Sui’s native token, SUI, has experienced a remarkable rally, soaring over 1,312% from its lowest price level in 2023.

This meteoric rise has propelled the token’s market capitalization to $15.98 billion, making SUI the 12th largest cryptocurrency, ahead of competitors like TON and Chainlink.

Key Drivers Behind SUI’s Surge

The surge in SUI’s price in 2025 aligns with several significant developments within the network. On January 1, 2025, the Sui blockchain unlocked 82 million SUI tokens—0.82% of the total supply. This strategic release has spurred high demand for the token, hence contributing to its recent growth.

Source: SuiNetwork via X

In addition, the total value locked of the Sui network has also crossed $2 billion, which underlines that investors are gaining more confidence in the DeFi ecosystem of the chain. So far, this growth is supported by large-scale DeFi protocols such as Suilend Protocol, NAVI Protocol, Cetus, Scallop Lend, and Aftermath Finance.

Record Trading Volume and Open Interest

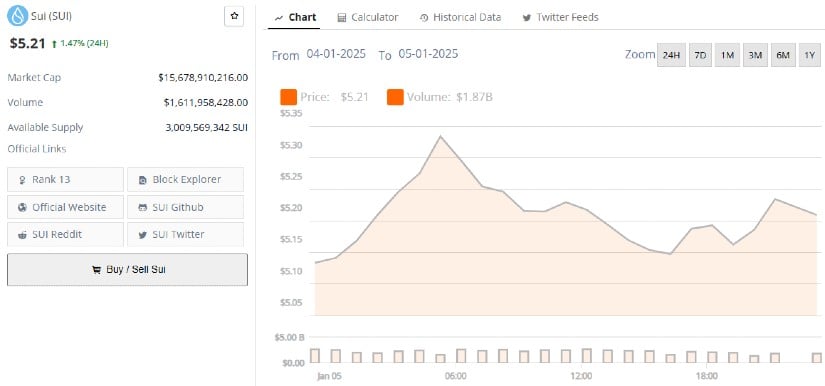

SUI’s trading momentum has been unprecedented. The token recently reached a trading price of $5.31, with a 24-hour trading volume peaking at $2.6 billion. Open interest in SUI futures has also surged by 37%, reaching a record high of $1.22 billion, underscoring growing investor interest.

Sui (SUI) price chart. Source: Brave New Coin

This bullish trend has further cemented SUI’s position in the market, with analysts projecting continued upward momentum and predicting higher prices. A breakout above key resistance levels, such as $5.50, could drive the price to new highs, potentially nearing $10 in the coming months.

Strategic Partnerships and Ecosystem Growth

Sui’s ecosystem has expanded through strategic collaborations and technological advancements. The network has partnered with major firms, including VanEck, Grayscale, and Franklin Templeton. Grayscale’s Sui Trust, now holding over $14 million in assets, is a testament to growing institutional interest.

Additionally, the launch of Deepbook V3, Sui’s proprietary on-chain order book, has significantly bolstered trading activity. With a cumulative trading volume exceeding $1 billion and its DEEP token valued at $375 million, Deepbook V3 has become a cornerstone of Sui’s DeFi ecosystem.

Challenges and Opportunities Ahead

While SUI has done well lately, the future course depends upon so many factors. Resistance levels of critical importance—like $5.50—are close enough and may play the role of a psychological barrier to the token price advancing further. If this fails, it might mean a pullback or some kind of consolidation.

On the regulatory frontier, such a deal might open up a path toward a possible spot SUI ETF from Sui and Grayscale, pending, of course, how things go between the U.S. Securities and Exchange Commission and crypto ETFs. A friendly turn in regulations might help increase the network’s viability for institutional investors.

Sui’s ability to sustain its momentum will rely on continued ecosystem growth, strategic partnerships, and favorable market conditions. For investors asking themselves what crypto to buy right now, there are several strong options. Ripple’s XRP token has strong appeal and the potential for big gains in 2025, as does Dogecoin, the largest meme coin by market cap.

However, with its robust DeFi infrastructure, record-breaking metrics, and increasing institutional support, SUI is poised to remain a strong contender in the cryptocurrency market.

As the network approaches a market cap of $16 billion, investors and analysts will closely monitor its performance, particularly its ability to surpass key milestones and maintain its competitive edge.