The race to launch a spot XRP exchange-traded fund (ETF) in the United States is gaining traction, with 21Shares at the forefront of the movement.

The Switzerland-based investment firm originally filed for an XRP ETF in November 2024, and now, equities exchange MEMX has submitted a proposal to the U.S. Securities and Exchange Commission (SEC) to list the fund as a “Commodity-Based Trust.” This classification signals a potential shift in the regulatory landscape, aligning XRP with assets like Bitcoin and Ethereum, both of which have already secured spot ETF approvals.

XRP ETF Filings Gain Momentum

The latest MEMX filing is only one of a number, with multiple financial institutions, including Canary Capital, Bitwise, and WisdomTree, submitting SEC applications for spot XRP ETFs. Last month, the Chicago Board Options Exchange (Cboe) also filed applications for four separate XRP ETFs. Notably, filings began even before Donald Trump’s recent victory at the presidency, which suggests issuers had imagined a more conciliatory regulatory environment under a Republican administration.

MEMX has proposed to the SEC that the fund be listed as a “Commodity-Based Trust.” Source: SEC

Under the previous democratic-aligned SEC chairman Gary Gensler, the SEC cracked down on cryptocurrencies, led by XRP. The SEC filed a 2020 action against Ripple in which XRP is an unregistered security and led to drawn-out litigation. But in 2023, a court gave a landmark judgment that XRP is not a security when trading on secondary markets. Still, SEC approval for an XRP ETF remained doubtful even then under the Biden administration.

Trump’s Crypto-Friendly Stance and Regulatory Shift

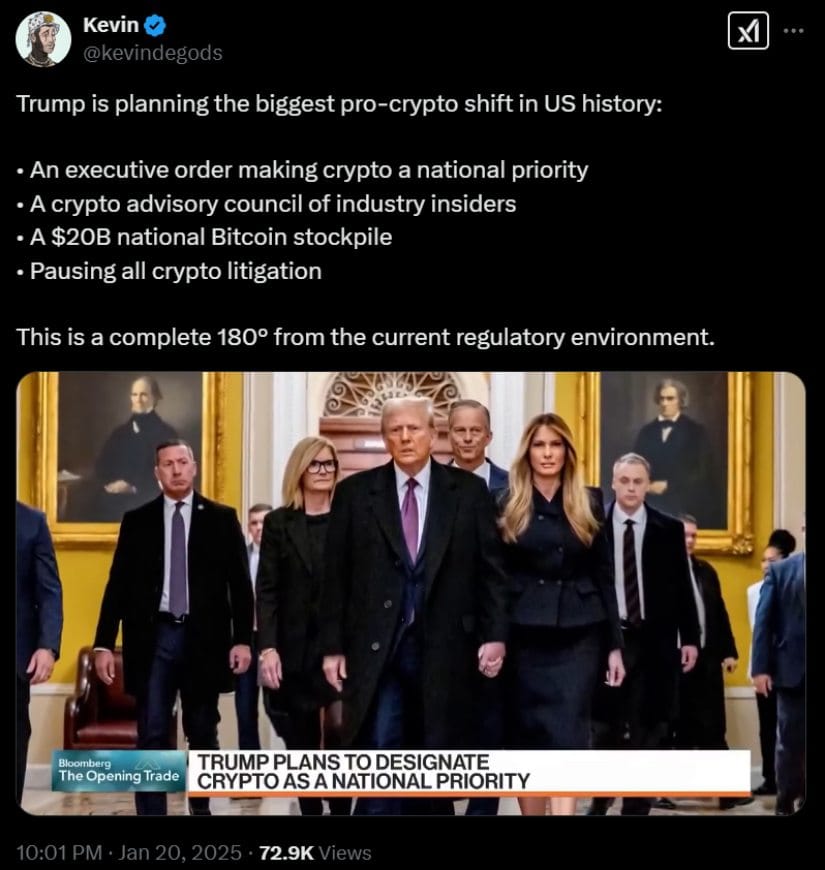

The political shift following Trump’s victory has dramatically increased the likelihood of an XRP ETF approval. Shortly after the election, Gensler stepped down, paving the way for pro-crypto executives such as acting SEC Chair Mark Uyeda and replacement Paul Atkins to lead the agency. Bloomberg ETF analyst James Seyffart estimates a 65% chance of approval by the end of 2025, though the SEC has until October to make its decision.

Trump plans a historic pro-crypto pivot with an executive order, advisory council, $20B Bitcoin reserve, and litigation freeze. Source: Kevin via X

Trump’s administration has already been crypto-friendly, and proposals to include Bitcoin in a national strategic reserve. If this pro-crypto stance extends to regulatory policy, XRP ETF approvals will be on the cards in the near future.

Shifting Market Sentiment and Investor Interest

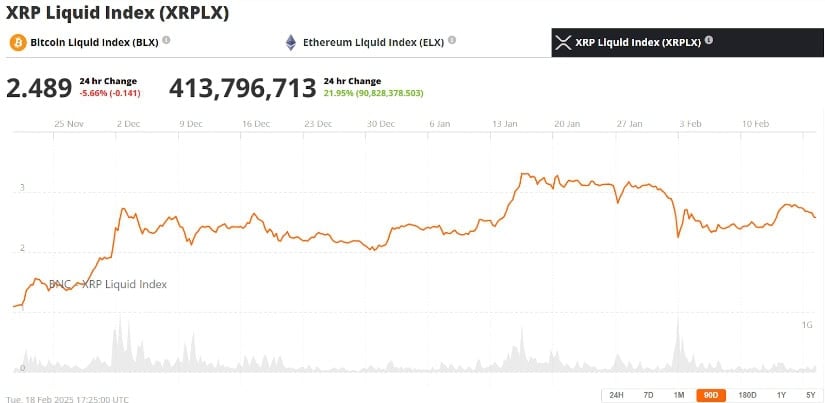

The heightened ETF activity comes at a time of increased volatility for XRP. The cryptocurrency had just broken the $3 threshold, a year-to-date surge of over 360%. It has since, however, retreated by nearly 20%, now trading below $2.70. Analysts attribute this volatility to market speculation regarding the ETF filings as well as ongoing legal uncertainties.

Ripple (XRP) was trading at around $2.48, down 5.66% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Matrixport, a Singapore blockchain firm, noted that XRP’s Relative Strength Index (RSI) remains around 40%, which is a position that has usually been associated with bullish momentum. The firm anticipates increased price appreciation to be driven by regulatory certainty under the new administration. “The recent rebound could have further upside, particularly if the SEC revisits its legal case against Ripple Labs under the new U.S. administration,” Matrixport stated.

Watch – XRP Price Analysis Video

Regulatory Uncertainty and Commodity Classification

While a court ruling, consistent with XRP not being a security, did not formally classify it as a commodity, the fact that MEMX titled its ETF application a “Commodity-Based Trust” suggests attempting to place XRP in the same category as Bitcoin and Ethereum, both of which have been deemed commodities by the SEC.

A social media post announces MEMX’s SEC filing for an XRP ETF and hints at notable partners. Source: XRP Captain via X

This classification could be a strategic move by issuers to make their approval argument more compelling. The SEC’s recent green light for Grayscale’s filing for an XRP ETF signals a shift from its previous caution, though no outright approval exists. Historically, the agency has taken the longest time possible to approve these filings, so an early determination is not anticipated.

The Road Ahead

As the SEC initiates the process of reviewing, investors and cryptocurrency users are waiting with bated breath for the destiny of these filings. An XRP ETF approval would be a milestone in the history of the crypto market, further mainstreaming digital currencies in mainstream capital markets. Regulatory doubts, however, continue, and traders are cautioned to be careful in light of market fluctuations.

With multiple issuers in contention and a changing regulatory environment, the coming months are likely to prove pivotal for XRP and the broader crypto ETF universe.