Nigeria has emerged as the leading hub for blockchain-related ventures in Africa, accounting for one-third of all blockchain deals across the continent, according to the latest edition of the African Blockchain Report published by Swiss venture capital firm CV VC in collaboration with South African banking group Absa. This fourth edition of the annual report outlines a sharp rise in blockchain adoption and funding activity in Africa, contrasting with global investment trends in the sector.

The report indicates that Africa is attracting blockchain venture capital at more than double the global average. While blockchain accounts for 3.2% of venture activity globally, it constitutes 7.4% of the total venture deal volume in Africa. Additionally, the continent recorded a 15% year-over-year increase in the number of blockchain deals, making it the fastest-growing region globally in this space.

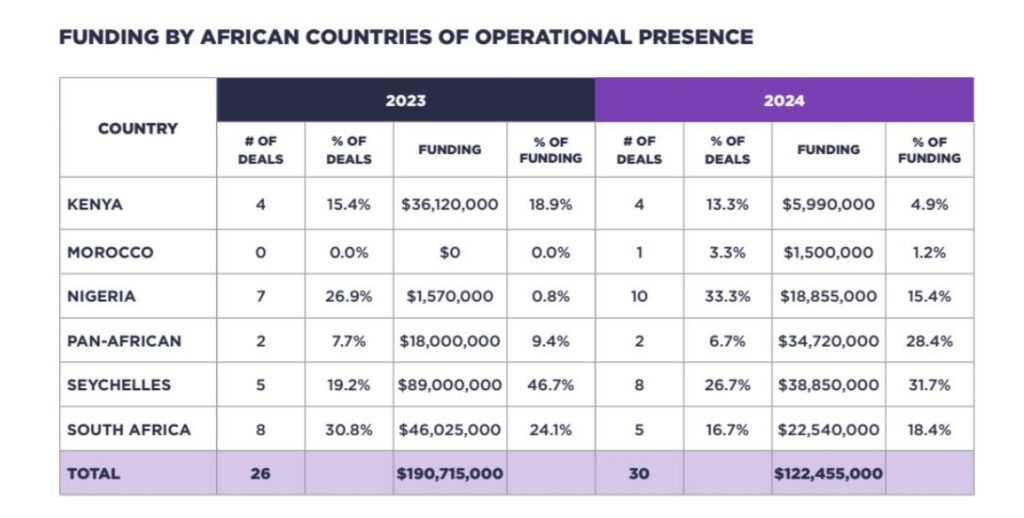

The median size of a blockchain deal in Africa stood at $2.8 million—exactly double the median amount for all sectors globally. However, despite this promising metric, total blockchain funding across the continent declined by 36% in 2024, amounting to $122.5 million. A large proportion of this activity occurred at the seed stage, reflecting strong early-stage interest in the technology.

Nigerian startups raised $20 million in blockchain-related funding during the year, as highlighted by a separate report from Hashed Emergent. Nigeria also now contributes 3% of the global blockchain developer pool, with over 300,000 active builders. While the continent’s share of global blockchain funding dropped from 1.8% to 1%, its deal count rose slightly to 2.3%, prompting analysts to describe this divergence as an opportunity gap rather than a sign of underperformance.

Kenya followed Nigeria as the second-most active country, accounting for 13% of all deals, while South Africa claimed 18% of the total funding value. Meanwhile, Pan-African startups—those that operate across borders—attracted 28.4% of all funding, a reflection of the regional impact these platforms are having.

The report emphasized that blockchain technology is increasingly being used to address specific African challenges, including data sovereignty, remittance efficiency, digital identity, access to credit, and transparent land ownership. CV VC Africa’s investment head stated that African founders are actively demonstrating how blockchain can offer practical solutions to real-world problems.

Financial services continue to dominate, absorbing 40.5% of blockchain funding, with centralized blockchain-based financial platforms leading the charge. Yet, blockchain’s role in Africa is expanding well beyond finance. The technology is gaining traction in agriculture—a sector employing over 60% of the African workforce. Innovations are helping secure land titles, enable rural energy grids, and document climate-positive farming practices.

Shamba Records’ CEO underlined the relevance of blockchain in agriculture by explaining how it merges traditional farming methods with modern transparency. The technology is helping mitigate food export losses caused by supply chain inefficiencies, which cost African economies billions. Blockchain verification of farmer identities and crop data is also expected to help meet the European Union’s import requirements, projected to reach €7.5 billion by 2025. Verified carbon tracking can even boost smallholder farmers’ incomes by up to $300 annually.

On the regulatory front, seven African countries, including Kenya and Seychelles, have already implemented digital asset regulations, while 35 others are exploring similar frameworks. This transition from risk aversion to proactive innovation is expected to offer startups the regulatory clarity they need to grow and attract capital.

Executives from CV VC reiterated that the continent’s performance reflects not a shortfall but a lack of participation by global capital. They highlighted Africa’s demographic and economic trajectory—with the continent expected to account for 25% of the world’s population and possessing 65% of its arable land by 2050—as a foundation for blockchain-led development.

Absa’s Head of Digital Assets concluded that African entrepreneurs are applying blockchain to address long-standing structural issues, from trade inefficiencies to agricultural reform, and suggested that blockchain will be pivotal to Africa’s broader digital transformation.