Apple Original Films’ F1 the Movie, starring Brad Pitt, smashed the box office with a $144 million global debut, including a hefty $55.6 million domestic weekend – topping both domestic and international charts – and driven in no short measure by digital wallet promos and crypto sponsorships

It’s Apple’s first real blockbuster success — even beating its mid-budget prestige wins (Killers of the Flower Moon) and their flops (Argylle, Fly Me to the Moon) . They bankrolled this with up to a $300 million production & marketing budget and finally cracked the code: big star (Top Gun: Maverick-style intensity), strategic global marketing, and F1’s Netflix-fueled hype cycle.

Apple’s Wallet Moves: Slick or Sleazy?

Apple cross-wired its ecosystem for promotion: iPhone alerts, Apple Maps tie-ins, haptic trailer, WWDC talk – slick synergy at play. But monetization purists aren’t impressed. Apple shoved a $10-off Fandango ticket promo into Wallet via push notification – without explicit opt-in – triggering outrage about ad creep in finance tools.

Reddit shouted “scummy”, “abuse of the system”, and compared it to the infamous U2 iTunes fiasco. Tech commentators warned, “if Wallet becomes a billboard, users are going to bolt” . That’s not user-first, it’s ad-first, and it’s bad optics for a brand built on “premium, minimal-ads.”

F1’s Crypto Curve: Racing Into Web3

F1’s relationship with crypto isn’t new, it was an early adopter. Crypto.com famously signed a $100 million deal with Formula 1 in 2021 – the sport’s first crypto sponsor – plastering circuits with branding and rolling out a bespoke crypto award. That symbiosis continued through the 2024–27 cycle as F1 leaned into NFTs, fan tokens, and blockchain engagement via the Crypto.com visa card.

And the film doesn’t shy away: expect shots of Crypto.com decals across cars and team gear – a nod to F1’s flirtation with Web3 and tokenized fandom. It’s product placement, sure, but it also anchors F1’s plot firmly in the digital-money era. If the sport wants to court the crypto crowd, there’s no better signal than weaving a major sponsor into its biopic.

Crypto.com is a major F1 sponsor, source: F1

Coinbase Joins F1: A Stablecoin-Fueled Partnership with Aston Martin Aramco

Earlier this year Coinbase inked a landmark sponsorship deal with Aston Martin Aramco, becoming the first Formula One partnership paid entirely in USDC, a stablecoin pegged to the U.S. dollar. The deal signals a leap forward for crypto in elite sports, showcasing blockchain’s real-world utility in speed, efficiency, and cross-border transactions.

“This shows our trust in Coinbase and commitment to innovation,” said Aston Martin’s Jefferson Slack. Coinbase branding will appear on the AMR25 race car, drivers’ suits, and team gear. The partnership also hints at on-chain fan experiences, adding a Web3 twist to F1 fandom.

Aston Martin has partnered with Coinbase

Coinbase’s VP of Marketing, Gary Sun, called it a milestone: “It’s our first crypto-only sports deal and F1 debut. USDC made sense for the scale and speed we needed, but partners can choose any crypto.”

This move builds on Formula One’s growing crypto momentum: Crypto.com holds the naming rights to the Miami Grand Prix through 2031, and Floki’s Valhalla game recently partnered with KICK F1 Sim Racing for NFT-based fan rewards.

As F1 accelerates into a blockchain-powered future, one thing is clear: crypto isn’t just along for the ride – it’s behind the wheel.

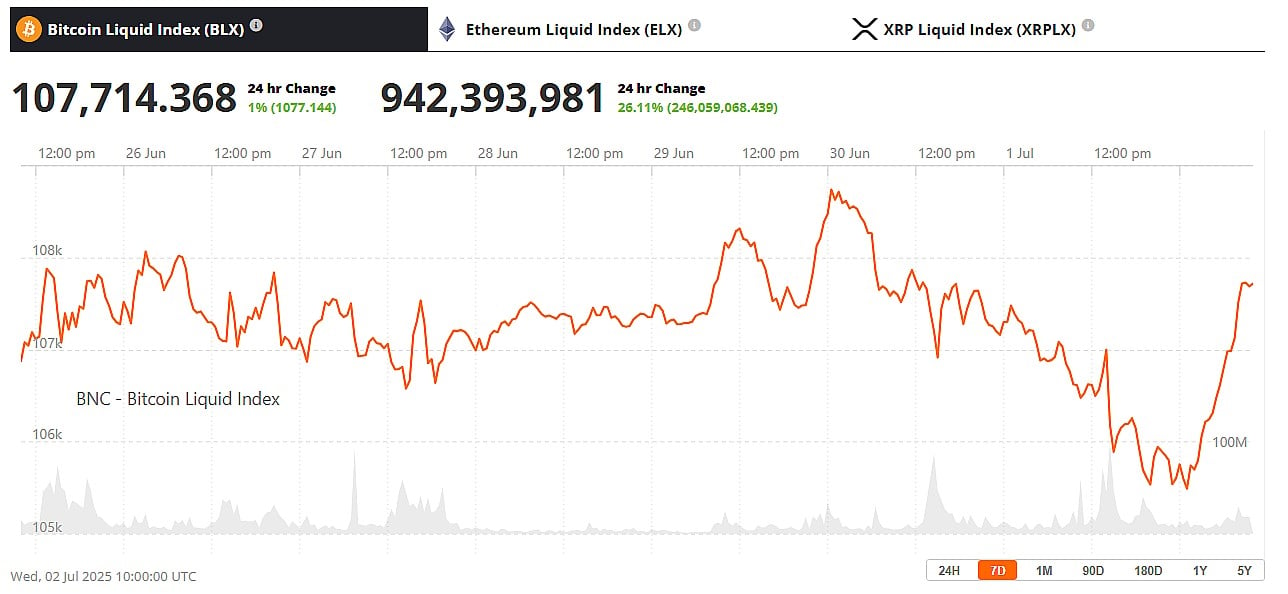

For investors who want to know if now is the right time to buy crypto, it is global sponsorships like the Crypto.com F1 partnership that are taking the crypto brand mainstream. And with Bitcoin approaching a new all time high and knocking on the door of price discovery, perhaps a crypto buy is worthy of consideration.

Bitcoin surged to above $108,600 early in the week, Source: BNC Bitcoin Liquid Index