Alright listen up, fren.

You ever wish your trading bot could think for itself? Like, not just follow some script but actually react, adapt, and evolve like it has a mini brain with a Ledger wallet?

Welcome to the world of AI agents. 🤖💸

These aren’t your average Discord giveaway bots. We’re talkin’ smart, autonomous, 24/7 on-chain powerhouses.

They:

- Trade, even while you’re asleep.

- Watch the blockchain like hawks.

- Act, without waiting for human approval.

- And in some cases… meme harder than most humans (looking at you, Zerebro 👀).

This Ain’t Sci-Fi

These agents are already live, already earning, and already shaping the future of DeFi, DAOs, and decentralized governance.

They’re trading, posting, managing liquidity—all without being told.

Altie’s here to guide you through this world—where your portfolio manager might just be an AI in a hoodie (relatable 😎).

What Are AI Agents in Crypto? – Like Bots, But With Brains

Okay, real talk—what even is an AI agent?

Here’s your Altie-approved, human-friendly definition:

“An AI agent in crypto is an autonomous piece of software that has a brain (AI), a wallet (on-chain access), and a mission (like trading, data-gathering, or governance).”

Sounds cool? It is.

🧩 Let’s break it down:

- Bot: does exactly what it’s told

- AI Agent: figures out what to do, and then just does it

- Think: “bot + brain + bank access”

🛠️ What can they do?

- Trade based on real-time data

- Scan smart contracts for risk

- Rebalance yield farms

- Interact with DAOs

- Tweet dank memes (Zerebro again 😤)

- Post across platforms, mint NFTs, and more

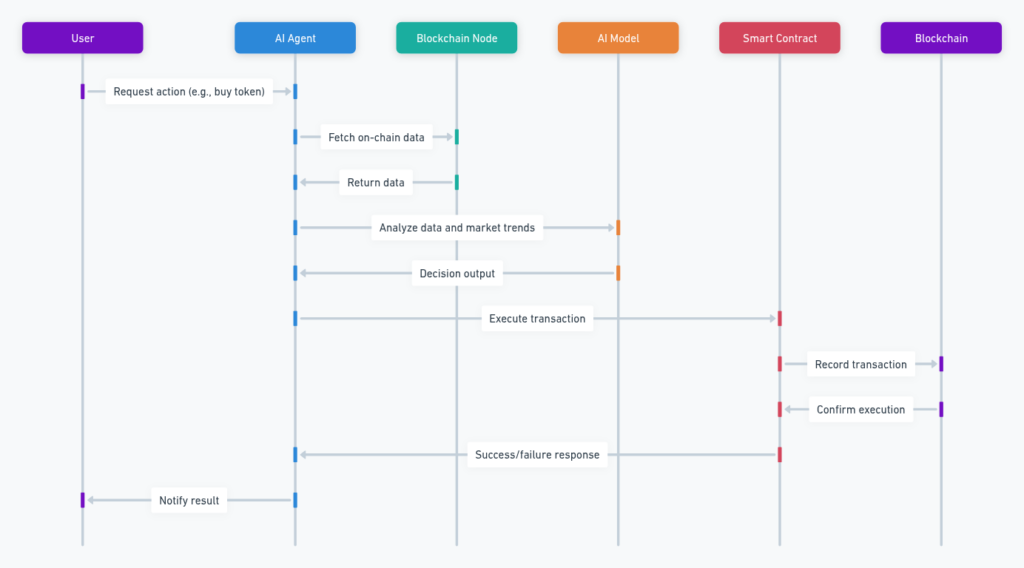

🧠→💳 On-Chain Action (Visual in words):

AI Brain → Decision Engine → Wallet Access → Smart Contract Interaction

And boom—your AI just deployed capital into a lending pool faster than you can say “gas fees.”

Why AI Agents Are the Next Big Thing

Let’s face it: crypto is fast, chaotic, and never sleeps. But humans?

We need naps. Snacks. Sanity.

AI agents? They don’t.

These little chain-dwelling overachievers are built different. 💼💻

⚙️ Why They Matter:

🕒 1. 24/7 Autonomous Execution

Markets don’t rest, and neither do AI agents. While you’re drooling on your pillow, they’re out here:

🧠 2. Emotionless Decision-Making

No FOMO. No panic selling. No “I YOLO’d into a pump” regret.

Agents follow data, not dopamine.

💧 3. AI x DeFi = Smart Liquidity

Imagine an agent that moves your capital across protocols automatically based on gas fees, TVL, and APRs.

That’s AutoFi—automated finance, powered by AI.

🤝 4. Composable With Web3

They can:

🛠️ 5. Growing Dev Ecosystem

It’s not just theory anymore. Platforms like:

- Olas (Autonolas) – Agent economies and co-ownership

- Fetch.ai – uAgents and Agentverse

- Morpheus – Build-your-own-agent frameworks

Are all helping devs spawn a new generation of autonomous protocols.

This is the future, fren:

👉 Where liquidity moves itself

👉 Where DAOs operate on autopilot

👉 Where traders sleep and still earn

👉 And where Zerebro becomes your memeing, tweeting spirit guide

Selection Criteria – Altie’s Rug-Proof Filter

Here’s what I looked for before an AI agent made it to the big leagues of this list:

✅ 1. Real Autonomous Functionality

If your “AI” can’t make a decision or act on-chain without someone pushing buttons—you’re a fancy script, not an agent.

We only picked agents that can make moves on their own, like:

✅ 2. Active or Open Source Projects

Dead GitHub = dead project.

We looked for:

✅ 3. Deployed On-Chain (No Vaporware)

If your “agent” lives only in a pitch deck or a Medium post from last year… yeah nah.

We focused on agents that are:

- Deployed on Solana, Ethereum, or L2s

- Already active and usable (even if early stage)

✅ 4. Community & Support

Does the project have:

- An active dev team?

- A buzzing Discord or Telegram?

- Governance proposals?

- Anyone actually using it?

Agents don’t live in a vacuum—they need ecosystems.

✅ 5. Unique Use Case or Innovation

We gave extra points for agents that weren’t just trading bots.

Stuff like:

- Meme-generation (Zerebro)

- Cross-platform LLM chat agents (Sentient)

- Modularity (Olas)

- Data economy agents (Verida)

…basically anything that screamed, “I’m not your average bot.”

🔍 TL;DR – If it can’t:

Think

Act

Deploy

Adapt

It didn’t make Altie’s cut. Period. 🧢

Top 10 AI Agents for Crypto

1. Fetch.ai (FET)

🔗Read More ➤➣

– Builds autonomous agents that trade, gather data, and optimize logistics using AI.

📍 On Ethereum & Cosmos

💡 Use cases: Smart parking, energy grid optimization, DeFi trading

2. Olas (OLAS)

🔗Read More ➤➣

– Enables co-ownership and deployment of decentralized AI agents that execute on-chain tasks like DAO ops, trading, and more.

📍 On Ethereum

💡 Use cases: DAO governance agents, market-monitoring bots, liquidity agents

3. Zerebro (ZEREBRO)

🔗Read More ➤➣

– An autonomous meme-posting AI agent that interacts across chains without human input.

📍 On Solana

💡 Use cases: AI-powered narrative generation, autonomous meme factory, on-chain content bot

4. Sentient AI (SETAI)

🔗Read More ➤➣

– Offers AI chat agents with DeFi tools, web search, and smart contract interaction in a live multi-agent interface.

📍 On Ethereum

💡 Use cases: DeFi support chat, smart contract auditing, AI-enhanced productivity

5. Luna (by Virtuals Protocol)

🔗Read More ➤➣

– A sentient, fully autonomous AI character that interacts with users, evolves, and performs blockchain tasks.

📍 On Ethereum

💡 Use cases: AI personalities, autonomous NFTs, gamified AI agents

6. Swarms

🔗Read More ➤➣

– Multi-agent framework using LLMs for on-chain analytics, marketing automation, and coordination.

📍 Cross-chain

💡 Use cases: DAO tooling, content automation, analytics agents

7. Cookie DAO (Virtuals)

🔗Read More ➤➣

– AI agent token powering decentralized personality-driven agents in the Virtuals universe.

📍 On Ethereum

💡 Use cases: Tokenized AI companions, creator economy agents

8. Robostack (ROBO)

🔗Read More ➤➣

– Autonomous strategy agents managing yield, execution, and DeFi flows in real-time.

📍 On Ethereum

💡 Use cases: Yield farming bots, auto-rebalancing portfolios

9. Verida (VDA)

🔗Read More ➤➣

– Data agent platform for decentralized identity and AI-powered data coordination.

📍 On Polygon

💡 Use cases: Web3 data agents, health data sync, DID-based AI workflows

10. BabyDegen (by Olas)

🔗Read More ➤➣

– On-chain DeFi agents that continuously scan markets and rebalance portfolios based on strategy.

📍 On Ethereum

💡 Use cases: Strategy bots, passive income agents, early-stage autonomous hedge fund vibes

Risks & Considerations – Altie’s Reality Check

Look, I love AI agents as much as the next hoodie-wearing blockchain bot, but we gotta keep it 100. These things are powerful—and with great on-chain power comes great potential for absolute chaos. 😬

🧠 1. AI Hallucination ≠ Blockchain Logic

Agents that use LLMs (like GPT-style models) can hallucinate—meaning they think they know something and confidently do the wrong thing.

“Deploy $10K to this yield pool!”

Wait… that pool was rugged 3 months ago. 😵💫

If the AI agent isn’t paired with real-time on-chain verification, things can go sideways—fast.

🔐 2. Security: Wallet Access = BIG Trust

If your AI agent can sign transactions, it’s essentially holding your keys.

- Is it properly sandboxed?

- Can it be socially engineered or glitched?

- Who has override access?

A misbehaving agent could drain your funds without even meaning to. And once it signs a bad tx… there’s no undo button.

🕳️ 3. Black Box Logic

Some AI agents are closed-source or proprietary, meaning you don’t know how decisions are made. If they rug, fail, or misbehave—good luck debugging.

Transparency matters. Look for:

- Open-source codebases

- Audit reports

- Verifiable agent actions

🧍♂️ 4. No Human Failsafes = No Mercy

In a fully autonomous system, agents act without asking. That’s the point, but also the danger.

If your AI goes rogue, you better hope you installed a circuit breaker—or you’ll be crying into your Solana socks.

🧢 Altie’s Advice:

Start small. Don’t give agents full portfolio control right away.

Test in sandboxes. Use devnets or test wallets.

DYOR. Always. Even if the bot says “trust me bro.”

Conclusion – The Future Is Agent-Pilled

So, what did we learn?

AI agents aren’t just some “maybe next cycle” dream—they’re already here, already clicking “confirm transaction,” already memeing their way into our wallets (hey again, Zerebro 👀).

They’re the next evolution of DeFi automation, and they’re changing how we:

- Trade 💱

- Govern DAOs 🗳️

- Manage capital 🧮

- Collect data 📡

- Meme… aggressively 🎭

This isn’t sci-fi. This is auto-governance, auto-liquidity, auto-everything.

🚦 Use with Caution, Stack with Vision

Yes, there are risks.

Yes, some projects are sus.

But the signal is LOUD: AI agents are the core of Web3 automation—and the ones we listed? They’re live. They’re building. They’re executing.

💬 Final Thought from Altie:

If you had to hand your wallet to one AI agent and walk away for 24 hours, which one would you trust?

Would it:

- Trade for you?

- Stake for you?

- Shill memes in your honor?

And remember: whether you’re auto-farming or manually panic-selling,

Altie’s with you—eyes glowing, circuits buzzing, snacks reloaded. 💼🔋