Telegram’s crypto holdings soared to a staggering $1.3 billion in the first half of 2024, marking a substantial increase from the $400 million at the end of 2023, according to a report by the Financial Times.

The comprehensive report offers a rare glimpse into the messaging giant’s operations amid a turbulent period marked by legal challenges faced by its founder, Pavel Durov.

Based in Dubai, Telegram’s digital asset portfolio experienced significant growth, providing much-needed financial stability after French authorities detained Durov in August. He was arrested on preliminary charges related to the platform’s alleged failure to tackle criminal activities.

However, the company reassured investors that Durov’s legal troubles had not affected Telegram’s day-to-day operations. In a statement dated October 22, 2024, Telegram emphasized that the allegations were targeting the founder and not the company itself, insisting that there was no “material impact” on its business activities.

Telegram Revenue Soars 190% in 2024

Telegram reported revenue of $525 million in the first half of 2024, marking a substantial 190% growth compared to the same period in 2023. About $225 million originated from a one-time arrangement involving Toncoin, a cryptocurrency initially developed by Telegram. Regulatory challenges later transformed the project into an open-source initiative. The agreement mandated small businesses to use Toncoin exclusively for advertising purposes.

In addition to Toncoin, Telegram’s financial disclosures show the company had earned $353 million from the sale of digital assets during the first half of the year. A large portion of this came from the sale of Toncoin, with $348 million worth sold since then. This helped propel Telegram into the black, with a post-tax profit of $335 million in the first half of 2024, a sharp contrast to the losses reported in 2023.

The company’s rapid rise in the crypto market, particularly through the sale of Toncoin, has been pivotal in maintaining its financial strength. However, Telegram faces increasing pressure from regulatory bodies, especially in light of accusations involving criminal content on the platform.

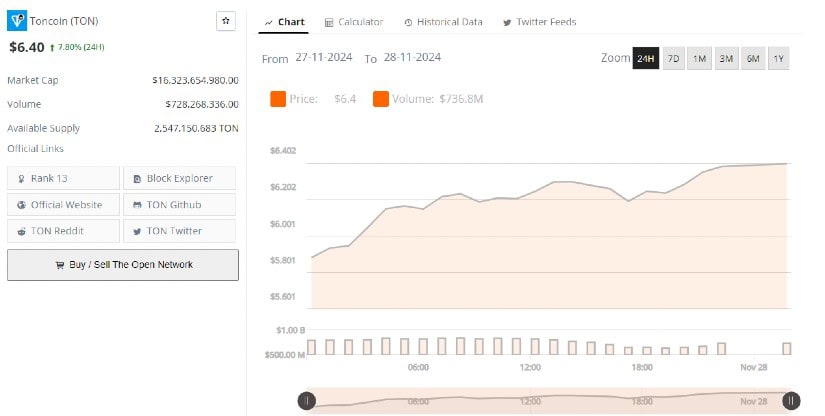

Telegram owns a considerable quantity of TON and remains vulnerable to fluctuations in TON markets. Following founder Pavel Durov’s arrest, TON’s value plunged by 25%, declining to $5.24. Subsequently, the asset rebounded, sparking a wider surge across cryptocurrency markets. By November 27, the cryptocurrency price stands at $6.40, marking a gain of 7.80% in the last 24 hours, according to Brave New Coin’s TON Price Index.

Telegram’s Advertising Revenue Surges to $120 Million

Experts have raised concerns that Telegram could struggle to attract advertising revenue, especially with its connection to child sexual abuse material and terrorist content, both of which have drawn heightened scrutiny from governments worldwide. In response, Telegram has committed to strengthening its content moderation practices, stating that it will expand its moderation team and continue cooperating with authorities in compliance with French laws.

“The company stands behind its practices in content moderation and co-operation with judicial authorities in strict compliance with the applicable French laws,” said Telegram.

Despite these challenges, Telegram’s advertising revenue surged to a record $120 million in the first half of 2024, with premium subscriptions contributing an additional $119 million, up from just $32 million in the same period the previous year.

Telegram remains committed to its dual monetization strategy, balancing ad sales with premium subscriptions, following the footsteps of major social media platforms like Meta and X. According to Durov, who retains full ownership of the company, Telegram could even consider going public as early as 2026, with plans to further expand its monetization efforts.

Telegram’s Long-Term Strategy

Although Telegram has profited from favorable market conditions by divesting some of its crypto assets, this is not part of its long-term strategy. Instead, Telegram focuses on scaling its advertising and subscription revenue streams. In fact, the surge in crypto holdings has acted as a financial buffer, helping Telegram weather the storm of Durov’s legal troubles and maintain growth amid volatile market conditions.

While Telegram’s bonds have faced fluctuations—initially dipping to as low as 87 cents on the dollar in August—they have since rebounded to 95 cents on the dollar as of September 2024. The bond buyback, amounting to $124.5 million, was a strategic move to stabilize the company’s financial position.