Hedera (HBAR) is once again capturing attention after a brief but sharp downturn led to renewed interest across the crypto space.

The asset has held above key support levels despite recent losses, suggesting stabilization. Institutional partnerships and a growing transaction base continue to support sentiment. As the market searches for direction, Hedera’s current setup reflects cautious optimism backed by strong fundamentals and network adoption.

Market Structure and Analyst Insight

Between June 10 and June 13, the HBAR/USDT 1-hour chart from Open Interest displayed a clear bearish structure. During this time, the price fell from above $0.180 to a local low near $0.145, highlighting a strong wave of sell-side pressure.

This sharp movement coincided with a notable drop in open interest from above 3.75 million to a low around 3.2 million, signaling a liquidation of leveraged positions during the downturn. Price action since then has been defined by consolidation between $0.145 and $0.155, reflecting hesitation among buyers.

Source: Open Interest

Open interest has since recovered modestly to approximately 3.46 million. However, this remains below prior highs, indicating that participants have yet to re-enter the market fully. The combination of a narrow price range and cautious re-leveraging suggests that market participants are waiting for confirmation of a clear breakout before allocating further capital.

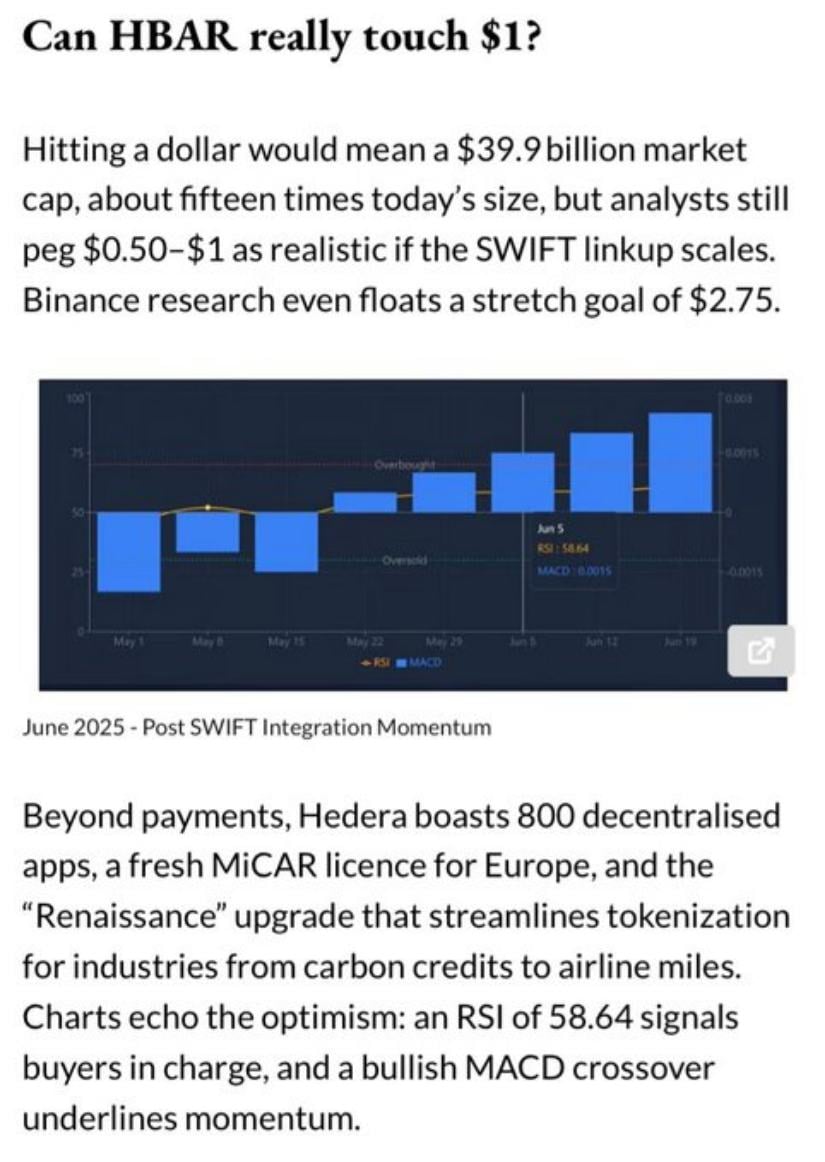

Analyst Mark Chadwick (@markchadwickx) shared commentary via X, referencing data from AnalyticsInsight, that reignited market interest in HBAR. Chadwick noted that a return to $1 per token would imply a market cap near $40 billion, approximately 15 times higher than current levels.

Source: X

While that projection depends on substantial growth, analysts view the ongoing SWIFT integration as a potential catalyst. The SWIFT pilot announced in February 2025 is already impacting price projections.

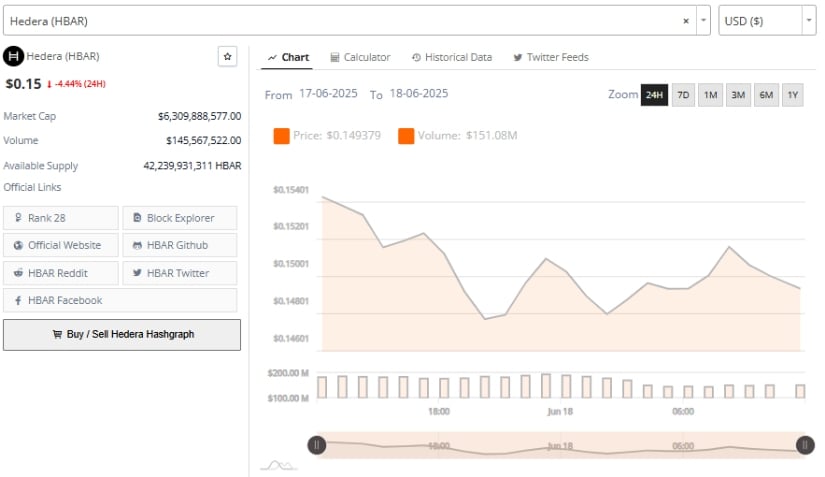

Hedera Price Prediction: Transaction Strength and Ecosystem Expansion

Data from Brave New Coin indicates that Hedera Price Prediction continues to operate at a high throughput, with daily transactions exceeding 2.5 million. This performance aligns with Hedera’s technical capability of processing over 10,000 transactions per second with minimal fees. At the time of writing, HBAR is priced at $0.15, down 4.44% over the past 24 hours, with a market capitalization of approximately $6.3 billion and daily trading volume exceeding $145 million.

Source: Brave New Coin

Hedera’s governance model is also seen as a strength by analysts. The project is supported by a council of major corporations, including Google, IBM, Deutsche Telekom, and LG, offering a unique mix of decentralization and enterprise-grade stability. The Hedera Consensus Service (HCS) continues to gain adoption, especially in areas like advertising integrity, digital identity, and logistics.

There is ongoing speculation around further integrations. Potential classification as a Nasdaq commodity and possible corporate partnerships, including one with Boeing, are seen as future growth drivers. Though speculative, these narratives contribute to long-term bullish sentiment around Hedera.

Weekly Chart Technical Analysis

The weekly chart of HBAR/USDT Price Prediction on TradingView highlights a history of high volatility. After reaching a peak of $0.49, HBAR entered a prolonged downtrend, finding support near $0.035. A strong rally in early 2025 lifted the price toward $0.30 before encountering resistance. Recent price action shows HBAR retracing to trade near $0.148, just above a visible support zone around $0.14.

Source: TradingView

The Relative Strength Index (RSI) on the weekly timeframe currently reads 43.40, down from earlier 2025 highs above 70. This suggests a reduction in momentum but not an oversold condition. RSI values above 40 have historically served as indicators of potential reversal zones for HBAR, raising the possibility of accumulation occurring at current levels.

The Moving Average Convergence Divergence (MACD) reflects a minor bearish crossover, with the MACD line at -0.0053 and the signal line above at 0.0020. The histogram has turned slightly negative, indicating weakening bullish momentum.

However, the crossover remains shallow, and the setup resembles conditions last seen before a major price surge in early 2023. Should price hold above key support and RSI maintain current levels, another upward breakout may develop in the coming weeks.