Solana is on the brink of a breakout, testing key resistance levels, with growing optimism and the upcoming ETF launch building momentum for a potential rally.

Solana is on the brink of a major price breakout, as it trades just beneath a crucial descending trendline that’s been capping its price since December 2024. With bullish headlines surrounding an upcoming ETF launch and market sentiment shifting toward optimism, SOL’s technicals are beginning to align.

SOL Solana Price on the Verge of a Breakout

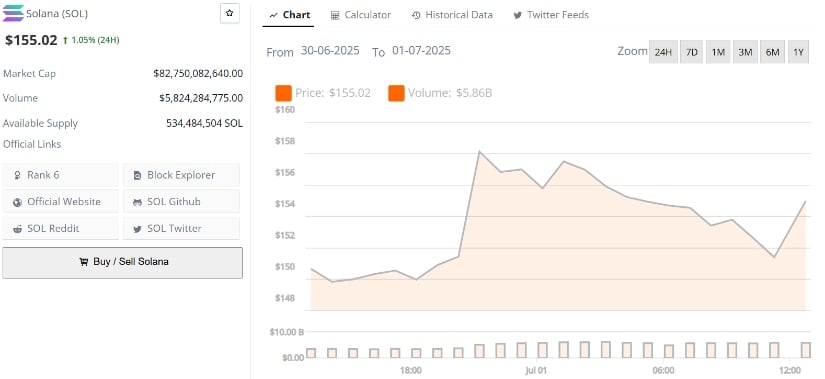

Solana is hovering just beneath a crucial descending trendline that has capped its price since December 2024. As highlighted by Zeus, price is pressing up against the $154 to $155 zone, right at the edge of a potential breakout. With bullish catalysts like the upcoming ETF launch making headlines, SOL has the narrative support, but the technical confirmation is still pending.

Solana is testing key resistance levels, with a potential breakout in sight. Source: Zeus via X

The lack of a strong reaction so far, just a 1% gain on a day packed with bullish news, shows participants may be waiting for a clean breakout and follow-through before committing. If SOL manages to push above this resistance with volume, the next upside target lies near $183 and $260

Solana Spikes on ETF Rumors

Solana briefly offered a major spike through resistance and tagged $160 after REX Shares confirmed its staked ETF will go live Wednesday. The breakout triggered nearly $9 million in short liquidations, causing a massive panic. However, price has now cooled off, retracing back into the $155 range as the market digests the news.

Solana’s current price is $155.08, up 1.05% in the last 24 hours. Source: Brave New Coin

Price Eyes Inverse H&S Neckline Break

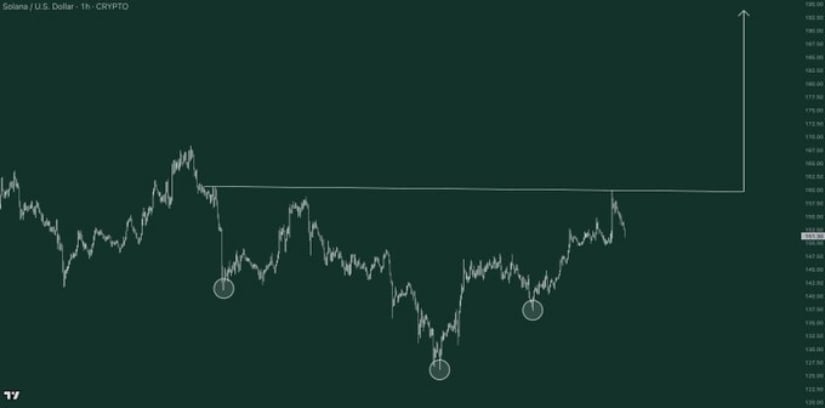

Following the pressure build-up under the multi-month downtrend, a new pattern is now catching attention: an inverse head and shoulders formation, as highlighted by analyst Gordon. This setup, developing over the past few months, signals a possible momentum shift from bearish to bullish. The neckline sits just above $158, and a decisive break above it would mark a strong confirmation of trend reversal.

SOL is eyeing a breakout with an inverse head and shoulders pattern, targeting $192. Source: Gordon via X

Technicals continue to align. Starting with compression under resistance, bullish headlines in the background, and now, early signs of a potential breakout. If SOL can close above the neckline with conviction, the next major target sits near $192, right where the pattern’s measured move completes.

Solana’s Sentiment Surges as ETF Odds Hit 99%

Solana’s ETF odds on Polymarket are leaving little room for doubt as the market now assigns a 99% chance of approval in 2025. The sharp 25% jump in conviction reflects how quickly sentiment has shifted following REX Shares’ announcement of the upcoming staked ETF.

Solana’s ETF approval odds soar to 99%, fueling bullish sentiment. Source: The Solana Post via X

Coming off a sharp $160 spike and a quick pullback, this kind of data strengthens the underlying bullish foundation. It’s no longer just about charts or speculation; market participants are now actively pricing in regulatory clarity and growing institutional interest.

Analyst Eyes Countertrend Move Before Major Breakout

After tagging $160 on the ETF news, SOL has shifted into a local correction mode for the short term, but the structure on HTF remains intact. As highlighted by R. Linda, the recent pullback appears to be a liquidity hunt rather than a breakdown. Price action shows a clear change in character on the higher timeframes, with a breakout above descending resistance and the formation of a rising trendline. The current dip is testing this trendline and the liquidity pocket between $150–$149, a level where bulls may look to reload.

Solana is in a short-term correction, with key support between $149 o $147. Source: R. Linda via X

Technically, the $149.36–$147.93 zone is the key to watch short-term. A successful retest and bounce here could reset momentum for another leg up. Above, resistance levels sit at $154.75 and $156.8, which previously capped price. Until those are broken, SOL remains in a tight range. But given broader developments, from ETF optimism to shifting sentiment, this could simply be the pause before the next move higher.

Final Thoughts

Solana is clearly at a crossroads, with its price action signaling a major potential breakout. As technicals align and bullish catalysts, like the upcoming ETF launch, fuel optimism, SOL has set itself up for a promising move. However, the key to unlocking that upside lies in a clean break above the $154 to $155 resistance zone. Once the bulls gain control, the next targets lie between $183 and $192, marking a strong move to the upside.