Ether (ETH), the second-largest cryptocurrency, has fallen out of investor relative to bitcoin (BTC), returning the worst bull-cycle performance against its larger rival since the Ethereum blockchain’s inception in 2015.

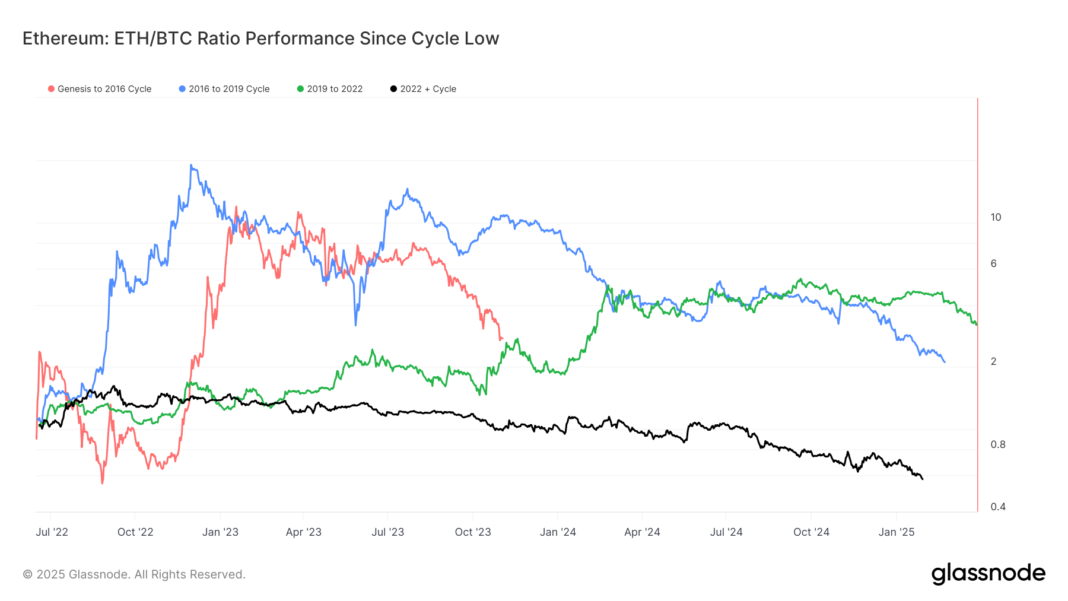

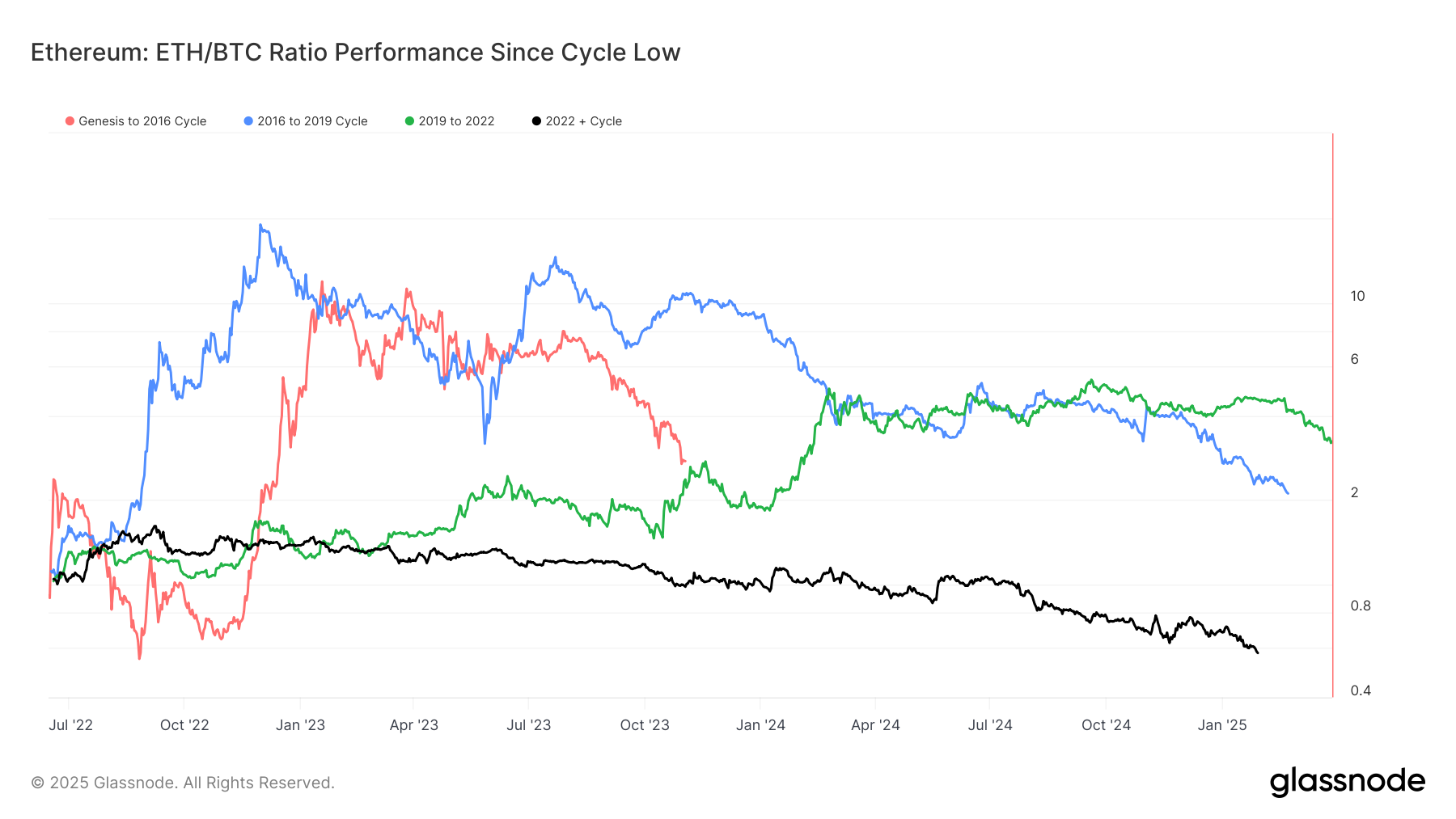

A comparison of the ether to bitcoin ratio across past cycles from the tokens’ respective lows shows consistent underperformance. The black line in the chart above represents the current cycle that started in November 2022, when bitcoin bottomed at around $15,500 during the collapse of crypto exchange FTX. With each cycle, ether’s return against bitcoin has diminished.

On Wednesday, the ratio dropped below 0.0300 to touch 0.02993, a four-year low. The previous low was recorded on Jan. 19, a day before President Trump’s inauguration. This month, the ratio — the exchange rate between the two largest cryptocurrencies — is down 15%. It has declined 44% over the past year.

Bitcoin is currently trading around $105,000, having recovered from the slump to $98,000 caused by the release of DeepSeek, a Chinese artificial intelligence (AI) program. Ether, currently at $3,202, would need to reach roughly $3,360 to undo the DeepSeek damage.

“My general take is that the ether to bitcoin ratio underperformance is more due to a strength of bitcoin rather than a weakness of ether,” said Andre Dragosch, head of research at Bitwise’s European desk. “Ether tends to suffer from ‘middle child syndrome,’ it is not as scalable as smart contract competitors like solana (SOL) while it is not really competing with bitcoin as the prime store-of-value.”