Microsoft’s annual shareholder meeting today, is set to be a pivotal event, with a significant proposal on the table: whether the tech giant should invest in Bitcoin.

Microsoft’s annual shareholders meeting is this Tuesday December 10 at 11:30am New York time. You can watch here.

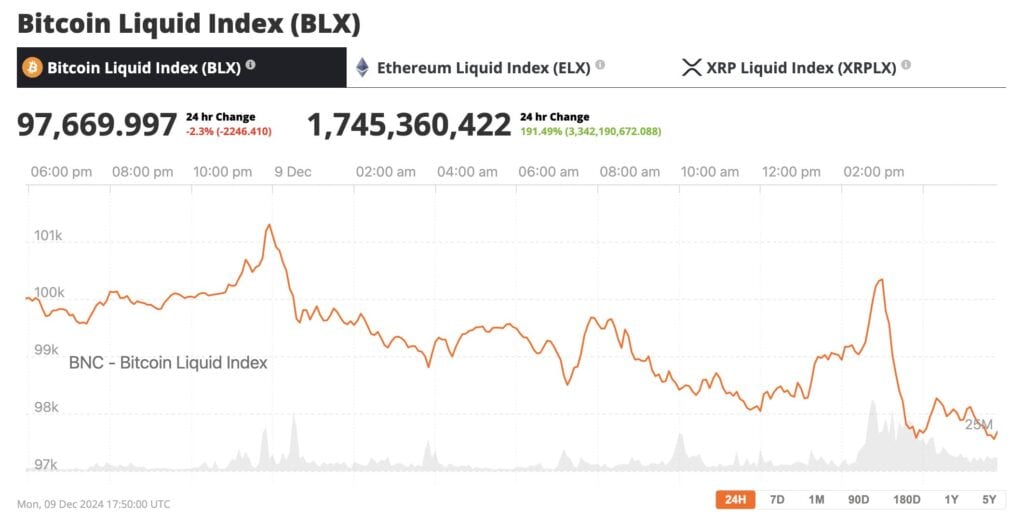

This comes at a time when Bitcoin has recently surpassed the $100,000 mark, partly due to President-elect Donald Trump’s pro-crypto stance and the nomination of crypto advocate Paul Atkins to lead the SEC.

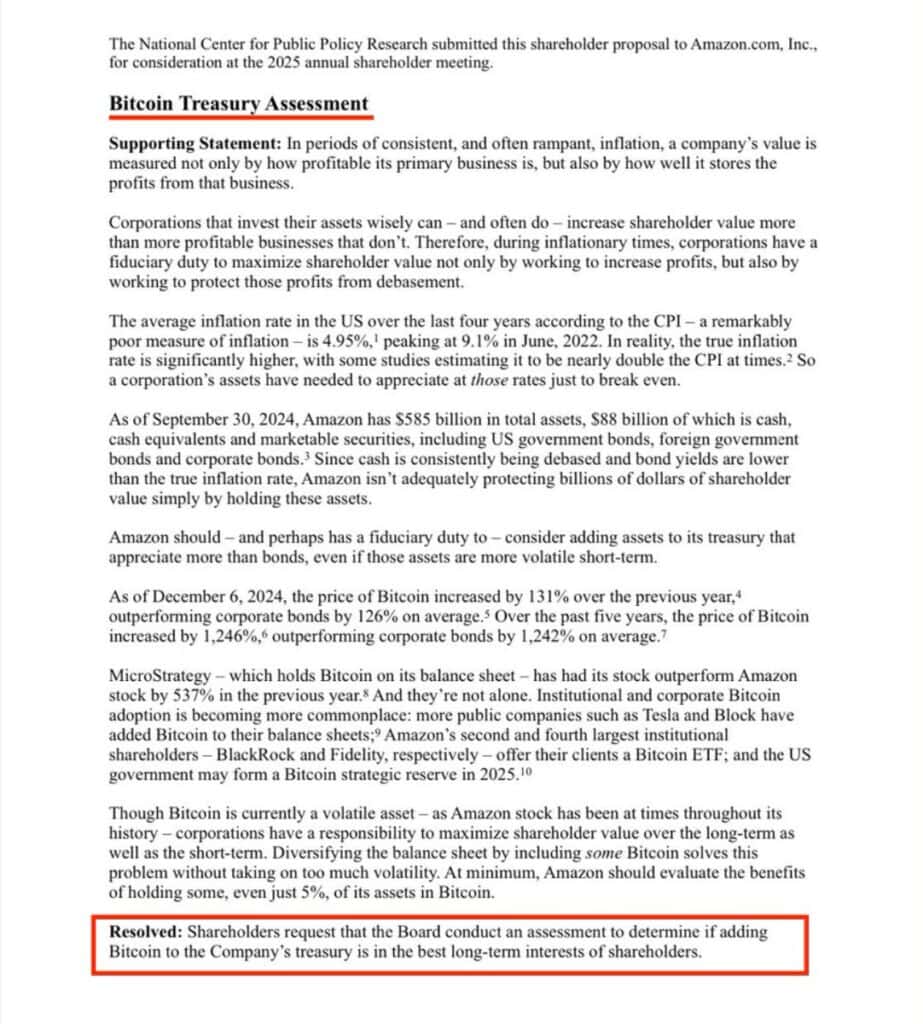

The proposal, titled “Assessment of Investing in Bitcoin,” will be put to a shareholder vote during the virtual meeting. Interestingly, Microsoft’s board has recommended against the motion, citing concerns over Bitcoin’s volatility and the potential risks to the company’s financial stability.

Source: X

Despite the board’s reservations, the timing of this vote is noteworthy. Bitcoin’s recent surge has been attributed to increased institutional adoption and favorable regulatory prospects under the incoming administration. Major corporations and financial institutions are increasingly viewing Bitcoin as a viable asset class, which could influence Microsoft’s shareholders as they consider the proposal.

Source: BNC Bitcoin Liquid Index

Microsoft’s history with Bitcoin has been cautious. The company briefly accepted Bitcoin as a payment method in 2014 but suspended the option in 2016, citing low usage and regulatory uncertainties. Revisiting Bitcoin investment now could signal a significant shift in strategy, aligning with the broader corporate trend toward cryptocurrency adoption.

The outcome of the December 10 vote could have far-reaching implications. A decision to invest in Bitcoin would position Microsoft among a growing list of companies embracing digital assets, potentially influencing other tech giants to follow suit. Conversely, a rejection might underscore the persistent caution in the corporate world regarding cryptocurrency investments.

As the meeting approaches, stakeholders and market analysts will be closely monitoring Microsoft’s decision, which could set a precedent for corporate engagement with cryptocurrencies in the evolving financial landscape.

Microsoft’s annual shareholders meeting is this Tuesday December 10 at 11:30am New York time. You can watch here

If this event follows the usual format, here’s what to expect: the session will begin with an introduction, followed by the presentation of various shareholder proposals, including Michael Saylor’s Bitcoin initiative. Afterward, Microsoft will announce the voting results.

https://www.youtube.com/watch?v=cH2t6VOdgkE

Don’t count on the Bitcoin proposal gaining approval—Microsoft’s board has already advised shareholders to vote against it. However, this likely outcome isn’t necessarily a reflection on the proposal’s merits. Instead, it illustrates the resistance innovative ideas often face when clashing with the conservative nature of massive corporations.

The true impact of Saylor’s proposal lies in sparking broader conversations. By raising Bitcoin as a topic of corporate consideration, it could inspire similar discussions at other major tech and non-tech firms, where shareholder advocacy might eventually lead to meaningful adoption.