In a heated exchange on Capitol Hill, Attorney General Pam Bondi and Senator Jeff Merkley (D-Ore.) clashed over President Donald Trump’s growing footprint in the crypto world, particularly his controversial Trump meme coin and its high-profile investor dinner.

The confrontation underscores escalating concerns around foreign influence, policy integrity, and the potential conflicts surrounding Trump’s deepening ties to digital assets during his second term in office.

Political Firestorm Over Trump’s Meme Coin Investor Dinner

During a Senate Appropriations Committee hearing on June 25, Senator Merkley raised pointed questions about a private White House dinner Trump hosted for the top 220 investors in his $TRUMP meme coin. Merkley zeroed in on the potential presence of foreign nationals, citing the attendance of Tron founder Justin Sun, a Chinese-born crypto entrepreneur currently facing legal scrutiny in the U.S.

“I want to know if, when the president held his dinner for 220 individuals who purchased the most of his meme coins, were there foreign interests attending that dinner?” Merkley pressed.

Senator Merkley questioned potential foreign presence at Trump’s memecoin dinner, while Attorney General Bondi deflected by redirecting the focus to DOJ budget priorities and crime in Oregon. Source: Aaron Rupar via X

Bondi, however, sidestepped the question, emphasizing that the hearing’s purpose was to discuss the Department of Justice’s budget. “Senator, we’re here to talk about the Department of Justice and my budget for the upcoming year,” she replied, shifting focus to a separate criminal case involving an alleged Sinaloa Cartel leader in Oregon.

Merkley accused the Attorney General of deflecting and reiterated the significance of foreign influence, particularly given Trump’s direct involvement in crypto fundraising. “This solicitation of investments in his personal product, his meme coin, led to many people who were coming from foreign countries attending that dinner. Don’t you think the American people have a right to know?” he asked.

Bondi struck back fiercely, calling Merkley’s claims “wildly offensive” and defending Trump’s national security record. “President Trump has done everything to keep America safe,” she asserted, noting that unlike President Biden, “he has shut down our borders.”

Trump’s Expanding Crypto Empire

The Trump meme coin is just one part of the former president’s rapidly growing crypto empire. Since launching World Liberty Financial with his sons in late 2024, Trump has spearheaded several digital ventures, including the release of a stablecoin called USD1. This asset was recently used in a $2 billion transaction between an Emirati firm and Binance, sparking fresh questions about international influence and regulatory oversight.

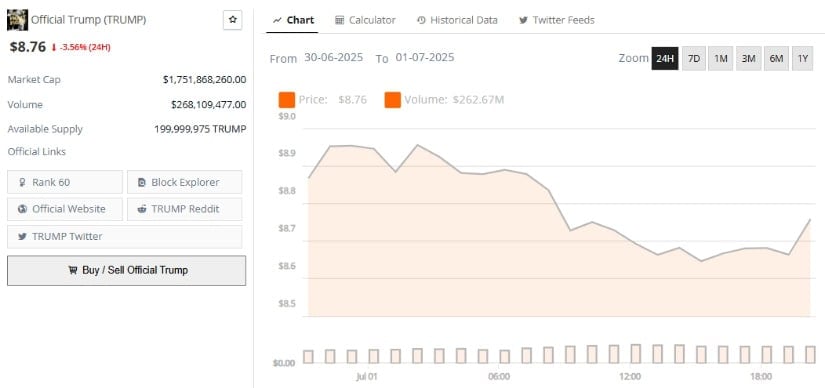

Official Trump (TRUMP) meme coin was trading at around $8.76, down 3.56% in the last 24 hours at press time. Source: Brave New Coin

USD1 has already surpassed USDC in trading volume, and World Liberty Financial is poised to go public soon, with a UAE-based sovereign fund becoming its largest institutional investor. Meanwhile, Trump Media & Technology Group has raised $2.5 billion to establish a Bitcoin reserve and is preparing to launch additional blockchain-based products.

Adding fuel to the political debate, Trump’s crypto mining and treasury arm reportedly raised $220 million in a recent funding round.

Legislative Momentum Builds Despite Ethical Concerns

While Democrats like Merkley attempt to raise red flags, Trump’s legislative allies are working to push pro-crypto bills through Congress. Senators Tim Scott (R-SC) and Cynthia Lummis (R-WY) recently hosted a public discussion with Bo Hines, head of the Presidential Council of Advisers for Digital Assets, to lay out the roadmap for crypto legislation.

The GENIUS Act, the Senate’s stablecoin bill, has been approved, while the House is advancing the CLARITY Act on crypto market structure. Discussions are ongoing about whether to merge both initiatives into a unified legislative package or pass them separately.

Despite calls for anti-corruption amendments that would limit Trump’s ability to profit from crypto ventures while in office, those proposals have been repeatedly struck down by the GOP-controlled majority. Merkley’s latest amendment to Trump’s flagship spending bill was blocked by a party-line vote of 47-53.

Trump Dodges Conflict of Interest Questions

In a recent press conference, Trump was asked if his personal and family involvement in crypto could jeopardize bipartisan support for the proposed legislation. The president offered no direct answer. Instead, he praised the industry’s growth and framed himself as a champion of American blockchain innovation.

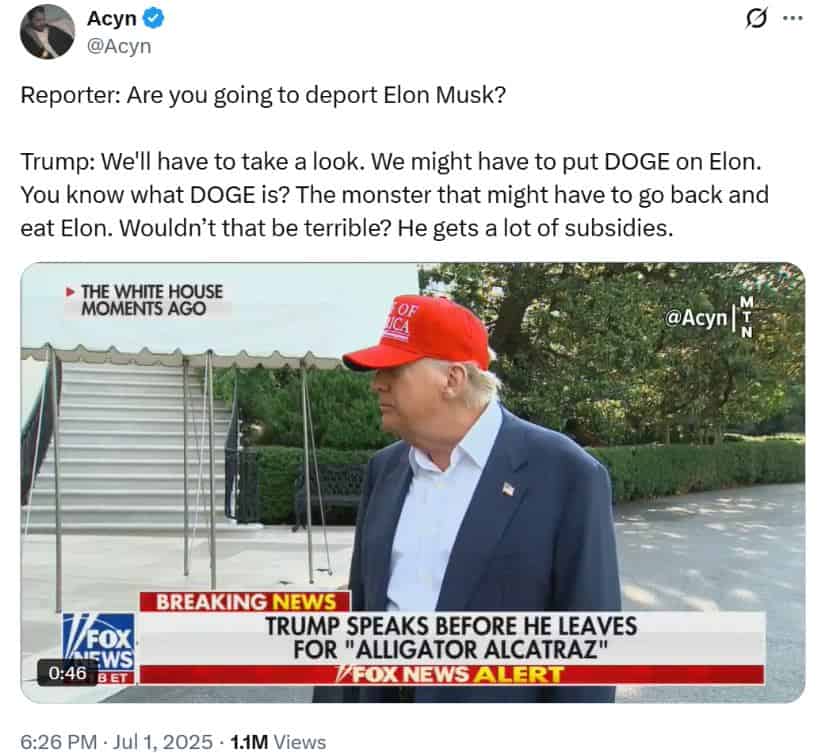

When asked if he would deport Elon Musk, Trump joked about sending “DOGE” after him, calling it a “monster” that might have to “eat Elon,” while criticizing Musk’s reliance on government subsidies.Source: Acyn via X

“I don’t care about investing,” Trump said. “I have kids and they invest in different things… But I’m President and what I did do there is build an industry that’s very important.”

In typical Trump fashion, he added, “We’ve created a very powerful industry and that’s much more important than anything that we invest in.”

Foreign Influence or Free Enterprise?

The broader debate over Trump’s crypto ventures, including the Trump meme coin, stablecoins like USD1, and mining infrastructure, reflects a larger tension in Washington between economic innovation and political ethics. As crypto legislation moves forward, scrutiny over Trump’s business dealings is unlikely to dissipate.

With digital assets becoming a pillar of Trump’s economic agenda, and his family’s firms dominating headlines and fundraising charts, the intersection of politics and blockchain is more entangled than ever. Whether these ventures will strengthen U.S. crypto leadership—or compromise it—is now a matter of national debate.