After the advent of Bitcoin, Ethereum, the second-largest cryptocurrency, brought massive, decentralized innovation. Through its Ethereum Virtual Machine (EVM), the Ethereum blockchain opened doors to Web3, decentralized applications, and decentralized finance through smart contracts.

Solana was launched as an Ethereum competitor to offer cheaper, faster, and scalable solutions to developers. The Solana blockchain became the leader of the meme coin boom. As of 2025, both projects have secured massive traction. But, if you had to pick one to invest in, which would it be?

Ethereum Blockchain vs. Solana Blockchain

| Metric | Ethereum (2025 Typical) | Solana (2025 Typical) |

| Consensus Protocol | Proof-of-Stake (via Ethereum 2.0 upgrade) | Hybrid: Proof-of-History (PoH) combined with Proof-of-Stake (PoS) |

| Block Finality Time | ~12 seconds per block | ~400 milliseconds per block |

| Average Transactions/sec | 15–30 real-world throughput | 1,000+ in practice; scalable to 65,000+ with upgrades like Firedancer |

| Typical Transaction Fee | Generally over $1, depending on network congestion | Consistently under $0.01, even during peak activity |

| User Activity | A larger established user base with steady activity | Rapidly growing user base, especially in DeFi and consumer apps |

Ethereum Blockchain is more mature as compared to Solana Blockchain as it is the native chain for many top-ranking projects, including NFTs, crypto tokens, and decentralized applications. However, the developers and communities who prefer better scalability and cheaper transactions opt Solana blockchain.

According to Defillama, the DEX scanner, in the last 30 days, the trading volume of the Solana blockchain on DEXs was $90.21 billion, followed by $66.81 on the Ethereum blockchain. The on-chain data shows that over 54% of the total Value Locked (TVL) is on the Ethereum ecosystem, while the Solana ecosystem shares only 7.65% of the total.

In the last 12 months, the number of new addresses on the Solana blockchain ranged between 100 million to 150 million per month. While Ethereum only secures only 3 million to 5 million new active addresses monthly.

Solana vs. Ethereum: Investing in 2025

Solana in 2025

Currently trading slightly above $150, Solana has a market cap of $81.12 billion. There are 524 million Solana coins already in circulation. Since this is a soft-cap token, it has an unlimited supply.

Solana’s price has been overly volatile in the short term but barely moved in the last 12 months. However, its price increased by 34% in the past three months. The price has been moving between a low of $95 and an all-time high of $295.

Solana recorded its all-time high of $295 on January 18, 2025. Since then, the price of Solana has been in constant decline due to the massive selling pressure and whale exit at the top. After recording a low of $95 on April 7, there are signs of price recovery as Bitcoin updates its all-time high.

Currently, the stochastic oscillator shows an oversold situation for Solana, despite the price reversal. The price is moving on a curved support line with a short-term target of $180.

Ethereum in 2025

Ethereum ranked second in cryptocurrencies, has a market cap of $307 billion. Currently trading at $2540, it has a total supply and circulating supply of 172 million ETH coins. Though the max supply of Ethereum is unlimited, the newly mined Ethereum tokens were limited through a burn mechanism to control the supply and keep the demand.

In the past 12 months, the price of Ethereum dropped by 31%, despite the price of Bitcoin being extremely bullish. However, in the past 90 days, Ethereum has gained over 39%. Bitcoin updated its all-time high multiple times. However, Ethereum, which was following Bitcoin’s trajectory, couldn’t even come near its previous all-time high.

Ethereum price has been declining on a bearish trendline and after touching a bottom of $1450, the price is finally recovering. The current sideways movement creates good support for Ethereum to further rise and reach its short-term target of $3000 and mid-term target of $4400.

Ethereum vs Solana:

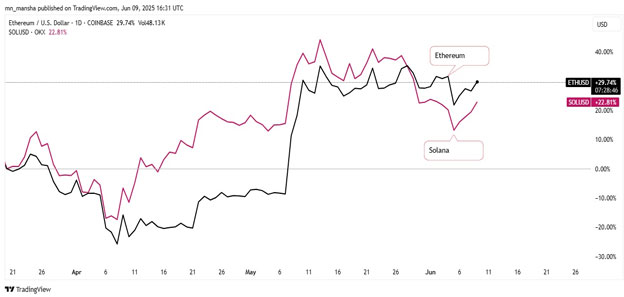

In the early months, the Solana price has been leading compared to the Ethereum price. However, in June, the price flattened and then dipped below the price of Ethereum. Ethereum, on the other hand, showed a massive spike during mid-May and eventually outperformed Ethereum in June.

Though both coins are highly volatile, Solana showed more short-term fluctuations. As of June 2025, both coins are on their bullish trajectory as the price recovers after Trump’s tariffs affect the crypto market. Overall, in this Ethereum vs. Solana comparison, Ethereum leads as an asset with more potential to grow in the coming months, as it has stronger investor momentum. However, their individual performance depends on the on-chain activity, project partnerships, and social sentiments.