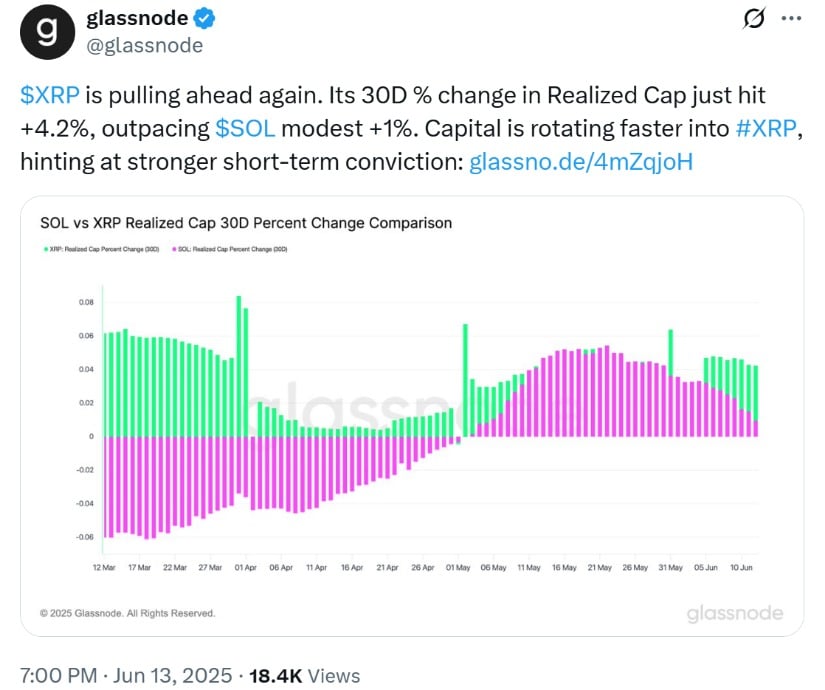

XRP has taken center stage in the crypto market as recent on-chain data reveals a 4.2% increase in its 30-day realized capitalization, significantly outperforming Solana’s 1% gain.

This surge reflects growing investor confidence in XRP, with capital rotating into the asset more decisively than many of its rivals. As the broader market looks for strong indicators of bullish sentiment, XRP appears to be gaining both momentum and market attention.

On-Chain Data Signals Institutional Interest

According to Glassnode, the 30-day realized cap — a metric that values coins at the price they last moved on-chain — has spiked 4.2% for XRP, compared to Solana’s modest 1%. This shift suggests short-term capital inflows are favoring XRP, often interpreted as a sign of bullish accumulation.

XRP’s 30-day realized capitalization surged by 4.2%, significantly outpacing Solana’s 1% gain, indicating stronger investor conviction and accelerating capital inflows. Source: Glassnode via X

“Capital is rotating faster into XRP, hinting at stronger short-term conviction,” Glassnode stated. Realized cap, unlike market cap, emphasizes coins that are actively transacted, giving a clearer picture of investor activity. Historically, such growth signals mounting interest from both retail and institutional players.

The divergence between XRP and Solana became evident in early June, as Solana slipped into negative territory while XRP surged. This reflects a pivot in trader behavior, likely driven by a mix of technical and fundamental developments in the XRP ecosystem.

XRP Price Struggles Below Resistance

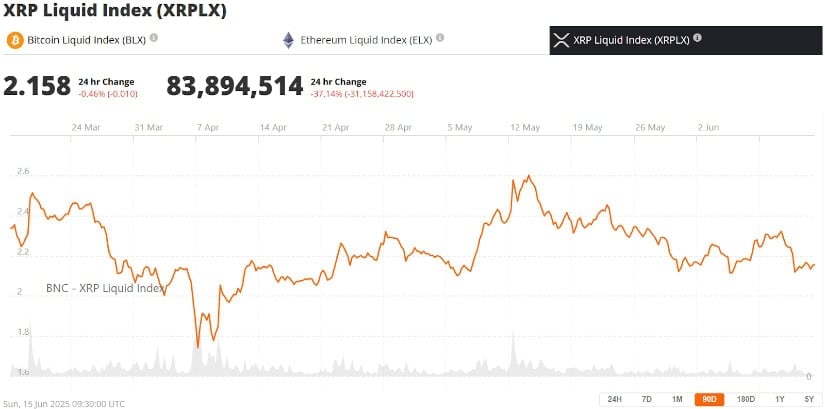

Despite positive on-chain signals, the XRP price has faced resistance in recent sessions. As of June 15, XRP trades around $2.13, slipping slightly by 0.7% over the past 24 hours. The token remains under a descending trendline that has suppressed breakout attempts since early June. Technical charts show strong rejection near $2.18, with red-bodied candles forming around that resistance.

XRP was trading at around $2.15, down 0.46% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

According to analysts, XRP must break above $2.22 to signal a bullish reversal. Until then, downside pressure remains likely. The 50-period exponential moving average (EMA) at $2.19 also acts as a short-term barrier.

Key technical levels to watch:

- Resistance: $2.18, $2.22

- Support: $2.09, $2.0474, $2.0042

- EMA resistance: 50-EMA at $2.19

The MACD indicator shows a minor bullish crossover, but fading momentum suggests caution. For traders, a confirmed breakout above $2.22 may open the path toward $2.27 and beyond.

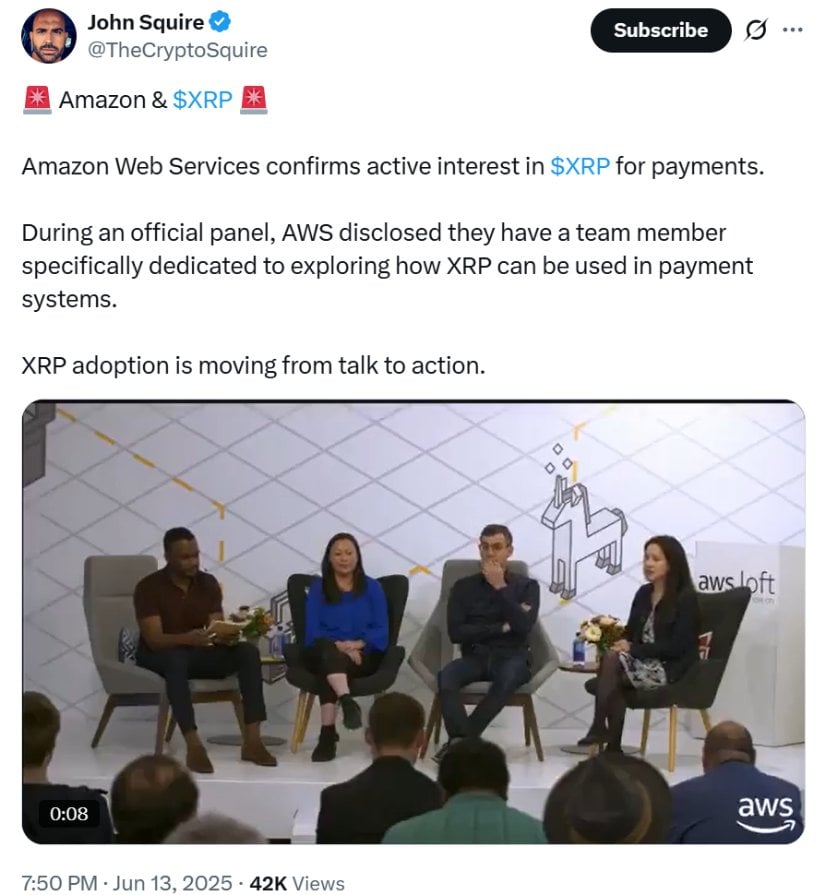

Amazon Web Services Exploring XRP for Payments

A significant development adding to XRP’s momentum comes from Amazon Web Services (AWS), which has confirmed active exploration of XRP as a payments solution. AWS reportedly assigned a dedicated team to study XRP’s integration into its payment infrastructure, marking a notable step toward institutional adoption.

Amazon Web Services (AWS) has confirmed its active interest in XRP for payments, revealing a dedicated team member focused on exploring its integration into payment systems. Source: John Squire via X

If successful, this partnership could enhance XRP’s position as a cross-border payments leader. Ripple’s network has long touted low-cost, fast transactions as a key selling point, making it suitable for large-scale enterprise applications.

This move also strengthens the argument for XRP’s real-world utility and may serve as a catalyst for future price growth. The potential for XRP to be used by global corporations through platforms like AWS could drive both demand and visibility.

XRP Realized Cap Growth Reflects Market Optimism

The realized cap trend is also signaling deeper changes in market sentiment. Between April and June, XRP recorded multiple spikes in realized cap, each aligning with bullish news or renewed buying interest. Solana, in contrast, spent much of March and April in decline, failing to maintain momentum.

This consistent capital rotation into XRP could indicate rising speculation over upcoming regulatory clarity or renewed hopes of a Ripple victory in its legal battle with the U.S. Securities and Exchange Commission.

XRP Lawsuit Update: Regulatory Outcome Looms

The ongoing XRP lawsuit with the SEC remains a critical factor for Ripple’s future. Investors are eyeing June 16, when Judge Torres is expected to deliver a key ruling in the 4.5-year-long legal saga. The joint motion filed by Ripple and the SEC earlier this month could resolve the case and return $75 million to Ripple, signaling a potential end to the courtroom uncertainty.

XRP is expected to surge once regulatory clarity is achieved, with a key update in the SEC vs. Ripple case anticipated on June 16. Source: KryptoJoeYo via X

A favorable judgment could open the door for Ripple to expand its partnerships, particularly in the U.S., and reignite institutional confidence in XRP. Many in the community see the lawsuit’s conclusion as the final hurdle before XRP can be fully embraced as a regulatory-compliant digital asset.

Final Thoughts: XRP Builds a Case for Breakout

With rising realized cap, strong institutional interest, and promising developments like AWS exploring XRP for payments, Ripple’s native token is attracting renewed market attention. Despite short-term technical resistance, the broader sentiment points toward a bullish setup — provided XRP can break past key price levels and regulatory concerns ease.

The XRP price prediction remains cautiously optimistic. A decisive move above $2.22 may ignite further gains, while continued accumulation and positive XRP lawsuit news could support a long-term rally. As one analyst put it, “XRP is consolidating, but the fundamentals are setting the stage for something bigger.”

Stay tuned as XRP continues to dominate headlines in both price action and real-world adoption.