalyst ahead. Source: 0xGumshoe via X

Final Thoughts

Solana’s outlook is quickly gaining strength, both on the news front and on the charts. With ETF approval possibly just weeks away, momentum is building, and the price is starting to reflect that shift. From a Solana price prediction point of view, things look promising. The recent higher low and push toward key resistance levels around $160 to $165 show clear bullish intent.

If Solana can break through this zone with strong volume, the next technical targets sit near $178, followed by $200 and beyond.