TRON eyes a breakout as $23B in daily USDT transfers and SRM’s $100M treasury boost confidence in its bullish momentum.

As TRON continues to break records with billions in daily stablecoin transfers, it’s clear the infrastructure is stronger than ever. Market watchers are now anticipating a potential breakout above the crucial $0.28 resistance level.

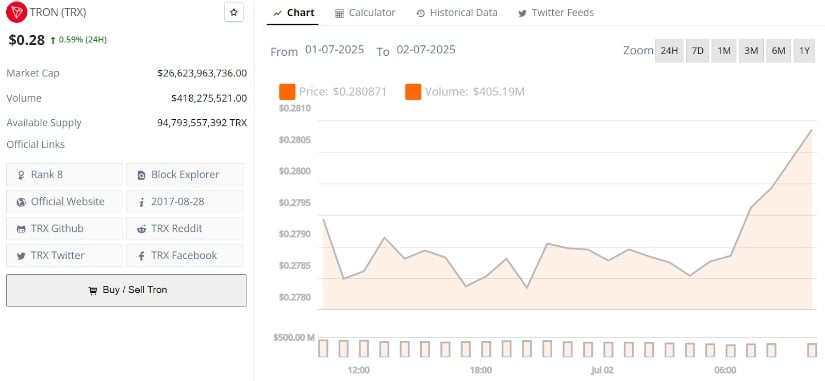

TRON (TRX) is trading at around $0.28, up 0.59% in the last 24 hours. Source: Brave New Coin

SRM Launches $100M TRON Treasury

SRM Entertainment has become the biggest publicly traded company holding TRON by completing a $100 million treasury launch. They have staked over 365 million TRX tokens using JustLend, which can earn up to 10% yearly returns. This is part of SRM’s plan to expand its presence in the blockchain and cryptocurrency space.

SRM Entertainment stakes 365M TRX and rebrands to TRON Inc. after launching a $100M treasury. Source: Cointelegraph via X

The company also plans to change its name to TRON Inc. to better reflect this new direction. On top of that, SRM is thinking about dividends from its TRX staking with shareholders, turning those rewards into real value for investors.

TRON Keeps Building

Following SRM’s massive $100 million TRX treasury launch, attention is turning back to TRON’s fundamentals. With billions of transactions, millions of users, and daily stablecoin volume, all point to infrastructure that’s quietly delivering. This kind of steady performance is exactly why institutions like SRM are aligning so closely with TRON.

Fundamental View: Enforces Bullish Bias

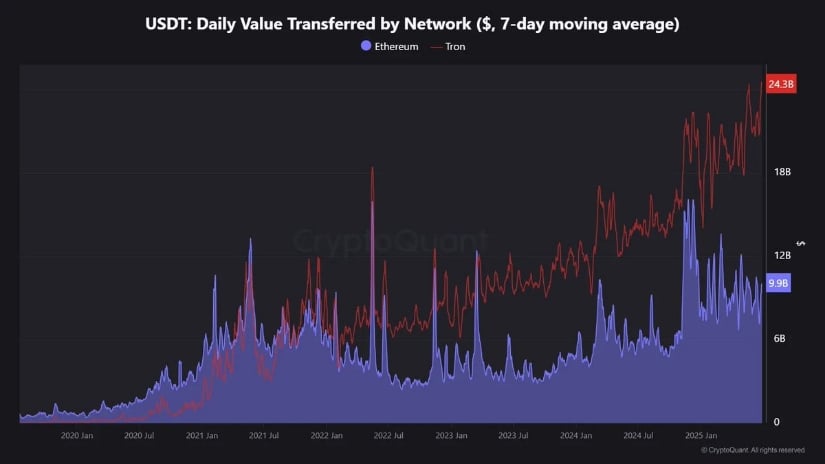

TRON just hit a new record, over $23 billion in daily USDT transfers on June 25, according to Satoshi Club. This isn’t a one-time spike either. Since mid-2022, TRON has consistently outpaced Ethereum in stablecoin volume, signaling strong demand and real network activity.

TRON hits $23B in daily USDT transfers, maintaining dominance over Ethereum in stablecoin volume since mid-2022. Source: Satoshi Club via X

With steady growth in daily usage and billions moving through the network, TRON’s infrastructure continues to show strength. These underlying fundamentals are what keep the outlook tilted bullish.

TRON Needs a Push Above $0.280

TRON price has worked its way back to a familiar ceiling near $0.28. Crypto Tony believes this is not the first time this level has acted as a roadblock. The price has been grinding higher with consistently higher lows, and the structure is beginning to look more like an ascending triangle.

TRX hovers near $0.2780 as an ascending triangle structure forms. Source: Crypto Tony via X

Currently hovering just under resistance at $0.2780, the setup is getting tighter. A weekly close above $0.28 would mark a notable shift, potentially setting the stage for a move toward $0.32 to $0.34. RSI on higher timeframes remains mid-range, suggesting there’s still room for price to stretch, especially with the recent bullish fundamentals continuing to support the narrative.

Cup and Handle Pattern Breakout Level is $0.280

TRX TRON price is forming what looks like a textbook cup pattern on the daily chart, and things are getting interesting near the $0.28 to $0.30 resistance area. Analyst TrendShot points out that a clean breakout above $0.30 would confirm the pattern and potentially open the door toward $0.35 and $0.40, targets based on the formation’s depth.

TRX forms a cup and handle pattern near $0.30, with a breakout potentially targeting $0.35–$0.40. Source: TrendShot via X

This builds directly on the ascending structure mentioned earlier, where TRX was pushing higher with consistently higher lows. If price fails to crack resistance cleanly, we may see a dip toward $0.24 for a potential reset. But given TRON’s strong fundamentals, from record USDT flows to SRM’s $100M staking move, the bias remains upward. Market participants are now shifting to volume and daily close confirmation.

Final Thoughts

Given the solid fundamentals and the formation of a bullish pattern on the charts, the TRON price prediction suggests TRX has the potential to make a strong move. The price is hovering just below the $0.28 resistance level, forming an ascending triangle pattern. A clean breakout above $0.28 could open the door for a move toward $0.32–$0.34.