Bitcoin holders are showing diamond hands as unrealized profits top $1.2T. Bitcoin Hyper ($HYPER) emerges as a bullish Layer-2 play.

Like a winner at the poker table who keeps doubling-down, investors in Bitcoin are demonstrating remarkable resilience. Even while lesser investors cave and cash out, ‘diamond hands’ Bitcoin holders now have unrealized profits exceeding $1.2T.

As a recent report from Glassnode stated:

HODLing appears to be the dominant market mechanic across a plethora of spending metrics, with realized profit taking declining, liveliness continuing to trend downwards, and Long-Term Holder supply surging to a new ATH.

Glassnode, The Week On-chain, Week 26, 2025

Bitcoin holders are gambling that the ultimate top is coming for the world’s leading crypto – and they want more. In the meantime, projects like Bitcoin Hyper are building their own future on the back of Bitcoin’s success.

Diamond Hands Weather Latest Bitcoin Dip

A recent price dip from around $106K to $99K – coinciding with geopolitical tension in the Middle East – tested the resilience of short-term holders.

But more buyers stepped in around the cost basis at $98.3K, propelling prices back up.

They eventually crested above $107K in a move analysts see as a bullish rebound.

On-chain data reveals multi-month metrics at record highs: coins untouched for 155+ days now total 14.7M $BTC, and the ‘liveliness’ indicator – which captures coin movement – continues to fall, further cementing a strong buy-and-hold posture.

Even those who acquired BTC during January’s breakthrough above $100k are continuing to hold, confident that there’s plenty of room left for Bitcoin to grow.

And despite sky-high unrealized gains, realized profits have dwindled to about $872M daily, far below prior peaks of $3.2B.

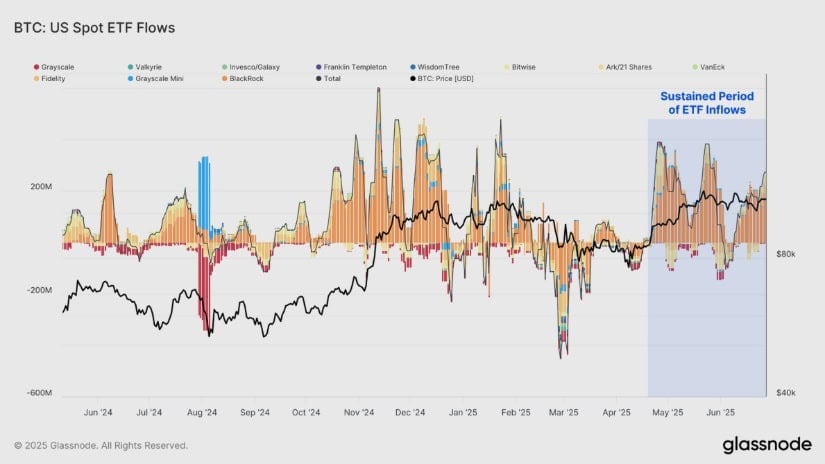

The upshot? There’s limited selling pressure and robust institutional demand, with US spot Bitcoin ETFs drawing average daily inflows of around $298M.

Without significant upward momentum, holders are unlikely to liquidate en masse – hinting that another price surge may be the catalyst required to unlock more supply.

According to Glassnode:

Investor behavior signals a strong preference for HODLing, as the current price range appears insufficient to trigger significant profit-taking.

Glassnode, The Week On-chain, Week 26, 2025

More demand is needed to push the price into the next ATH. Will it come from an upstart Bitcoin Layer-2?

Bitcoin Hyper ($HYPER) – The Fastest Layer in Bitcoin History Has Arrived

Unlock fast and cheap $BTC payments with Bitcoin Hyper ($HYPER) – a first-of-its-kind Bitcoin Layer 2.

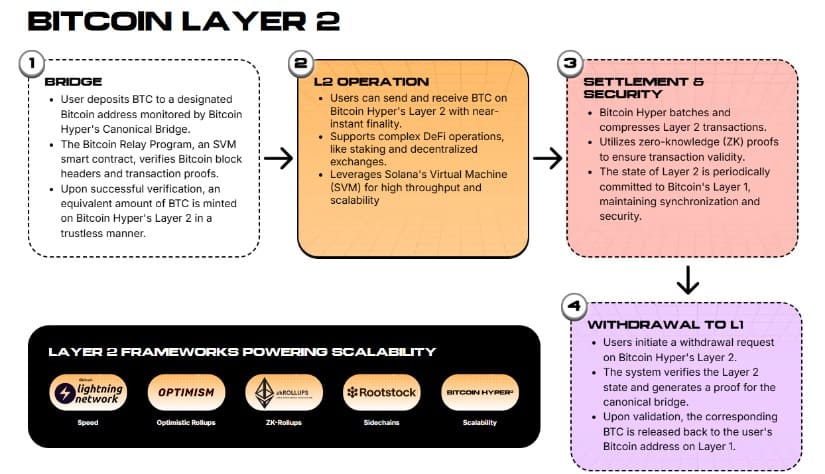

Powered by the Bitcoin Relay Program (an SVM smart contract), Bitcoin Hyper allows users to deposit $BTC to a designated address and receive freshly-minted $HYPER on a Layer 2. The process works in reverse too, allowing users to withdraw $BTC back on the Layer 1.

With Bitcoin Hyper, all the power of a proper Layer 2 comes to Bitcoin. That means ZK-rollups, the Lightning network, DeFi, all of it – now available to Bitcoin holders.

Staking also comes to Bitcoin via Bitcoin Hyper. During the presale, $HYPER tokens can be staked for a whopping 429% dynamic APY.

The project showcases fairly even allocation in its tokenomics. As expected, Development receives the most attention, with 30% of available tokens. Treasury (25%) and Marketing (20%) come next, with Rewards (15%) and Listings (10%) last.

Bitcoin Hyper is off to a roaring start, raising $1.8M in its first few weeks. Tokens are currently priced at $0.0121.

To learn how to buy Bitcoin Hyper ($HYPER), visit the presale page.

Bitcoin Enjoys Its Diamond Hands Phase

Bitcoin is entering a phase defined by entrenched long-term holding and tempered short-term selling.

With institutional capital flowing in and profits largely unrealized, the stage appears set for the next leg up – a step that could be accelerated by Bitcoin Hyper’s success.

Do your own research before investing. This isn’t financial advice.

Disclaimer: This content has been supplied by a third party contributor. Brave New Coin does not endorse or promote any products or services mentioned herein. Readers are encouraged to conduct independent research before making any financial decisions. The information provided is for informational and educational purposes only and should not be interpreted as investment advice.