Solana is gaining momentum with the launch of its first-ever staking ETF, as institutional interest and technical indicators point to a potential breakout.

A wave of fresh catalysts has lined up all at once, from the launch of the first-ever SOL staking ETF. Moreover, the price action is starting to respond, technical indicators are firming up, and participants say the setup could be pointing to a bigger move ahead.

First-Ever SOL Staking ETF Gets Launched

Solana just marked a major milestone in U.S. markets with the launch of the first-ever SOL staking ETF. Rolled out by REXShares and trading under the ticker $SSK, this new product allows traditional investors to gain exposure to SOL staking. It’s a step toward bringing crypto-native yield into a more accessible and regulated environment.

Solana’s $SSK ETF launch opens the door for traditional investors to access SOL staking. Source: SolanaFloor via X

Bitcoin spot ETFs and Ethereum futures ETFs helped legitimize those assets in the eyes of larger institutions. ETFs made it easier for big investors to get involved, and that helped bring in a lot more money. If the same path plays out for Solana, this ETF could end up being more than just a headline. It could act as a gateway for long-term price appreciation, especially if staking yield becomes a broader narrative in traditional markets.

James Seyffart reveals, SSK didn’t waste any time drawing attention; trading volume crossed $8 million within the first 20 minutes of launch. That kind of early activity shows there’s real interest, not just from crypto-native circles but from traditional investors too. It’s a strong signal that SOL staking, via an ETF, may have just opened up to a much wider audience.

$SSK ETF crossed $8 million in trading volume within 20 minutes. Source: James Seyffart via X

Ascending Trendline Keeps Solana Bullish

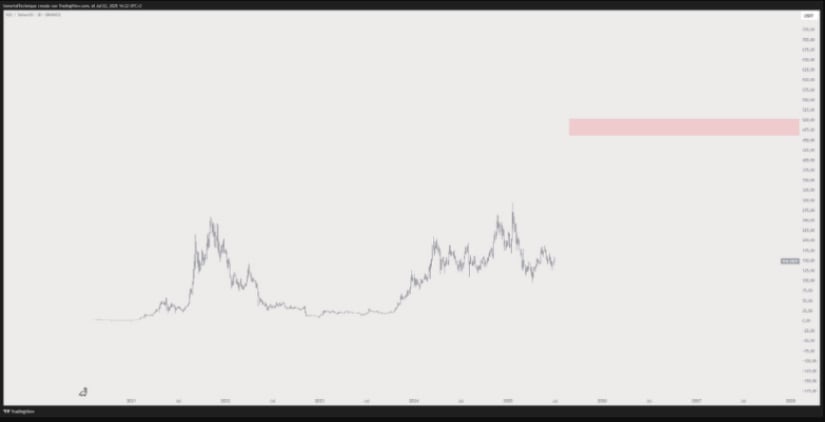

Coming off the momentum of the SOL staking ETF launch, there’s another reason bulls might be feeling confident. A long-term chart shared by CryptosBatman shows SOL continuing to respect a clear ascending trendline that’s been intact since mid-2022. Every major correction has found support on this line, and the most recent bounce is once again holding that structure.

Solana continues to respect a key ascending trendline, suggesting bullish momentum with potential upside targets of $180, $220, and $300. Source: CryptosBatman via X

While the price hovers around the $140 to $150 zone, this support line suggests that current levels could be a base. As long as SOL remains above this ascending trendline, the broader structure remains bullish. If momentum picks up from here, key upside levels to watch include the $180 zone, which aligns with prior resistance, followed by $220 and possibly even $300 on a longer horizon.

Wall Street Interest in Solana Hits New Highs

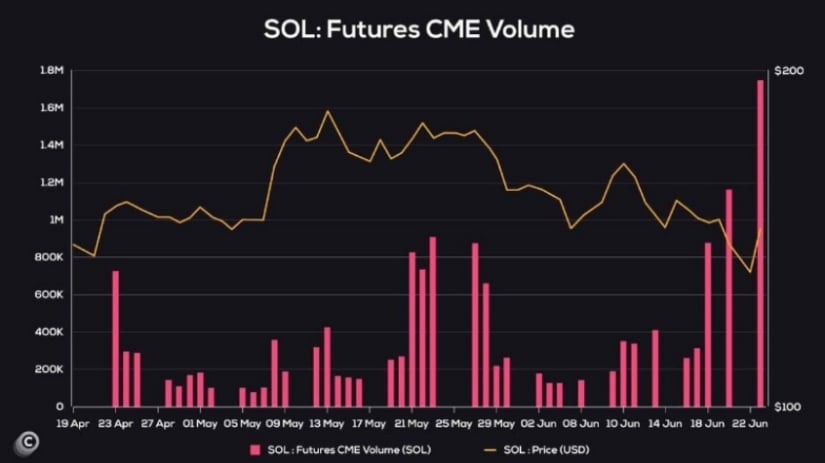

Solana’s recent momentum isn’t just about on-chain strength or ETF launches; traditional markets are tuning in too. According to a new chart from Coinvo, SOL futures volume on the CME has just hit an all-time high. This spike in volume from institutional venues is a strong sign that big players are actively positioning.

Solana’s SOL futures volume on the CME hits an all-time high. Source: Coinvo via X

This comes right after the launch of the first-ever SOL staking ETF and a clean technical setup holding firm on higher timeframes. When institutional interest starts spiking alongside solid fundamentals and a supportive chart, it often hints at the beginning of a much larger trend.

Solana Price Prediction: Eyes on the Red Zone

As momentum builds around Solana, community voices are already mapping out the next big move. Inmortal’s chart shows a projected upside zone, sitting in the $470–$500 range. It’s a visual projection for where SOL could head if the current structure holds and the broader market stays bullish. The change in tone around Solana reflects growing confidence within the Solana community, especially following the successful launch of the SOL staking ETF.

Solana’s price could reach the $470–$500 range if the current bullish momentum and market structure hold. Source: Inmortal via X

Indicators Flash Potential Reversal for Solana

The short-term indicators are now showing a possible bounce setup. A chart from chad_ventures highlights how SOL found support at the 20-day Simple Moving Average. Price is reacting upward from that zone, suggesting buyers are stepping in to defend the level.

Solana shows signs of a potential bounce with support and tightening Bollinger Bands. Source: chad_ventures via X

Meanwhile, the Bollinger Bands are tightening. When this happens, it often leads to a strong move in either direction. If SOL holds above the 20-day SMA and expands out of this tight range, the next targets to monitor would be the $158 and $173 levels from recent highs.

Final Thoughts

The charts are showing strong structures, the community is leaning bullish, and even institutional players are getting off the sidelines. If SOL can stay above key levels like the 20-day SMA and the long-term ascending trendline, this could turn into a full-blown breakout cycle. Targets between $180 and $220 seem realistic if momentum holds, with higher projections like $300 or even $500 floating around in more aggressive scenarios.