The Trump orbit may be scaling back its crypto exposure — and doing it quietly. According to a fresh Forbes investigation, DT Marks DeFi LLC — the Trump family’s shadowy crypto vehicle — has reduced its stake in World Liberty Financial (WLF) by nearly 20% since the end of 2024.

In December, DT Marks held a commanding 75% of World Liberty Financial. But as of January, that figure had slid to “approximately 60%,” according to WLF’s own website, as reported by Forbes. Fast-forward to mid-June, and it’s reportedly hovering around 40%. No press releases. No fanfare. Just a strategic offload of potentially millions in crypto equity while Congress sharpens its knives.

What this means for World Liberty Financial (WLF) plans to create a strategic reserve of digital assets, remains unknown.

What’s prompting the retreat? Timing is everything. The divestment coincides with growing bipartisan scrutiny over Trump’s personal and legislative entanglements with the crypto industry. Lawmakers have been sniffing around World Liberty Financial for months, especially since the platform launched its USD1 stablecoin back in March — right in the middle of debates around the GENIUS Act, a bill to regulate dollar-pegged digital tokens.

The Crypto Commander-in-Chief?

Let’s not kid ourselves. Trump isn’t just dabbling in crypto — he’s practically campaign-financing through it. According to filings, he’s pulled in more than $57 million in income from WLF and related ventures since June, off the back of $550 million in token sales.

And now, as President, he’s advocating for regulatory clarity on stablecoins, urging Congress to pass the GENIUS Act “ASAP.” It’s the kind of thing that would normally be applauded — if it didn’t smell like a conflict of interest.

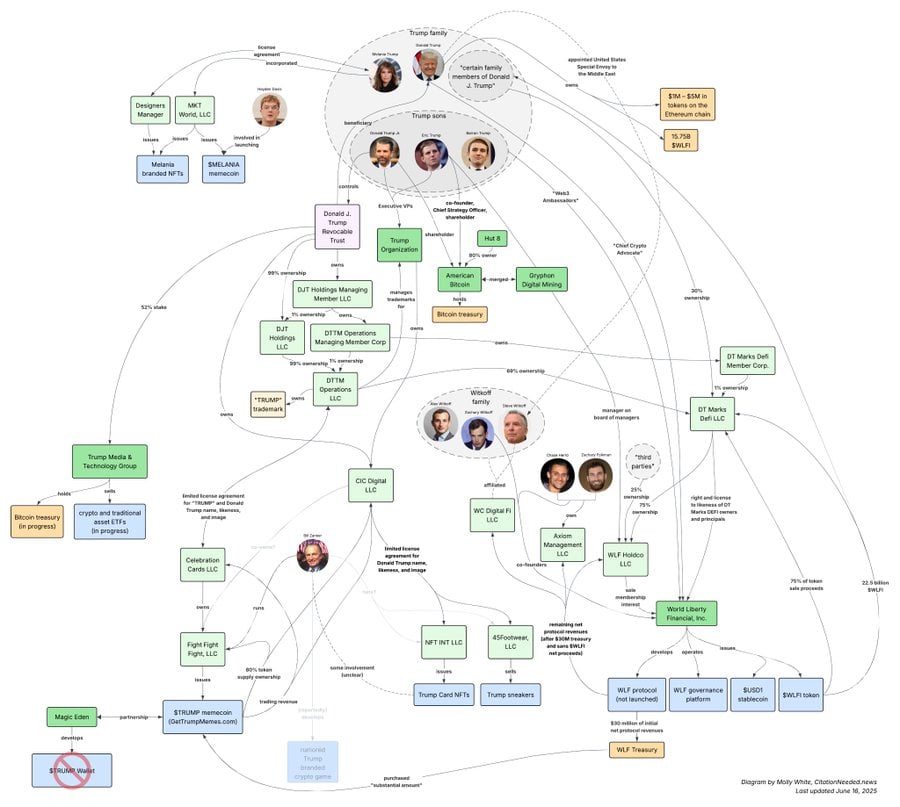

Web3 critic Molly White posted this infographic of Trump’s Crypto dealings, Source: X

The Global Play

In a geopolitical twist, a $2 billion investment from an Abu Dhabi fund is reportedly set to be settled via WLF’s USD1 token — a move that raised more than a few Congressional eyebrows. Because nothing screams “transparent governance” like an unregulated U.S. presidential-linked crypto coin settling billion-dollar deals with Gulf investors.

The Senate managed to push the GENIUS Act through with support from both sides of the aisle, but the bill now faces an uphill battle in the House — largely due to Trump’s crypto baggage. If passed, it could upend how privately issued digital dollars operate in the U.S. financial system. But with Trump backing both the bill and a private stablecoin, the optics are…well, not ideal.

Controlled Burn or Political Cleanup?

Whether this is a planned retreat or a cleanup operation ahead of a 2025 campaign push remains to be seen. One thing’s clear: this isn’t just about profit-taking. It’s about liability mitigation. With regulatory probes circling and mainstream media catching wind, the Trump family appears to be de-risking its most controversial digital asset.

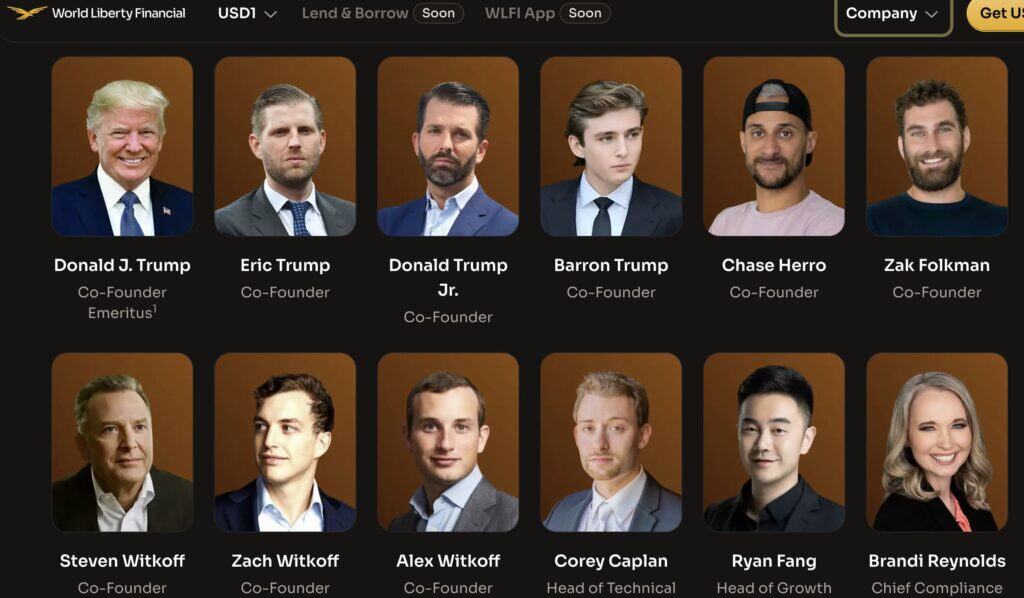

The founding team at WLF includes the Trump top brass, Donald, Eric, Don, and Barron, Source: World Liberty Financial

The irony? In trying to legitimize crypto by regulating it, Trump might end up setting fire to the very empire he helped build in the shadows. If the GENIUS Act becomes law, stablecoin issuers will need licenses, audits, and reserve requirements — none of which WLF has bragged about.

So is Trump trying to get ahead of regulation, or pull the ripcord before the hammer drops?

As always with Trumpworld, the real story isn’t just in what they’re saying — it’s in what they’re quietly selling.