XRP showed signs of strength early in the week but failed to sustain its upward momentum as it approached key resistance.

Despite rising inflows and growing open interest, the XRP price is facing renewed selling pressure, highlighting investor caution amid broader market and macroeconomic uncertainty.

XRP Price Pulls Back After $2.22 Rejection

After surging nearly 7% over the weekend to hit $2.22, XRP’s rally began to fade by Monday. The XRP price today stands at $2.21, slipping just over 1% from its local peak. This stall comes despite mounting institutional interest and a broader recovery in crypto markets following U.S. Senate discussions on budget reform—referred to as the “Big Beautiful Bill.”

XRP was trading at around $2.216, up 1.17% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

While the bill sparked short-term enthusiasm across risk assets, including XRP, the bullish momentum appears to have been short-lived. “Fiscal instability and structural deficits tend to support crypto assets,” analysts noted, “but follow-through depends on legislative clarity and investor confidence.”

XRP Investment Products Attract $10.6 Million Inflows

According to CoinShares’ latest Digital Asset Fund Flows report, XRP investment products brought in $10.6 million last week, pushing year-to-date inflows to $219 million. Total assets under management (AUM) for XRP now sit at approximately $1.18 billion.

“We believe this resilient investor demand has been driven by a combination of factors, primarily heightened geopolitical volatility and uncertainty surrounding the direction of monetary policy,” CoinShares stated in the report.

This marks a strong vote of confidence in XRP, even as the XRP coin price struggles to break above resistance. The consistent inflows suggest that institutional investors continue to see long-term potential in the token.

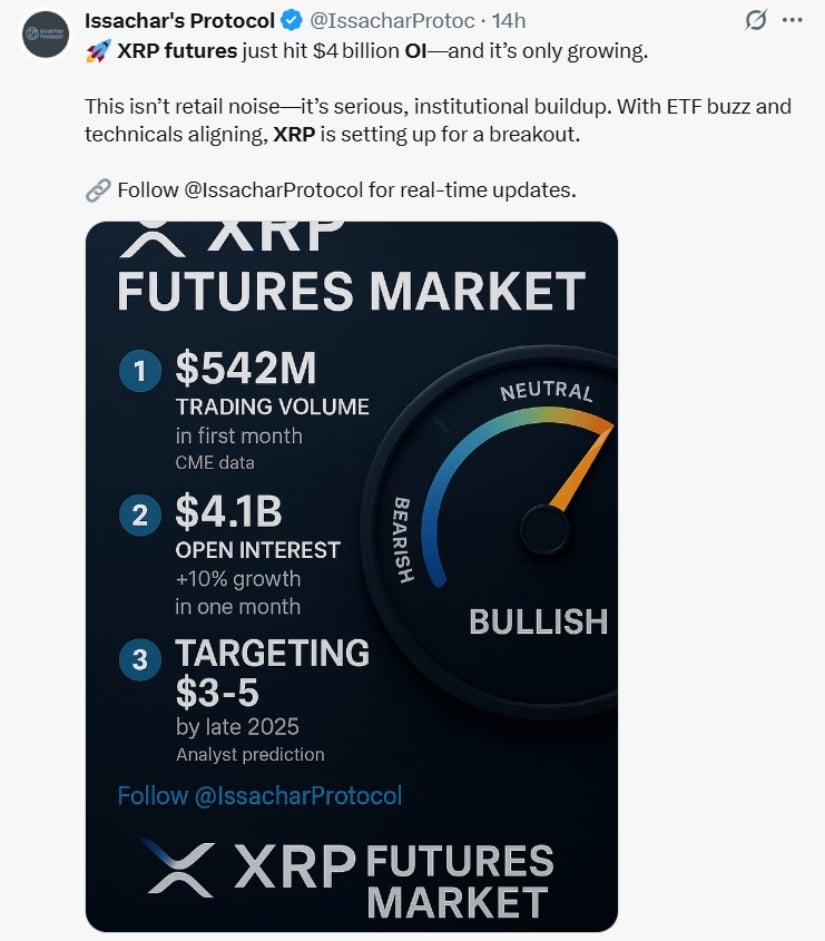

Derivatives Market Signals Strength but Warns of Volatility

In the derivatives market, XRP OI futures increased from $3.54 billion as of June 23 to over $4.19 billion—a 15.5% increase. High OI with growing trading volume typically signals high conviction among traders. XRP derivatives volume increased nearly 17% over the last 24 hours to reach close to $3 billion.

XRP futures open interest has surged past $4 billion, signaling strong institutional accumulation as ETF speculation and bullish technicals hint at a potential breakout. Source: @IssacharProtoc via X

However, liquidations have been relatively balanced, at $1.52 million in longs and $1.53 million in shorts that were destroyed, which reflects a struggle between the bulls and bears. The XRP crypto market may still be in the course of a trend-determining process, as traders digest macro headlines and technical signals.

Technical Setup: Will XRP Go Up or Break Down?

Technically, XRP is consolidating below the 100-day EMA at $2.22. A rejection at this level has turned the focus back toward downside support. However, the Relative Strength Index (RSI) has topped above 50, hinting at fresh bullish momentum.

XRP is holding above key support at $2.19, with the 200 EMA offering a strong base—setting the stage for a potential rebound toward $2.33. Source: EA_GOLD_MAN_COPY_TRADE on TradingView

A critical support area lies at the 200-day EMA near $2.10. If the XRP price breaks below this, it could test levels around $1.90 or even lower, including $1.80 and $1.61—support zones last visited in April. The SuperTrend indicator has issued a sell signal, adding to the cautious outlook.

Yet, some analysts remain hopeful. “If XRP can hold above $2.15 and consolidate, a breakout to $2.33 or $2.65 remains possible,” one trader suggested, referencing historical resistance levels last touched in mid-June.

Ripple News: Legal Uncertainty Lingers After Dropping SEC Cross-Appeal

Ripple’s legal battle with the U.S. Securities and Exchange Commission (SEC) continues to shape sentiment. Last week, Ripple Labs confirmed that it dropped its cross-appeal following a court decision to uphold a $125 million penalty related to institutional sales of XRP.

While the move could hint at Ripple’s attempt to bring the XRP lawsuit to a close, uncertainty still clouds the outcome. The ripple vs SEC case remains a major overhang for long-term XRP prediction models. Many in the crypto community believe that a final XRP court case update today could act as a major bullish or bearish catalyst.

XRP Cloud Mining Spurs Renewed Interest

Beyond legal developments, new financial products are generating excitement in the XRP ecosystem. PFMCrypto recently launched XRP-focused cloud mining contracts that simulate mining rewards. Though XRP doesn’t use a proof-of-work model, the contracts offer a way for investors to earn daily XRP payouts without hardware.

PFMCrypto has introduced a low-cost, 1-day XRP cloud mining contract, offering a convenient hedge for XRP holders during market slowdowns. Source: Emilie via X

Features include flexible contract lengths, daily withdrawals, and secure infrastructure. The innovation has contributed to renewed enthusiasm among retail investors, particularly during consolidation periods where passive income strategies gain traction.

Outlook: Can XRP Break Through Resistance?

Despite the price of XRP today showing weakness at resistance, the broader picture remains mixed. On one hand, rising XRP open interest, steady institutional inflows, and continued investor interest provide a supportive backdrop. On the other hand, technical rejection at $2.22 and legal uncertainties could cap upside in the near term.

The next few sessions will be critical. A confirmed breakout above $2.22 could set the stage for a 7–22% rally, targeting levels like $2.33 and $2.65. However, failure to hold the $2.10–$2.15 support zone could result in a slide back toward $1.90 or lower.

As XRP crypto price prediction models adjust to new data, traders are advised to monitor volume, legal developments, and macroeconomic events closely.