At the time of writing, WIF trades near $0.85, showing stability after recent pullbacks.

Dogwifhat (WIF) has found renewed traction as technical indicators point to a potential bullish reversal. The price remains well-supported near the $0.80 level, consolidating within a critical accumulation range. Analysts now highlight key developments that could shape the token’s next move, particularly as it approaches high-confluence resistance.

Cloud Structure Flips Bullish as Buyers Regain Ground

According to an analysis shared by Console Future (@ConsoleFuture), Dogwifhat is trading within a stable consolidation band between $0.82 and $1.00. The 1-day Ichimoku cloud has shifted from red to green, signaling a potential momentum shift if the price sustains above $0.90. This change in cloud coloration typically reflects improving sentiment and may suggest a structural setup for a trend reversal, contingent on confirmation above key moving averages.

Source: X

The token is currently holding above both the EMA34 and EMA89, indicating short-term support remains intact. However, the EMA200, located near $0.97–$1.00, still slopes downward and serves as the main barrier. A confirmed daily close above this level would be critical in validating the transition to a new uptrend. The $0.98–$1.00 region now represents a key test zone where price action will likely determine short-term direction.

Volume and Momentum Indicators Reflect Growing Accumulation

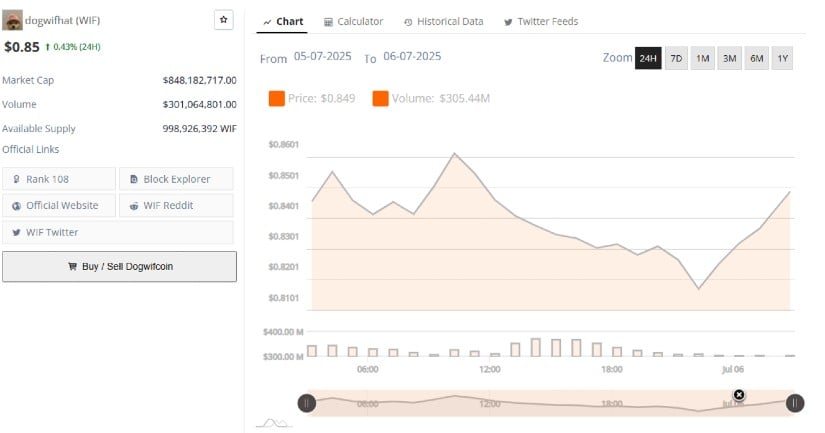

Recent 24-hour price action outlines a U-shaped intraday recovery, where WIF opened at $0.849, dipped to around $0.842, and returned to a high near $0.856 before closing at $0.85. This pattern, coupled with narrowing volatility, suggests controlled movement with modest bullish pressure. Daily trading volume reached approximately $301 million, with the heaviest activity observed during the early and mid-day trading hours.

Source: BraveNewCoin

Notably, lower volume accompanied the brief pullback in the latter session, indicating that sellers lacked conviction at lower levels. This volume structure supports the interpretation of ongoing accumulation rather than distribution. Market capitalization remains steady at $848 million, with the token ranked near 108 by size. Continued price stabilization above $0.85 could allow buyers to test higher levels, including the psychological threshold at $0.90.

Key Indicators Signal Strengthening Trend Structure

On the broader daily chart, Dogwifhat continues to form a pattern of higher lows following its pullback from the $1.00 peak in May. Support remains firm near $0.80, where prior buyer interest emerged. Price now hovers around $0.842, slightly under the session open of $0.846, maintaining a tight consolidation range. A successful breakout above $0.90 could reopen the path toward a retest of $1.00 and possibly the $1.20 extension if momentum accelerates.

Source: TradingView

Momentum indicators are beginning to confirm this setup. The Relative Strength Index (RSI) stands at 49.67 and continues to trend upward after stabilizing above 45 in mid-June. A move above the 55–60 range would likely strengthen the bullish outlook.

Meanwhile, the MACD is showing a narrowing spread between its main and signal lines, with the histogram now positive at 0.012. This crossover indicates that bearish momentum is weakening and could shift in favor of buyers if supported by an increase in volume. These technical elements suggest that a breakout could form as WIF approaches its critical resistance zone.