The United States cryptocurrency sector is abuzz with speculation and cautious optimism as it anticipates the incoming administration of President-elect Donald Trump.

With the Republican Party gaining control of Congress, industry leaders foresee the potential for a more favorable regulatory environment that could catalyze growth and mainstream adoption in 2025.

A Shift in Regulatory Tone?

Over the past several years, the crypto sector has faced stringent scrutiny under the Biden administration, with Securities and Exchange Commission (SEC) Chair Gary Gensler spearheading numerous enforcement actions. High-profile cases against Ripple, Coinbase, and others highlighted regulatory concerns over unregistered securities offerings. However, many in the industry believe that Trump’s administration could signal a pivotal shift.

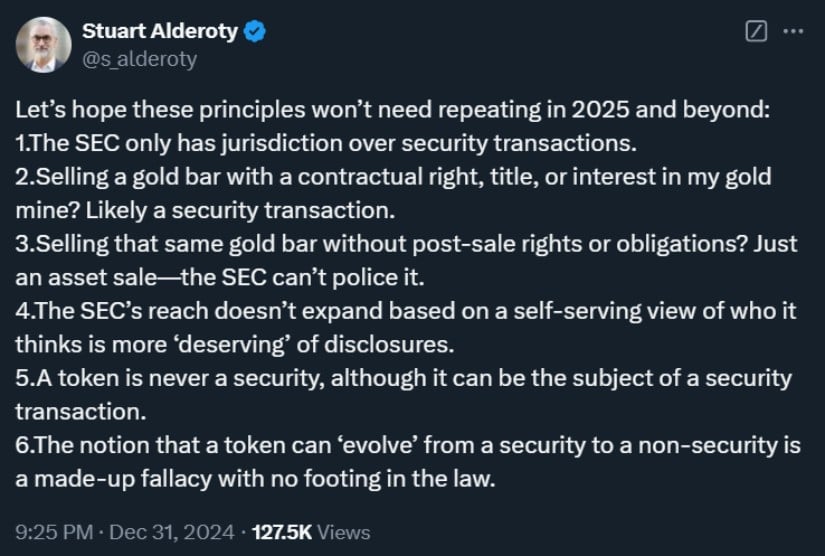

Source: Stuart Alderoty via X

Ripple’s Chief Legal Officer, Stuart Alderoty, expressed hope for a more balanced approach. In a Dec. 31 post on X, Alderoty emphasized the need for regulatory clarity, asserting that while tokens can be part of security transactions, “a token is never a security.” Ripple continues to appeal a $125 million judgment from August 2024 in its case against the SEC.

Adding to this optimism, the US Supreme Court’s 2024 decision to overturn the Chevron doctrine, which previously granted agencies deference in interpreting ambiguous laws, could reshape how courts approach SEC cases. Coinbase Chief Legal Officer Paul Grewal noted this development as a potential game-changer.

Trump’s Pro-Crypto Stance

The president-elect has made bold promises to support the cryptocurrency sector. His campaign rhetoric included proposals to establish a strategic Bitcoin stockpile and create a crypto advisory council. Trump’s nominations for key regulatory positions—including Paul Atkins as SEC Chair—are viewed as indicators of a pro-market approach.

Source: MJ Truth Ultra via X

At the Bitcoin Mena 2024 conference in Abu Dhabi, Eric Trump, the president-elect’s son, assured attendees that his father would champion the industry. Linking the challenges faced by both the crypto sector and his family to systemic issues, Eric stated, “Had it not been for those attacks, I don’t think my eyes would have been as open to the crypto industry.”

From Crisis to Revival

The expected policy change comes after a wild period for the crypto market. After the failure of FTX in late 2022, Bitcoin was pushed down to US$16,000 and knocked confidence in the asset class. That narrative has flipped on its head now. In December 2024, Bitcoin surged past $100,000, propelled by fresh optimism. It marked a milestone celebrated the world over—from a Lamborghini in Dubai spray-painted with “BTC 100K THANKS TRUMP.

Yesha Yadav, associate dean at Vanderbilt University Law School, called the revival “a turnaround of near-mythical proportions.” She also warned, however, that increased integration with traditional financial systems could heighten risks.

Balancing Opportunity and Risk

While many industry leaders view the incoming administration as a boon, others caution against potential pitfalls. Eswar Prasad, a senior fellow at the Brookings Institution, voiced concerns about the combination of “greater legitimacy and light regulation,” which could exacerbate systemic risks if a major market downturn occurs.

Crypto’s history of attracting fraudulent schemes remains a point of contention. High-profile legal actions against figures like former Binance CEO Changpeng Zhao and FTX executives underline the sector’s ongoing challenges.

Strategic Lobbying Pays Off

The crypto industry’s enthusiasm for Trump’s presidency is no coincidence. Major players, including Coinbase, Ripple, and venture capital firms like Andreessen Horowitz, invested heavily in lobbying efforts. The Fairshake Super PAC, backed by these entities, raised $170 million to support pro-crypto candidates during the election cycle. Stuart Alderoty of Ripple hailed the PAC’s efforts, stating they would have “a clear and immediate impact” on Congress’s regulatory decisions.

With Trump’s inauguration on the horizon, the crypto sector is preparing for a potentially transformative era. Leaders are optimistic about reduced regulatory friction and enhanced legitimacy. However, balancing innovation with investor protection will remain critical as the industry moves toward broader institutional adoption.

As Coy Garrison, a partner at Steptoe and former SEC counsel, put it, “This is a new beginning in many ways.” The coming months will reveal whether the administration can deliver on its promises and usher in a golden age for cryptocurrencies.