Solana hovers near $144 as ETF momentum and a Nasdaq listing boost investor interest, hinting at a potential rally ahead.

Solana trading around $144 doesn’t seem like a big deal, but a lot is happening behind the scenes. With new ETF updates and a public listing tied to the Solana ecosystem, things are slowly starting to shift.

Sol Strategies Files to Go Public

In a notable development, Canadian-listed firm Sol Strategies has filed with the U.S. SEC to trade on Nasdaq under the ticker “STKE.” According to documents shared by Cointelegraph, the company is positioning itself as a Solana-aligned entity, having accumulated $SOL as a treasury asset.

Sol Strategies holds over 420,000 SOL as it files to list on Nasdaq, offering traditional markets a new route into crypto. Source: Cointelegraph via X

Sol Strategies currently holds around 420,706 SOLs. Moves like these are where blockchain-affiliated firms step into public markets, are significant. They open doors for traditional investors to get indirect exposure to crypto protocols through regulated equities.

Solana ETF Hopes Ramping Up

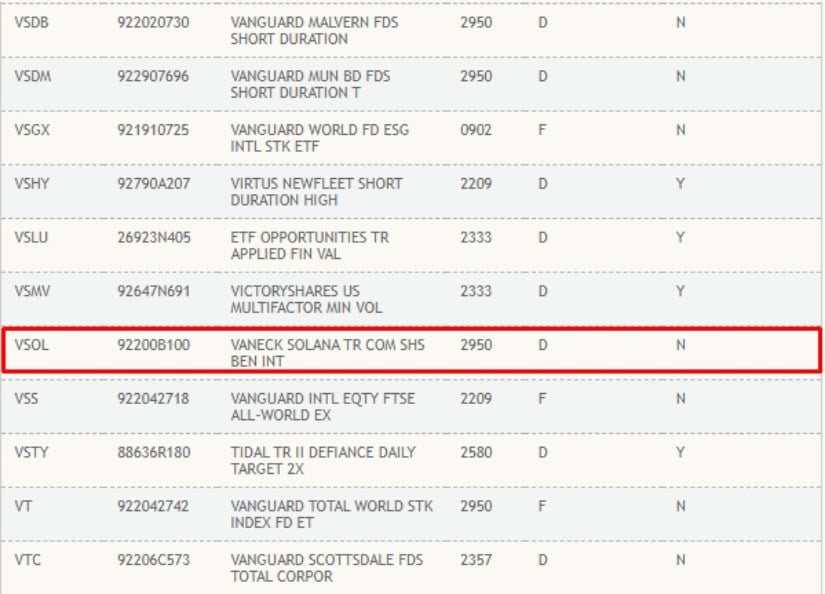

VanEck’s spot Solana ETF has officially appeared on the DTCC’s listings under the ticker “VSOL,” signaling a crucial step toward potential approval. While the fund can’t begin trading until it receives the green light from the SEC, analysts are already pricing in a 90% chance of approval now.

VanEck’s Solana ETF appears on DTCC under VSOL. Source: Crypto Coin Show via X

This move places Solana alongside the likes of Bitcoin and Ethereum in the race for institutional access, and many. Just recently, Sol Strategies, with over 420,000 SOL on its books, filed to list on Nasdaq. Together, these developments open the door to regulated exposure and smoother capital flows, setting the stage for a potentially positive impact on the SOL price.

Solana Price Prediction Eyeing New ATHs

Coming right off the back of VanEck’s ETF listing and Sol Strategies’ Nasdaq filing, Solana’s price action is now showing signs that it may be preparing for another classic breakout cycle. Analyst LordOfAlts points to a recurring pattern: consolidate, pump, repeat. SOL saw a 623% run in 2023, followed by a 90% move in 2024. Now, in mid-2025, the chart structure looks eerily similar, with SOL ranging just below the $180 mark and building pressure.

SOL consolidates below $180 as chart structure mirrors previous breakout cycles. Source: LordOfAlts via X

On the technical side, SOL has been forming a consolidation phase, sitting just under the breakout levels. With DEX volume on Solana dominating and macro sentiment shifting in its favor, fueled by the ETF narrative and ecosystem growth, the stage may be set for a move toward $227 or even the $280 zone.

Solana Eyes Breakout but $120 Retest Likely First

Solana’s chart is starting to look good. After breaking out of a falling wedge in Q1, SOL formed a clean uptrend and is now coiling again inside a smaller descending structure. As shown in the chart from LLuciano_BTC, this second contraction phase could be prepping for a continuation breakout. Price is currently testing the $145 to $148 range, a level that’s acted as a short-term pivot. The demand zone below near $120 continues to hold, and the structure remains intact unless that breaks.

SOL tests $145–$148 while coiling below resistance, with eyes on $160 breakout or possible dip to $120 support. Source: LLuciano_BTC via X

Price action fits neatly into the larger picture outlined in recent Solana price predictions. With the $227 to $280 range already mapped as the next major resistance zone, this current structure could be the pause before that next leg up. If SOL can break through the $160 level with volume, it would confirm the continuation pattern and align with the previous cycle’s fractals.

Liquidity Sweep in Sight Before Next Leg

While broader sentiment around Solana remains bullish due to ETF momentum and Nasdaq-aligned treasury holdings, crypto analyst Kingpin Crypto isn’t ruling out one more dip before any breakout materializes. Analyst notes that SOL is hovering just above its equal lows, a mid-range level that’s acted as a support for price over the past two months.

SOL may dip toward $140 to $142 for a liquidity sweep before resuming its upward trend. Source: Kingpin Crypto via X

The structure suggests there’s still a strong chance of a liquidity sweep toward the $140–$142 zone before any meaningful upside attempt. This wouldn’t break the overall trend, but it would clean up the range.

Final Thoughts

Solana isn’t just riding the ETF wave; it’s building a much bigger narrative. Between VanEck’s VSOL listing, Sol Strategies’ Nasdaq filing, and on-chain strength from DEX volumes, SOL is positioning itself fundamental coin.

Still, a quick liquidity sweep toward $140 wouldn’t be surprising, but that could just be the setup before the breakout everyone’s watching. If SOL reclaims $160 with conviction, those $227 and $280 levels come into focus.