Hedera (HBAR) is showing signs of a tentative recovery after weeks of downward pressure.

The token has been trading in a narrow range, with brief surges quickly met by resistance, keeping upside potential limited. As of July 6, 2025, HBAR is hovering near the $0.154 mark as traders assess whether recent bullish attempts can break through the $0.160 resistance level.

Market data suggests a neutral stance, with volume, momentum indicators, and open interest reflecting a cautious outlook.

Intraday Bounce Fails to Sustain as Volume Weakens

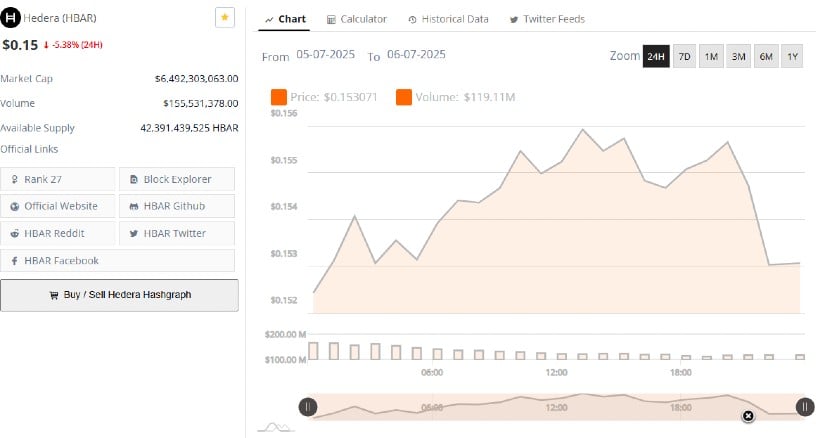

The 24-hour trading session from July 5 to July 6 began with modest optimism. HBAR climbed from approximately $0.152 to over $0.155 by mid-session, showing temporary strength as short-term buyers returned. However, the upward movement lacked intensity and failed to sustain above the short-term resistance of $0.1555. The price pulled back by the end of the day, closing at $0.153071, and indicating a reassertion of selling pressure.

Source: BraveNewCoin

Trading volume supports this reversal. The total volume reached $119.11 million, down significantly from the previous session’s $162 million. This decline suggests limited follow-through from market participants, even as the price attempted to rise.

Without a strong volume to support continued upward movement, the rally lost momentum quickly. The current market cap remains at $6.49 billion, positioning Hedera at rank 27, but further gains may be limited without improved market participation.

Short-Term Price Action Stalls Below Resistance

On the 1-hour chart, HBAR has been consolidating in a tight range between $0.152 and $0.156 following a sharp rally from below $0.145 to a high near $0.164. The current sideways movement reflects uncertainty, with the recent correction halting the bullish continuation.

Price action has flattened, suggesting that buyers and sellers are reaching a temporary equilibrium. Bulls must reclaim control above $0.156 to shift market sentiment in their favor.

Source: Open Interest

Supporting this view, open interest (OI) peaked at over 3.8 million contracts during the June 30 price rally. Since then, OI has gradually declined, now sitting at approximately 3.399 million. The decline indicates that traders closed positions during the correction, often a signal of caution or lack of conviction. Without a rebound in OI and price, HBAR risks slipping below $0.152, potentially triggering further losses toward $0.148.

Indicators Suggest Recovery Attempts Are Still Fragile

The daily chart shows HBAR posting a modest gain of 1.14%, closing at $0.15482. This green candle approaches the upper boundary of the Bollinger Bands, but the token remains below the 20-day Simple Moving Average (SMA) at $0.16069. That SMA currently acts as the key resistance level for any extended recovery.

If broken, it may pave the way toward higher zones around $0.17 to $0.18. However, failure to breach this level may result in renewed pressure toward $0.148 or the lower Bollinger Band at $0.13697.

Source: TradingView

Momentum indicators remain neutral. The Awesome Oscillator (AO) shows a slight improvement with green histogram bars forming, but the AO remains below the zero line at -0.00271. This suggests bearish momentum is fading, though not yet reversed.

A confirmed bullish trend would require AO to cross above zero alongside increasing price action. Until such confirmation appears, HBAR’s trend remains range-bound with modest upside attempts amid weak participation.