After weeks of tight consolidation, XRP appears poised for a potential breakout as bullish catalysts converge across technical, regulatory, and institutional fronts.

Currently trading near $2.19, XRP price has shown signs of regaining strength from last week’s dip to $2.05, though a clear breakout remains elusive. The market is now closely watching whether upcoming developments, such as the CME XRP futures boom and the XRPL EVM sidechain launch, could finally trigger a decisive move.

XRP Presses Against Key Technical Barriers

XRP price today continues to oscillate within a multi-month symmetrical triangle, a formation often preceding sharp volatility. The daily chart shows a tightening range, with XRP steadily approaching a descending resistance trendline formed since March. A breakout above this line could mark the beginning of a significant bullish move.

XRP was trading at around $2.19, down 1.31% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Although short-term indicators reflect some caution—such as the Parabolic SAR dots hovering above the price and the Supertrend indicator flipping bearish at $2.3281—XRP has consistently held above the critical $2.20 support level. This price floor has been defended vigorously since early June, hinting at growing buyer interest beneath current levels.

Institutional Optimism Rises With Spot ETF Speculation

Adding to the bullish narrative, analysts Eric Balchunas and James Sayffart from Bloomberg have significantly raised the odds of an XRP spot ETF approval by the U.S. SEC to 95%. This shift reflects growing acceptance of XRP as an institutional-grade asset, enabling stock exchange investors to gain exposure without directly holding the coin.

XRP gains spotlight amid a 95% spot ETF approval chance, bullish legislative progress, and growing investor interest following a market dip. Source: Oscar Ramos via X

ETF filings by major players like Grayscale, Franklin Templeton, and CoinShares underscore increasing confidence in Ripple’s compliance trajectory following recent developments in the XRP lawsuit. Notably, this optimism hasn’t yet been fully priced in, as the price of XRP today remains subdued despite the high approval odds.

Ripple Launches XRPL EVM Sidechain to Boost Utility

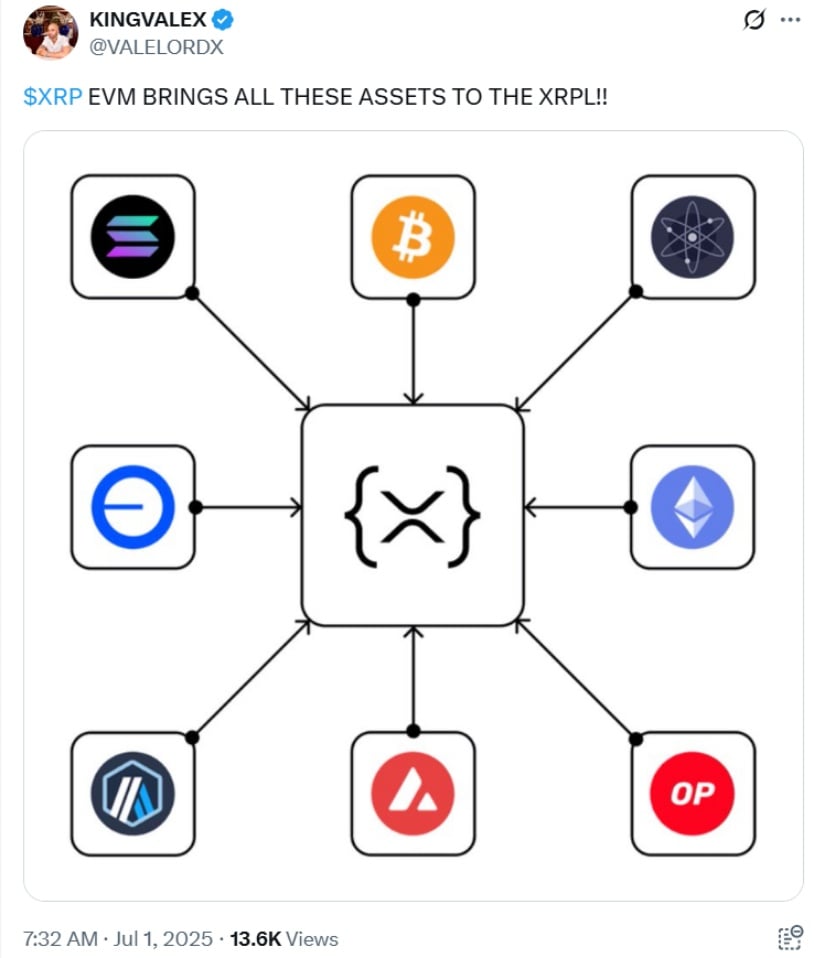

In a strategic move to boost utility, Ripple Labs has confirmed the mainnet launch of the XRPL EVM Sidechain. Developed in partnership with Persyst, the sidechain brings Ethereum-compatible smart contract capabilities to the XRP Ledger, enabling developers to build, port, and deploy EVM-based dApps natively on the XRPL ecosystem.

XRP EVM integration expands the XRPL by enabling support for a wide range of Ethereum-based assets and applications. Source: KINGVALEX via X

According to Ripple CTO David Schwartz, “The XRPL EVM Sidechain introduces a programmable setting for developers… while remaining anchored to the XRPL’s efficiency.” The innovation positions Ripple XRP as a contender in Web3 and DeFi for real-world asset tokenization, stablecoins, and cross-border payments use cases.

XRP Futures Take Off as Institutional Participation Rises

Fuelling the bullish fervour, XRP futures witnessed a sky-high rally after CME Group launched cash-settled contracts tracking the XRP-Dollar reference rate. XRP futures notched up $542 million in trading volume during their first month, a sign of robust institutional investor interest.

Open interest in XRP futures increased from $3.72 billion to $4.11 billion, reflecting increased speculative activity and confidence in XRP crypto price prediction. Analysts have attributed this surge to a variety of factors ranging from regulatory clarity to positive macroeconomic momentum and strong ETF speculation.

As Lingrid, a prominent market analyst, observed: “XRP bounced off two major support lines and is now regaining momentum. A move toward the $2.40–$2.44 zone looks increasingly likely.”

Macro and Geopolitical Winds Support a Risk-On Shift

Broader economic and geopolitical fundamentals have also favored risk assets like XRP. The current direction of Federal Reserve policy has signaled possible rate reductions, a scenario in the past that channels liquidity to the crypto space.

Meanwhile, a Middle East ceasefire improved investors’ confidence, sending altcoins like XRP on a 9% rampage on June 24. Collectively, these macro conditions are driving risk-on sentiment, increasing speculative demand for XRP futures, and reviving the possibility of a breakout to a significant price level.

What’s Next: $2.44 Breakout or Extended Consolidation?

Currently, XRP forecasts revolve around whether or not the price is able to convincingly break through the $2.34 to $2.44 resistance band, which has been a cap over the past few months. The ability to hold above this range may unleash a bullish leg up to the $2.65 level, which was last visible in May.

XRP is trading near the lower boundary of a rising channel, indicating potential support and a possible rebound zone. Source: cryptodailyuk on TradingView

However, a failure to remain above $2.18 could expose XRP to additional weakness, perhaps retracing to support at $2.06 or even $1.90. The market is wait-and-see, but good on-chain fundamentals, rising futures open interest, and the utilization of smart contract functionality all tilt bullish in the medium term.

Final Thoughts

The convergence of technological, regulatory, and infrastructurally inspired catalysts puts XRP in a potentially revolutionary position. With the XRPL EVM Sidechain up and running, chances of ETF approval at an all-time high, and CME futures trading volume exploding, the XRP coin price has the opportunity to escape its multi-month triangle formation soon.

If the trend continues, the ripple XRP price prediction for 2025 can exceed previous projections, especially if macroeconomic fundamentals remain good and institutional inflows accelerate.

All eyes remain focused at the $2.44 breakout point, which may determine whether XRP initiates a new uptrend—or remains mired in consolidation for a bit longer.